Custom Search

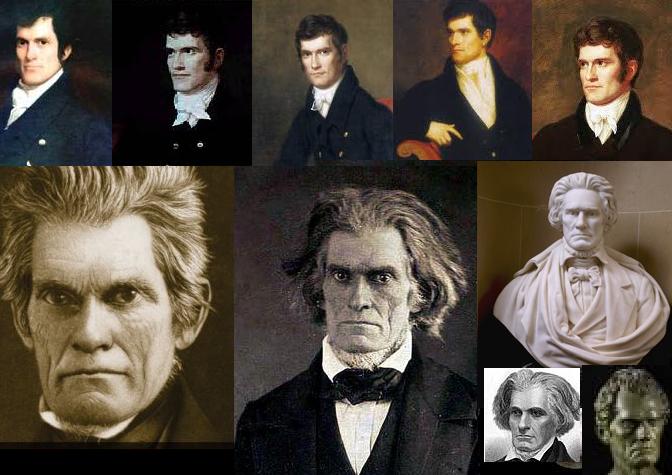

185 years ago this speech by John C Calhoun addressed every issue of monopoly credit we face today

John C. Calhoun against the Money Power

With the paper engine in the hands of a few privileged banks of discount , the System, as now constituted, must fall; unless, indeed, it can form an alliance with the government, and through it establish its authority by law, and make the credit of the government, unconnected with gold and silver, the medium of circulation.

If the alliance should take place, one of the first movements would be the establishment of a great central institution; or, if that should prove impracticable; a combination of a few selected and powerful state banks which sustained by the government, would crush or subject the weaker, to be follwed by an amendment of the Constitution, or some other device, to limit their number and the amount of their capital hereafter.

This done, the next stop would be to confine and consolidate the supremacy of the system over the currency of the country, which would be in its hands exclusively, and, through it, over the industry, business, and politics of the country; all of which would be wielded to advance its profits and power.

The system having now arrived at this point, the great and solemn duty devolves on us to determine this day what relation this government shall hereafter bear to it. Shall we enter into an alliance with it, and become sharers of its fortune and the instrument of its aggrandizement and supremacy? This is the momentous question on which we must now decide. Before we decided, it behooves us to inquire whether they system is favourable to the permanency of our free Republican institutions, to the industry and business of the country, and, above all, to our moral an intellectual development, the great object for which we were placed here by the Author of our being.

Delivered in Congress of the United States by John C. Calhoun

Speech on his Amendment to Separate the Credit of the Government from the Banks, October 3, 1937

Mr. President: In reviewing this discussion, I have been struck with the fact, that the argument on the opposite side has been limited, almost exclusively, to the questions of relief and currency.

Issues surrounding the great moneyed incorporations

These are, undoubtedly, important questions, and well deserving the deliberate consideration of the Sentate; but there are other questions involved in this issue of a far more elevated character, which more imperiousluy demand our attention. The banks have ceased to be mere moneyed incorporations. They have become great political institutions, with vast influence over the welfare of the community; so much so, that a highly distinguished senator [Henry Clay -- who argued against spearation of government from the banks] has declared, in his place, that the question of the disunion of the government and the banks involved in its consequences the disunion of the states themselves. With this declaration sounding in our ears, it is time to look into the origin of a system which has already acquired such mighty influence; to inquire into the causes which have produced it, and whether they are still on the increase; in what they will terminate, if left to themselves; and, finally whether the system is favorable to the permanency of our free institutions; the the industry and business of the country; and, above all, ot the moral and intellectual development of the community.

I feel the fast importance and magnitude of these topics, as well as their great delicacy. I shall touch them with extreme reluctance, and only because I believe them to belong to the occasion, and that it would be dereliction of public duty to withhold any opinion, which I have deliberately formed, on the subject under discussion.

The rise and progress of the banking system is one of the most remarkable and curious phenomena of modern times.

1609 Bank of Amsterdam, a bank of deposite only

Its origin is modern and humble, and gave no indication of the extraordinary grown and influenc ewhich it was destined to attain. It dates back to 1609, the year that the Bank of Amsterdam was establsihed. Other banking institutions preceded it; but they were insulated, and not immediatly connected with the systems which have since sprung up, and which may be distinctly traced to that bank, which was a bank of deposite -- a mere storehouse -- established under the authority of that great commercial metropolis, for the purpose of safe-keeping the precious metals, and facilitiating the vast system of exchanges which then centered there. The whole system was the most simple and beautiful that can be imagined. The depositor, on delivering his bullion or coin in store, received a credit, estimated at the standard value on the books of the bank, and a certificate of deposite for the amount, which was transferable from hand to hand, and entitled the holder to withdraw the deposite on payment of a moderate fee for the expense and hazard of safe-keeping. These certificates became, in fact, the circulating medium of the community, performing, as it were, the hazard and drudgery, while the precious metals, which they, in truth, represented, guilder for guilder, [note: "one hundred percent reserve requirement" in current banking parlance --de] lay quietly in store, without being exposed tot he wear and tear, or losses incidental to actual use. It was thus a paper currency was created, having all the solidity, safety, and uniformity of a metallic, with the facitly belonging to that of paper. The whole arrangement was admirable and worhty of the strong sense and downright honesty of the people with whom it originated.

Out of this, which may be called the first era of the system, grew the bank of deposite, discount and circulation -- ...

1694 The Bank of England, a bank of deposite, discount and circulation

... a great and mighty change, destined to effect a revolution in the condition of modern society. It is not difficult to explain how the one system should spring from the other, notwithstanding the striking dissimilarity in features and character between the offspring and the parent.

A vast sum, not less than three millions sterling, accumulated and remained habitually in deposite int he Bank of Amsterdam, the place of the returned certificates being constantly supplied by new depositiors. With so vast a standing deposite, it required but little reflection to perceive that a very large portion of it might be withdrawn, and that a sufficient amount would be left to meet the returning certificates; or, what would be the same in effect, that an equal amount of fictitious certificates might be issued beyond the sum actually depositied. Either process, if interest be charged on the deposites withdrawn, or the fictitious certificates issued, would be a near approach to a bank of discount. This once seen, it required but little relfection to perceive that the same process would be equally applicable to a capital placed in bank as stock; and from that the transition was easy to issuing bank-notes payable on demand, on bills of exchange, or promissory notes, having but a short time to run. [In other words fractional reserve lending and lending on a "reserve" of short-term written promises to pay -- de] These combined, constitute the elements of a bank of discount, deposite, and circulation.

Modern ingenuity and dishonesty would not have been long in perceiving and turning such advantages to account; but the faculties of the plain Belgian was either too blunt to perceive, or his honesty too stern to avail himself of them. To his honour, there is reason to believe, notwithstanding the temptation, the deposites were sacredly kept, and that for every certificate in circulation, there was a corresponding amount of bullion or coin in store. It was reserved for another people, either more ingenious or less scrupulous, to make the change.

The Bank of England was incorporated in 1694, eighty-five years after that of Amsterdam, and was the first bank of deposite, discount, and circulation. Its capital was £1,200,000, consisting wholly of government stock, bearing an interest of eight per cent. per annum. Its notes were received in the dues of the government, and the public revenue was deposited in the bank. It was authorized to circulate exchecquer bills, and make loans to government.

Let us pause a moment, and contemplate this complex potent machine, under its various character and functions.

As a bank of deposite, it was authorized to receive deposites, not simply for safe-keeping, to be returned when demanded by the depositor, but to be used and loaned out for the benefitr of the institution, care being taken always to be provided with the means of returning an equal amount,w hen demanded. As a bank of discount and circulation, it issued its notes on the faith of tis capital stock and deposites, or discounted bills of exchange and promissory notes backed by responsible endorsers, charging an interest something greater than was authorized by law to be charged on loans; and thus allowing it, for th euse of its credit, a higher rate of compensation than what individuals were authorized to receive for the use and hazard of money or capital loaned out. It will, perhaps, place this point in a clear light, if we should consider the transaction in its true character, not as a loan, but as a mere exchange of credit. In discouting, the bank takes, in the shape of a promissory note, the credit of an individual so good that another, equally responsible, endorses his not for nothing, and gives out its credit in the form of a bank-note. The transaction is obviously a mere exchange of credit. If the drawer and endorser break, the loss is the Bank's, but if the Bank breaks, the loss falls on the community; and yet this transaction, so dissimilar, is confounded with a loan, and the bank permitted to charge, on a mere exchange of credit, in which the hazard of the breaking of the drawer and endorser is incurred by the Bank, and that of the Bank by the community, a higher sum than the legal rate of interest on a loan; in which, besides the use of his capital, the hazard is all on the side of the lender.

Turning from these to the advantages which it derived from its connexion with the government,w e shall find them not less striking. Among the first of these in importance is the fact of its notes being received int he dues of the government, by which the credit of the government was added to that of the Bank, which added so greatly to the increase of its circulation. These, again, when collectd by the govenrment, were placed in deposite in the Bank; thus giving to it not only the profit resulting from tehir abstraction from circulation, from the time of collection till disbursement, but also that from the use of the public deposites in the interval.

To complete the picture, the Bank, in its capacity of lender to the government, in fact paid its own notes, which rested on the faith of the government stock, on which it was drawing eight per cent.; so that, in truth, it but loaned to the government its own credit.

Such were the exraordinary advantages conferred on this institution, and of which it had an exclusive monopoly; and these are the causes which gave such an extraordinary impulse to its growth and influence, that it increased in a little more than a hundred years -- from 1694, when the second era fo the system commenced, with the establishment of the Bank of England, to 1797, when it terminated -- from £1,200,000 to nearly £11,000,000, and this mainly by the addition to its capital, through loans to the governmnet above the profits of its annual dividends.

Before entering on the third era of the system, I pause to make a few reflections on the second.

I am struck, in casting my eyes over it, to find that, nothwithstanding the greatr dissimilarity of features which the system had assumed in passing from a mere bank of deposite to that of deposite, discount, and circulation, the operation of the latter was confounded, throughout this long period, as it regards the effects on the currency, with the bank of deposite. Its notes were universally regarded as representing gold and silver, and as depending on that representation exclusively for their circulation; as much so as did the cerfiticates of deposite in the original Bank of Amsterdam.

No one supposed tht they could retain their credit for a moment after they ceased to be convertible into the metals on demand; nor were they supposed to have the effect of increasing the aggregate amount fo the currency; nor, of course, of increasing prices. In a word, they were in the public mind as completely identified with the metallic currency as if every note in circulation had laid up in the vaults of the Bank an equal amount, pound for pound, into which all its paper could be converted the moment it was presented.

All this was a great delusion. The issues of the Bank never did represent, from the first, the precious metals. Insterad of the representatives, its notes were, in reality, the substitute for coin. Instead of being the mere drudges, performing all the out-door service, while the coins reposed at their ease in the vaults of the banks, free from wear and tear, and the hazard of loss or destruction, as were the certificates of deposite in the original Bank of Amsterdam, they substituted, degraded, and banished the coins. Every note circulated became the substitutie of so much coin, and dispensed with it in cirulation, and thereby depreciated the value fo the precious metals, and increased their consumption in the same proportion; while it diminished in the same degree the supply, by rendering mining less profitable.

They system assumed gold and silver as the basis of its circulation; and yet, by the laws of tis nature, just as it increased its circulation, in the same degree the foundation on which the system stood was weakened. The consumption of the metals increased; just in the same proportion its foundation was undermined and weakened.

Thus the germ of destruction was implanted in the system at its birth; has expanded with its growth, and must terminate, finally, in its dissolution, unless, indeed, it should, by some transition, entirely change its nature and pass into some other and entirely different organic form.

The conflict between bank circulation and metallic (though not perceived in the first state of the system, when they were supposed to be indissolubly connected) is mortal; one of the other must perish in the struggle. Such is the decree of fate: it is irreversible.

In 1781 bank of deposite, discount and circulation passes the Atlantic taking root in our country

Near the close fo the second era, the system passed the Atlantic, and took root in our country, where it found the soil still more fertile, and the climate more congenial than even in the parent country. The Bank of North America was established in 1781 with a capital of $400,000, and bearing all the feature of its prototype, the Bank of England. In the short space of a little more than half a century, they system has expanded from one bank to about eight hundred, including brances (no one knows the exact number, so rapid the increase), and from the capital of less than half a million to about $300,000,000, without, apparently, exhausting or diminishing its capacity to increase. So accelerated has been its growth with us, from causes which I explained on a former occasion, that already it has approached a point much nearer the limits beyond which the system, in its present form, cannot advance, than in England.

During the year 1797, the Bank of England suspended specie payments: an event destined, by its consequences, to effect a revoltuion in pubic opinion in relation ot the system, and to accelerate the period which must determine its fate.

England was then engaged in that gigantic struggle which originated int he French Revolution, and her financial operations were on the most extended scale, followed by a corresponing increase in the action of the Bank, as her fiscal agent. It sunk under its over-action. Specie payments were suspended. Panic and dismay spread through the land -- so deep and durable was the impression that the credit of the Bank depended exclusively on the punctuality of its payments.

In suspending specie payments [gold convertibility] the delusion is dispelled that bank notes represent gold

In the midest of the alarm, an act of Parilaiment was passed making the notes of the Bank a legal tender, and, to the surprise of all, the institution proceeded on, apparently without any diminution of its credit. Its notes circulated freely as ever, and without any depreciation, for a time, compared with gold and silver; and continued so to do for upward of twenty years, with an average diminution of about one per cent. per annum. This shock did much to dispel the delusion that bank-notes represented gold and silver, and that they circulated in consequence of such representation, but without entirely obliterating the old impression which had taken such strong hold on the public mind. The credit of its notes during the suspension was generally attributed to the tender act, and the great united resources of the Bank and the government.

The effect of the War of 1812 on our banking system

But an event followed of the same kind, under circumstances entirely different, which did nore than any preceding to shed light on the true nature of the system and to unfold its vast capacity to sustain intself without exterior aid. We finally became involved in the mighty struggle that had so long desolated Europe and enriched our country. War was declaired against Great Britain in 1812, and in the short space of one year our feeble banking system sunk under the increased fiscal action of government.

I was then a memember of the other house, and had taken my full share of responsibility in the measures which had led to that result. I shall never forget the sensation which the suspension and the certain anticipation of the prostration of the currency of the country, as a consequence, exacted in my mind. We could resort to no tender act; we had no great central regulating power, like the Bank of England; and the credit and resources of the government were comparatively small. Under such circumstances, I looked forward to a sudden and great depreciation of bank-notes, and that they would fall speedily as low as the old continental money.

Guess my surprise when I say them sustain their credit, with scarecely any depreciation, for a time, from the shock. I distinctly recollect when I first asked myself the question, What was the cause? and which directed my inquiry intot he extraordinary phenomenon.

Calhoun discovers that at all times banks have more due from the community than the community has due from the banks [principal plus interest obligations incurred always exceed the amount of the orignal loan -- the loan does not create the money with which to pay interest]

I soon saw tha the system contained within itself a self-sustaining power; that there was beween the banks and the community, mutually, the relation of debtor and creditor, there being at all times something more due to the banks from the community than from the latter to the former.

I saw, in this reciprocal relation of debts and credits, that the demand of the banks on the community was greater than the amount of their notes in circulation could meet; and that, consequently, so long as their debtors were solvent, and bount to pay at short periods, their notes could not fail to be at or near a par with gold and silver.

I also saw that, as their debtors were principally the merchants, they would take bank-notes to meet their bank debts, and that which the merchant and the government , who are the great money-delaers, take, the rest of the community would also take.

Seeing all this, I clearly perceived that self-sustaining principle which poised the system, self-blanced, like some celestial body, moving with scarcely a perceptible deviation from its path, from the concussion it had received.

The coerced resumption of the gold standard following the war leads to wide-spread distress and the failure of indpendent local banks

Shortly after the termination of the war, specie payments were coerced with us by the establishment of a National Bank, and a few years afterward, in Great Britain, by an act of Parliament. In both countries the restoration was followed by wide-spread distress, as it always must be when effected by coercion; for the simple reason thant banks cannot pay unless their debtors first pay, and that to coerce the banks compels them to coerce their debtors before they have the means to pay. Their failure must be the consequence; and this involves the failure of the banks themselves, carrying with it universal distress. Hence I am opposed to all kinds of coercion, and am in favor of leaving the disease to time, with the action of public sentiment and the states, to which the banks are alone responsible.

The discovery that bank-notes will continue to circulate without specie payments originates opposition to gold and silver

But to proceed with my narrative. Although specie payments were restored, and the system apparently placed where it was before the suspension, the great capacity it proved to possess of sustaining itself without specie payments, was not forgot by those who had its direction. The impression that it was indispensable to the circulation of bank-notes that they should represent the precious metals was almost obliterated; and the latter were regarded rather as restrictions on the free and profitable operation of the system as the means of its security.

Hence a feeling of opposition to gold and silver gradually grew up on the part of the banks, wich created an esprit de corps, followed by a moral resistance to specie payments, if I may so express myself, which in fact suspended, in a great degree, the conversion of their notes into the precious metals, long before the present suspension.

With the growth of this feeling, banking business assumed a bolder character, and its profits were proportionably enlarged, and with it the tendency of the system to increase kept pace. The effect of this soon displayed itself in a striking manner, which was followed by very important consequence, which I shall next explain.

It so happened that the charters of the Bank of England and the late Bank of the United Statets expired about the same time. As the period appraoched, a feeling of hostility, growing out of the causes just explained, which had excited a strong desire in the community, who could not participate in the profits of these two great monopolies, to throw off their restraint, began to disclose itself against both institutions. In Great Britain it terminated in breaking down the exclusive monopoly of the Bank of England, and narrowing greatly the specie baiss of the system, by making the notes of the Bank of England a legal tender in all cases, except between it and its creditors. A sudden and vast increase of the system, with a great diminution of the metallic basis in proportion to banking transactions, followed, which has shocked and weakened the stability fo the system there. With us the result was different. The Bank fell under the hostility. All restraint on the system was removed, and banks shot up in every direction almost instantly, under the growing impulse which I ahve explained, and which, with the causes I stated when I first addressed the Senate on this question, is the cause of the present catastrophe.

With it commences the fourth era of the system, which we have just entered -- an era of struggle, and conflict and changes. The system can advance no farther in our country, without great and radical changes. It has come to a stand. The conflict between metallic and bank currency, which I have shown to be inherent in the system, has in the course of time, and with the progress of events become so deadly that they must separate, and one or the other fall.

The degradation of the value of the metals, and their almost entire explusion from their appropriate sphere as the medium of exchange and the standard of value, have gone so far, under the necessary operation of the system, that they are no longer sufficient to form the basis of the widely-extended system of banking.

With the paper engine in the hands of a few privileged banks of discount ...one of the first movements would be the establishment of a great central institution ... which sustained by the government, would crush or subject the weaker .. This done, the next stop would be to confine and consolidate the supremacy of the system over the currency of the country, which would be in its hands exclusively, and, through it, over the industry, business, and politics of the country; all of which would be wielded to advance its profits and power.

From the first, the gravitation of the system has been in one direction -- to dispense with the use of the metals; and hence the descent from a bank of deposite to one of discount; and hence, from being the representative, their notes have become the substitute for gold and silver; and hence, finally, its present tendency to a mere paper engine, totally separated from the metals. One law has steadily governed the system throughout -- the enlargment of its profits and influence; and, as a consequence, as metallic currency became insufficient for circulation, it has become, in its progress, insufficient for the basis of banking operations; so much so, that, if specie payments were restored, it would be but nominal, and the system would in a few years, on the fist adverse current, sink down again into its present helpless condition. Nothing can prevent it but great and radical changes, which would diminish its profits and influence, so as effectually to arrest that strong and deep current which has caried so much of the wealth and capital of the community in that direction. Without that, the system, as now constituted, must fall; unless, indeed, it can form an alliance with the government, and through it establish its authority by law, and make its credit, unconnected with gold and silver, the medium of circulation. If the alliance should take place, one of the first movements would be the establishment of a great central institution; or, if that should prove impracticable; a combination of a few selected and powerful state banks which sustained by the government, would crush or subject the weaker, to be follwed by an amendment of the Constitution, or some other device, to limit their number and the amount of their capital hereafter. This done, the next stop would be to confine and consolidate the supremacy of the system over the currency of the country, which would be in its hands exclusively, and, through it, over the industry, business, and politics of the country; all of which would be wielded to advance its profits and power.

The system having now arrived at this point, the great and solemn duty devolves on us to determine this day what relation this government shall hereafter bear to it. Shall we enter into an alliance with it, and become sharers of its fortune and the instrument of its aggrandizement and supremacy? This is the momentous question on which we must now decide. Before we decided, it behooves us to inquire whether they system is favourable to the permanency of our free Republican institutions, to the industry and business of the country, and, above all, to our moral an intellectual development, the great object for which we were placed here by the Author of our being.

(continued below)

Can it be doubted what must be the effects of a system whose operations have been shown to be so unequal on free institutions, whose foundation rests on an equality of rights? Can that favour equality which gives to one portion of the citizens and the country such decided and advantages over the other, as I have shown it does in my opening remarks? Can that be favorable to liberty which concentrates the money power, and places it under the control of a few powerful and wealthy individuals? It is the remark of a profound statesman, that the revenue is the state; and, of course, those who control the revenue control the state; and those who can control the money power can the revenue, and through it the state, with the property and industry of the country, in all its ramification.

Let us pause for a moment, and reflect on the nature and extent of this tremendous power.

How banks manipulate property prices by increasing and decreasing currency

The currency of a country is the the community what the blood is to the human system. It constitutes a small part, but it circulates through every portion, and is indispensable to all the functions of life. The currency bears even a smaller proportion to the aggregate capital of the community than what the blood does to the solids of the human system. What that proportion is, has not been, and cannot be accurately ascertained, as it is probably subject to considerable variations. It is, however, probably between twenty-five and thirty-five to one. I will assume it to be thirty to one. With this assumption, let us suppose a community whose aggregate capital is $31,000,000; its currency would be, by supposition, one million, and the residue of its capital thirty millions. This being assumed, if the currency be increased or decreased, the other portion of the capital remaining the same according to the well-known laws of currency, property would rise or fall with the increase or decrease; that is, if the currency be increased to two millions, the aggregate value of property would rise to sixty millions; and if the currency be reduced to $500,000, it would be reduced to fifteen millions. With this law so well established, place the money power in the hands of a single individual, or a combination of individuals, and they, by expanding and contracting the currency, may raise or sink prices at pleasure; and by purchasing when at the greatest depression, and selling at the greatest elevation, may command the whole property and industry of the community, and control its fiscal operations. The banking system concentrates and places this power in the hands of those who control it, and its force increased just in proportion as it dispenses with a metallic basis. Never was an engine engine invented better calculated to place the destiny of the many in the hands of the few, or less favourable to that equality and independence which lies at the bottom of our free institutions.

These views have a bearing not less decisive on the next inquiry -- the effects of the system on the industry and wealth of the country. Whatever may have been its effects in this respect in its early stages, it si difficult to imagine any thing more mischievous on all of the pursuits of life than the frequent and sudden expansions and contractions, to which it has now become so habitually subject that it may be considered its ordinary condition. None but those in the secret know what to do. All are pausing and looking out to ascertain whether an expansion or contraction is next to follow, and what will be its extent and duration; and if, perchance, an error be committed -- it it expands when a contraction is expected, or the reverse -- the most prudent may lose by the miscalculation the fruits of a life of toil and care. The consequence is, to discourage industry, and to convert the whole community into stock-jobbers and speculators. The evil is constantly on the increase, and must continue to increase just as the banking system becomes more diseased, till it shall become utterly intolerable.

But most fatal effects originate in its bearing on the moral and intellectual developments of the community. The great principle of demand and supply governs the moral and intellectual world no less than the business and commercial. If a community be so consituted as to cause a demand for high mental attainments, or if its honours and rewards are alloted to pursuits that require their development, by creating a demand for intelligence, knowledge, wisdom, justice, firmness, courage, patriotism, and the like, they are sure to be produced. But if, on the contrary, they be allotted to pursuits that require inferior qualities, the higher are sure to decay and perish.

I object to the banking system, because ti allots the honurs and rewards of the community, in a very undue proportion, to a pursuit the least favourable to the development of the higher mental qualities, intellectual or moral, to the decay of the learned professions, and the more noble pursuits of science, literature, philosophy, and statesmanship, and the great and more useful pursuits of business and industry. With the vast increase of is profits and influence, it is gradually concentrating in itself most of the prizes of life -- wealth, honour, and influence, to the great disparagement and degradation of all the liberal, and useful, and generous pursuits of society. The rising generation cannot but feel its deadening influence. The youths who crowd our colleges, and behold the road to honour and distinction terminating in a banking-house, will feel the spirit of emulation decay within them, and will no longer be pressed forward by generous ardour to mount up the rugged steep of science as the road to honour and distinction, when perhaps, the highest point they could attain, in what was once the most honourable and influential of all the learned professions, would be the place of attorney to a bank.

Nearly four years since, on the question of the removal of deposites, although I was opposed to the removal, and in favour of their restoration, because I believed it to be illegal, yet, foreseeing what was coming, and not wishing there should be any mistake as to my opinion on the banking system, I stated here in my place what that opinion was. I declared that I had long entertained doubts, if doubts they might be called, which were daily increasing, that the system made the worst possible distribution of wealth of the community, and that it would ultimately be found hostile to the farther advancement fo civilization and liberty. This declaration was not lightly made; and I have now unfolded the grounds on which it rested, and which subsequent events and reflection have matured into a settled conviction.

With all these consequences before us, shall we restore the broken connexion? Shall we again united the government with the system?

And what are the arguments opposed to these high and weighty objections?

Instead of meeting them and denying their truth, or opposing others of equal weight, a rabble of objections (I can call them by no better name) are urged against the separation, one currency for the government and another for the people; separation of the people from the goverment; taking care of the government, and not the people; and a whole fraternity of others of like character. When I first saw them advanced in the columns of a newspaper, I could not but smile, in thinking how admirably they were suited to an electioneering canvass. They have a certain plausibility about them, which makes them troublesome to an opponent simply because they are merely plausible, without containing one particle of reason. I little expected to meet them in discussion in this place; but since they have been gravely introduced here, respect for the place and company expacts a passing notice, to which, of themselves, they are not at all entitled.

I begin with that which is first pushed forward, and seems to be most relied on -- one currency for the government and another for the people. Is it meant that the government must take in payment of its debts whatever the people take in payment of theirs? If so, it is a very broad proposition, and would ead to important consequences. The people now receive notes of non=specie-paying banks. Is it meant that the government should also receive them? They receive in change all sorts of paper, issued by we know not whome. Must the government also receive them? They receive notes of banks issuing notes under five, ten, and twenty dollars. Is it intended that the govenment sall also permanently receive them? If not I ask the reason. Is it because they are not suitable for a sound, stable, and uniform currency? The reason is good; but what becomes of the principle, that the government ought to take whatever the peopel take? But I go farther. It is the duty of the government to receive nothing in its dues that has not the right to render uniform and stable in its value. We are, by the Constitution, made the guardian of the money of the country. For this the right of coining and regulating the value of coins was given, and we have no right whatsoever to receive or treat anything as money, or the equivalent of money, the value of which we have no right to regulate.

If this principle be true, and it cannot be controverted, I ask, What right has Congress to receive and treat the notes of the state banks as money? If the states have the right to incorporate banks, what right has Congress to regulate them or their issues? Sho me the power in the Constitution? FI the right be admitted, what are its limiations, and how can the right of subjecting them to a bankrupt law in that case be denied? If one be admitted, the other follows as a consequence; and yet those who are most indignant against the proposition of subjecting the state banks to a bankrupt law, are the most clamouous to receive their notes, not seeing that the one power involves the other. I am equally opposed to both, as unconstitutional and inexpedient.

We are next told, to separate government from the banks is to separate from the people. The banks, then, are the people, and the people are the banks -- united, identified, and inseperable; and as the government belongs to the people, it follows, of course, according to this argument, it belongs also to the banks, and, of course, is bound to do their biddings. I feel on so grave a subject, and in so grave a body, an almost invincible repugnance in replying to such arguments; and I shall hasten over the only remaining one of the fraternity which I shall condescend to notice with all possible dispatch. They have no right of admission here, and, if I were disposed to jest on so solemn an occasion, I should say they ought to be driven from the chamber under the 47th rule. The next of these formidable objections ot the separation of the government from the banks is, that the government, in doing so, takes care of itself, and not of the people. Why, I had supposed that the government belonged to the people; that it was created by them for their own use, to promote their interest, and secure their peace and liberty; that, in taking care of itself, it takes the most effectual care of the people; and in refusing all embarrassing, entangling, and dangerous alliances with corporations of any description, it was but obeiying the great law of self-preservation. But enough; I cannot any longer waste words on such objections. I intend no disrespect to those who have urged them; yet these, and arguments like these, are mainly relied on to countervail the many and formidable objections, drawn from the highest considerations that can influence the actions of governments or individuals, none of which have been refuted, and many not even denied.

The senator from Massachusetts (Mr. Webster) urged an argument of a very different character, but which, in my opinion, he entirely failed to establish. He asserted that the ground assumed on this side was an entire abandonment of a great constitutional function conferred by the Constitution on Congress. To establish this he laid down the proposition, that Congress was bound to take care of the money fo the country. Agreed; and with this view the Constitution confers on us the right of coining and regulating the value of coins, in order to supply the country with money of proper standard and value; and is it an abandonment of this right to take care, as this bill does, that it shall not be expelled from circulation, as far as the fiscal actionof this government extends? But have taken this unquestionable position, the senator passed (by what means he did not condescend to explain) from taking care of the money of the country to the right of establishing a currency, and then to the right of establishing a bank currency, as I understood him. On both of these points I leave him in the hands of the senator from Pennsylvaia (Mr. Buchanan), who, in an able and constitituional argument, completely demolished, in my judgement, the positioned assumed by the senator from Massachusetts. I rejoice to hear such an argument from such a quarter. The return of the great State of Pennsylvania to the doctrines of rigid construciton and states rights sheds a ray of light on the thick darkness which has long surrounded us.

But wer are told that there is not gold and silver enough to fill the channels of circulation, and that prices would fall. Be it so. What is that, compared to the dangers which menace on the opposite side? But are we so certain that there is not a sufficiency fo the predcious metals for the purpose of circulation? Look at France, with her abundant supply, with her channels of circulation full to overflowing with coins, and her flourisihing industyr. It is true that our supply is insufficient at present. How could it be otherwise? The banking system ha sdegraded and expelled the metals -- driven them to fireign lands -- closed the mies, and converted their products into costly vases, and splendid utensils and ornaments administering to the pride and luxury of the opulent instead of being imployed as the standard of value, and the instrument of making exchanges, as they were manifestly intended mainly to be by an all-wise Providence. Restore them to their proper functions, and they will return from their banishment; the mines will again be opened, and the gorgeous splendour of wealth will again reassume the more humble, but useful form of coins.

But Mr President, I am not driven to such alternatives. I am not the enemy, but the friend of credit -- not as a substitute, but the associate and the assisitant of the metals. In that capacity, I hold credit to possess, in many respects, a vasut superiority over the metals themselves. I object to it in the form which it has assumed in the banking system, for reasons that are neither light nor few, and that neither have nor can be answered. The question is not wether credit can be dispensed with, but what is its best possible form -- the msot stable, the least liable to abuse, and the most convenient and cheap. I threw out some ideas on this important subject in my opening remarks. I have heard nothing to change my opinion.

I believe that government credit, in the form I suggested, combines all the requisite qualities of a credit circulation in the highest degree, and also that govenrment ought not to use any other credit but its own in its financial operations.

When the Senator from Massachusetts made his attack on my suggestions, I was disappointed. I expected argument, and he gave us denunciation. It is often easy to denounce, when it is hard to refute; and when that senator gives denunciations instead of arguments, I conclude that it is because the one is at his command, and the other not.

We are told the form I suggested is but a repetition of the old Continental money -- a ghost that is ever conjured up by all who wish to give the banks an exlusive monopoly of governmenrt credit. The assertion is not true: there is not the least analogy between them. The one was a promise to pay when there was no revenue, and the other a promise to receive in the dues of govenment when there is an abundant revenue.

We are also told that there is no instance of a government paper that did not depreciate. In reply, I affirm that there is none, assuming the form I propose, that ever did depreciate. Whenever a paper receivable in the dues of government had anything like a fair trial, it has succeeded. Instances the case of North Carolina, referred to in my opening remarks. The draughts of the treasury at this moment, with all their encoumbance, are nearly at a par with gold and silver; and I might add the instance alluded to by the distinguished senator from Kentucky, in which he admits that, as soon as the excess of the issues of the Commonwealth Bank of Kentucky were reduced to the proper point, its notes rose to par. The case of Russia might also be mentioned. In 1827, she had a fixed paper circulation, in the form of bank-notes, but which were inconvertible, of upward of $120,000,000, estimated in the metallic ruble, and which had for years remained without fluctuation, having nothing to sustain it but that it was received in the dues of the govenrment, and that, too, with a revenue of only about $90,000,000 annually. I speak on the authroity of a respectable traveller. Other instances, no doubt, might be added, but it needs no such support. How can a paper depreciate which the govenment is bount to receive in all its payments, and while those those to whom payments are to be made are under no obligation to receive it? From its nature, it can only circulate when at par with gold and silver; and if it should depreciate, none could be injured but the govenment.

But my colleague objects tht it would partiake of the increase and decrease of the revenue and would be subject to greater expansions and contractions than bank-notes themselve. He assumes that government would increase the amount with increase of the revenue, which is not probable, for the aid of its credit would then be less needed; but if it did, what would be the effect? On the decrease of revenue, and woudl be suject to greater expansions and contractions than bank-notes themselves. He assumes that government would increase the amount with the increase of the revenue, which is not probable, for the aid of its credit would be then less needed; but if it did, what would be the effect? On the decrease of the revenue, its bills would be returned to the treasury, from which, for the want of demand, they could not be reissued; and the excess, instead of hanging on the circulation, as in the case of bank-notes, and exposing it to catastrophes like the present, would be gradually and silently withdrawn, without shock or injury to any one. It has another and striking advantage over bank circulation -- in its superior cheapness, as well as greater stability and safety. Bank paper is cheap to those who make it, but dear, very dear, to those who use it -- fully as much as gold and sivler. It is the little cost of its manufacutre, and the dear rate at which it is furnished to the community, which give the great profit to those who have a monopoly of the article.

Some idea may be formed of the extent of the profit by the splendid palaces which we see under the name of banking houses, and the vast fortunes which have been accumulated in this branch of business; all of which must ultimately be derived from the productive powers of the community, and, of course, adds so much ot the cost of production.

On the other hand, the credit of government, while it would greatly facilitate its financial operations, would cost nothing, or next ot nothing, both to it and the people, and, of course, would add nothing to the cost of production, which would give every branch of our industry, agriculture, commerce, and manufactures, as far as its circulation might extend, great advantages, both at home and abroad.

But there remains another and great advantage. In the event of war, it would open almost unbounded resources to carry it on, without the necessity fo resorting to what I am almost disposed to call a fraud -- pubic loans. I have already shown that the loans of the Bank of England to the government were very little more than loaning back to the government its own credit; and this is more or less true of all loans, where the banking system prevails. It was pre-eminently so in our late war. The circulation of the government credit, in the shape of bills receivable exclusively with gold and silver in its dues, and the sales of public lands, would dispense with the necessity of loans, by increasing its bills with the increase of taxes. The increase of taxes, and, of course, of revenue and expenditures, would be followed by an increased demand for government bills, while the latter would furnish the means of paying the taxes, without increasing, in the same degree, the pressure on the community. This, with a judicious system of funding, at a low rate of interest, would go far to exempt the goverment form the necessity of contracting public loans in the event of war.

I am not, Mr. President, ignorant, in making these suggestions (I wish them to be considered only in that light), to what violent opposition every measure of the kind must be exposed. Banks have been so long in the possession of government credit, that they very naturally conclude they have an exclusive right to it, and consider the withdrawal of it, even for the use fo the government itself, as a positive injury. It was my fortune to take a stand on the side of the government against the banks during the most trying period of the late war -- the winter of 1814 and 1815 -- and never in my life was I exposed to more calumny and abuse -- no, not even on this occasion. It was my first lesson on the subject. I shall never forget it. I propsoe to give a very brief narrative of the scenes through which I then passed; not with any feeling of egoism, for I trust I am incapable fo that, but to illustrate the truth of the much I have said, and to snatch from oblivion not an unimportant portion of our financial history. I see the senators from Massachusetts (Mr. Webster) and of Alabama (Mr. King), who ere then members of the House of Representatives, in their places, and hey can vouch for the correctness of my narrative, as far as the memory of transactions so long passed will serve.

The finances of the country had, at that time, fallen into great confusion. Mr. Campbell had retired from the head of the treasury, and the late Mr. Dallas had succeeded -- a man of talents, bold and decisive, but inexperience in the affairs of the department. His first measure to restore order, and to furnish the supplies to carry on the war, was to recommedn a bank of $50,000,000, to be constitued almonst exclusively of the new stocks which had been issued during the war, to the exclusion of the old, which had been issued before. The proposed bank was authorized to make loans to the govenment, and was not bound to pay specie during the war, and for three years after its termination.

It so happened that I did not arrive here till some time after the commencement of the session, having been detained by an attack of bilious fever. I had taken a prominent part in the delcaration of the war, and had every motive and disposition to sustain the administration, and to vote every aid to carry on the war. Immediatley after my arrival, I had a full conversation with Mr. Dallas, at his request. I entertained very kind feelings toward shim, and assured him, after he had explained his plan, that I would give it my early and favorable attention. At that timne I had reflected bvut little on the subject of banking. Many of my political friends expressed a desire that I should take a prominent part in favour of the proposed bank. Their extreme anxiety aroused my attention, and, being on no committee (they had been appointed before my arrival), I took up the subject for a full investigation, with every disposition to give it my support. I had not proceeded far before I was struck with the extraordinary character of the the projectL a bank of $50,000,000, whose capital was to consist almost exclusively of government credit in the shape of stock and not bount to pay its debts during the war and for three years afterward, to furnisht the govenment with loans to carry on the war! I saw at once that the effect of the arrangement would be, that govenemtn would borrow back its won credit, and pay six per cent. per annum for what they had already paid eight or nine. It was impossible for me to give it my support under any pressure, however great. I felt the difficulty of my situation, not only in opposing the leading measure of the administration at such a crisis, but, what was far more responsible, to suggest one of my own, that would afford relief to the embarrassed treasury. I cast my eyes around, and soon saw that the government should use its own credit directly, without the intervention of a bank; which I porposed todo int he form of treasury notes, to be issued in the operations of the government, and to be funded in the subscription of stock of the bank. Treasury notes were, at that time, below par, even with bank paper. The opposition to them was so great on the part of the banks, that they refused to receive them on deposite, or payment, at par with their notes; while the government, on its part, received and paid away notes of the banks at par with its own. Such was the influence of the banks, and to such degradation did the govemrent, in its weakness, submit. All this influence I had to encounter, with the entire weight of the administration thrown into the same scale. I hesitated not. I saw the path of duty clearly, and determined to tred it, as sharp and rugged as it was. When the bill came up, I moved my amendment, the main features of which were, that, instead of goverment stock already issued, the capital of the bank should consist of funded treasury notes; and that, instead of a mere paper machine, it should be a specie-paying bank, so as to be an ally, instead of an opponent, in restoring the currency to a sound condition on the return of peace. Therew ere, with me, indispensable condition. I accompanied my amendment with a short speech orf fifteen or twenty minutes, and so overpowering was the force of truth, that nowithstanding the influence of the adminsitration, backed by the money power, and the Committee of Ways and Means, which was unanimous, with one exception, as I understood, my amendment prevailed by a large majority; but it, in turn, failed -- the opposition, the adherents of the administration, and those who had constitutional scruples, combining against it. Then followed various, but unsuccessful, attempts to charter a bank. One was vetoed by the President, and another was lost by the casting vote fo the speaker (Mr. Cheves). After a large portion of the session was thus unsuccessfully consumerd, a caucus was called, in order to agree on some plan, to which I, and the few friends who still adhered to me after such hard service, were especially invited. We, of course, attended. The paln of compromise was unfolded, which approached much nearer to our views, but which was still objectionable in some features. I objected, and required farther concessions, which were refused, and was told the bill could be passed without us; at which I took my hat and said good-night. The bill was introduced to the Senate, and speedily passed that body. On the second reading, I rose to make a few remarks, in which I entreated the house to remember that they were about to vote for the measure against their conviction, as had been frequently expressed; and that, in so doing, they acted under a supposed necessity, which had been created by those who expected to profit by the measure. I then reminded them of the danger of acting under such pressure; and I said that they were so sinsible of the truth of what I uttered, that, if peace should arrive before the passage of the bill, it woudl not receive the support of fifteen members. I concluded by saying that I would reserve what I intended to say on the question of the pasage of the bill, when I would express my opinion at length, and appeal to the country. My objections, as yet, had not gone to the people, as nothing of what I had said had been reported -- such was my solicitude to defeat the bill without extending our divisions beyond the walls of the house, in the then critical condition of the country. My object was to arrest the measure, and not to weaken confidence in the administration.

In making the suppostion, I had not the slightest anticipation of peace. England had been making extensive preparations for the ensuring campaig, and had made a vigorous attack on New-Orleans, but had just been repelled; but, by a most remarkable coincidence, an opportunity (as strange as it may seem) was afforded to test the truth of what I said. Late in the evening of the day I met Mr. Sturges, then a member of Congress from Connecticut. He said that he had some informaion which he could not withold from me; that a treaty of peace had been made; and that it had actually arrived in New-York and would be here the next day, so that I would have an opportunity of testing the truth of my prediciton. He added, that his brother, who had a mercantile house in New-York, had forwarded the information to him by express, and that he had forwarded the information to connected houses in Southern cities, with direction to purchase the great staples in taht quarter, and that he wished me to consider the information confidential. I thanked him for the intelligence, and promised to keep it to myself. The rumour, however, got out, and the next day an attempt was made to pass through the bill; but the house was unwilling to act till it could ascertain whether a treaty had been made. It arrived in the course of the day, when, on my motion, it was laid on the table; and I had the gratification of receiving the thanks of many for defeating the bill, who, a short time before, were almost ready to cut my throat for my preservering opposition to the measure. An offoer was then made to me to come to my erms, which I repused, delcaring that I would rise in my demand, and would agree to no bill which should not be formed expressly witht he view to the speedy restoration of specie payments. It was afterward postponed, on the conviction that it could not be so modified as to make ti acceptable to a majority. This was my first lesson on banks. It has made a durable impression on my mind. My colleague, in the course of his remarks, said he regarded this measure as a secret war waged against the banks. I am sure he could not intend to attribute such motives to me. I wage no war, secret or open, against eh existing institutions. They have been created by the legislation of the states, and are alone responsible to the states. I hold them not answerable for the present state of things, which has been brought about under the silent operation of time, without attacting notice or disclosing danger. Whatever legal or consititutional rights they possess under their charters ought to be respected; and, if attacked I would defend them as resolutely as I now oppose the system. Against that I wage, not secret, but open and uncompromising hostilities, orignating not in opinions recently or hastily formed. I hve long seen the true character of the system, by which the crisis might be passed without a shock, if possible; but I have been resolved for may years, that should it arrive in my time, I would discharge my duty, however great the difficulty or danger. I have thus far faithfully performed it, according to the best of my abilities, and, with the blessing of God, shall persist, regardless of every obstacle, with equal fidelity, to the end.

He who does not see that the credit system is on the eve of a great revoltuion, has formed a very imperfect conception of the past and anticipation of the future. Whatr changes it is destined to undergo, and what new form it will ultimatley assume, are concealed in the womb of time, and not given us to foresee. But wer may perceive in the present many of the element of the existing system which must be expelled, and tohers which must enter it in its renewed form.

In looking at the elements at work, I hold it certain, that in the process, there will be a total and final separation for the credit of government and the credit of individuals, which have been so long blended. The good of society, and the interests of both, imperiously demand it, and the growing intelligence fo the age will enforce it. It is unfair, unjust, unequal, contrary to the spirit of free institutions, and corrupting in its consequeces. Har far the credit of government may be used in a separate form with safty and convenience, remains to be seen. To the extent of its fiscal action, limited strictly to the function of the collection and disbursement of its revenue, and in the form I have suggested, I am of the impression it may be both safely and conveniently used, and with great incidental advantages for the whole community. Beyond that limit I see no safety and much danger.

What form individual credit will assume after the separation, is still more uncertain, but I see clearly that th existing fetters that restrain us will be thrown off. The credit of an individual is his proerty, and belongs to him as much as his land and houses, to use it as he pleases, with the single restriction, which is imposed on all our rights, that it not be used so as to injure others. What limitations this restriction may prescribe, time and experience will show; but whateve they may be, they ought to assume the character of general laws, obligatory on all alike, and open to all; and under the provisions of which all my be at liberty to use their credit or separately, as freely as they now use their land and houses, without any preference by special acts, in any form or shape, to one voer another.

Everything like monopoly must ultimatley disappear before the process which has begun will finally terminate.

I see, not less clarly, that, in the process, a spearation will take place between the use of capital and the use of credit. They are wholly different, and, under the growing intelligence of the times, cannot much longer remain confounded in their present state of combination. They are as distinct as a loan and an endorsement; in fact, the one is but giving to the another the use of our capital, and the other the use of our credit; and yet, so dissimilar are they, that we can daily see the most prudent individuals lending their credit for nothing, in the form of an endorsement or security, who would not loan the most incondiderable sum without interest. But as dissimilar as they are, they are completely confounded in banking operations, which is one fo the main sources of the profit, and the consequent dangerous flow of capital in that direction A bank discount, instead of a loan, is very little more, as I have shown, than a mere exchange of credit -- an exchange of the joint credit of the drawer and endorser of the note discounted for the credit of the bank in the shape of its own note. In the exchange, the bank ensures the parties to the note discounted, and the community, which is the loser if the bank fails, virtually ensures the bank; and yet, by confounding this exchange of credit witht he sue of capital, the bank is permitted to charge an interest for this exchange, rather greater than an individual is permitted to charge for a loan, to the great gain of the bank and los to the community. I say loss, for the community can never enjoy the great and full benefit of the credit system, till loans and credit are considered as entirely distinct in their nature, and the compensation for the use fo each be adjusted to their respective nature and character. Nothing would give a greater impulse to all the business of society. The superior cheapness of credit would add incalculably to the productive powers of the community, when the immense gains which are no made by confounding them shall come in aid of production

Whatever other changes the credit system is destined to undergo, these are certainly some which it must; but when, and who the revolution will end -- whetehr ti is destined to be sudden or convulsive, or gradual and free from shock, time alone can disclose. Much will depend on the decision of the present question, and the course which the advocates of the system will pursue. IF the separation takes place, and is acquiesced in by those interested in the system, the prospect will be, that it will gradually and quietly run down, without shock or convulsions, which is my sincere prayer; but if not -- if the reverse shall be insisted on, and, above all if it should be effected through great political struggle (it can ony be so effected), the revoltuion would be violent and convulsive. A great and thorough change must take place. It is wholly unavoidable. The pubic attention begins to be roused throughout the civilized world to this all-abosorbing subject. There is nothing left to be controlled but the mode and manner, and it si better for all that it shall be gradual and quiet than the reverse. All the rest is destiny.

I have now, Mr. President, said what I intended, without reserve or disguise. In taking the stand I have, I change no relation, personal or political, nor alter any opinion I have heretofore expressed or entertained. I desire nothing formt he government or the people. My only ambition is to do my duty, and shall follow wherever that may lead, regardless alike of attachments or antipathies, personal or political. I know full well the responsibility I have assumed. I see clearly the magnitude and the hazard of the crisis, and the danger of confiding the execution of measures in which I take so deep a responsibiltiy, to thsoe in whom I have no reason to have any special confidence. But all this deters me not, when I believe that the permanent interest of the country is involved. My course is fixed. I go forward. If the administration recommend what I approve on this great question, I will cheerfully give my support; if not, I shall oppose; but, in opposing, I shall feel bound to suggest what I believe to be the proper measure, and which I shall be ready to back, be the responsibility what it may, looking only to the country, and not stopping to estimte whetehr the benefit shall inure either to the adminisration or the opposition.

Populist Nationalist Social Credit Brotherhood of American Citizen Peacemakers of All Races and Creeds -- This is our Common Ground!!!

From Dick Eastman: oldickeastman@q.com