Is Ebola a Manufactured Crisis to Bring in Martial Law? – Metals & Markets Holiday Edition

The Unhived Mind

Is Ebola a Manufactured Crisis to Bring in Martial Law? – Metals & Markets Holiday Edition

Posted on August 30, 2014 by The Doc

http://www.silverdoctors.com/is-ebola-a-manufactured-crisis-to-bring-in-martial-law-metals-markets-holiday-edition/

00:00

00:00

MP3 File: Right Click, Save as…

In this special Holiday Weekend Edition of Metals & Markets, The Doc & Eric Dubin discuss:

•Chinese silver inventories decimated in Shanghai, while US & Royal Canadian Mint sales remain on pace for all-time sales records

•The Doc puts Ebola death totals in perspective- Are the powers that be manufacturing a crisis to usher in martial law & restrict American travel, or are we facing a bonafide Ebola contagion?

•Eric breaks down the latest on the Ukrainian/Russian crisis and the drums leading to a massive conflict with the West

•With gold & silver refusing to break down on the thinly traded last week of summer, we look ahead to gold & silver trading when the traders and bullion banks return to their desks Tuesday- is the long await rally dead ahead?

The SD Weekly Metals & Markets With The Doc & Eric Dubin is below:

Source: The irrepressible William Banzai 7

# # # #

Gold and silver managed to turn in respectable trading this week. The “China Put” for gold and even silver remains in place. Silver leaped higher like a scalded cat earlyThursday morning. London cartel monkeys squelched that move. But that pricing action speaks to the fact that deep pocket buyers are willing to capitalize on any significant decline in silver, and that puts the fear of god into those holding shorts too. This is also clear given huge open interest in silver, at a time when gold open interest has significantly diverged. As Bill Murphy explained when he was last on our show, when it comes to COMEX silver trading, there are big money interests taking on the cartel.

September should prove to be an interesting month. The Shanghai Gold Exchange is scheduled to launch physical settlement contracts on Sept. 26th, with settlement delivery availability even outside of China. It will take some time, but China will become the primary market setting the price for gold and silver. She has played along with the cartel’s manipulation for the most part. But that will eventually change.

We’re now in the strongest season for gold and silver demand. Even though western based retail demand has fallen for physical gold, silver demand remains healthy and it will not take much to send prices higher. The paper market trades in a way that suggests physical supply is tighter than most believe — and there certainly are some interesting dynamics going on in China when it comes to Shanghai Futures Exchange silver inventories. SRSrocco Report has tracked this story. Click here for the latest report. Silver inventories have fallen by about 90% over the last year.

.gif)

.gif)

What’s wrong with this picture?

ZeroHedge ran an interesting story Friday discussing the discrepancy between the Conference Board’s consumer sentiment survey and the snapshot provided by the University of Michigan’s consumer confidence survey. The divergence can be seen in the following chart:

.jpg)

The elevated stock market and the parade of context-devoid mainstream media reports about rising levels of employment play a big role in maintaining the masses’ normalcy bias. If you’re asked how your view of the economy compares to last month, odds are your comments will not reflect much change. But when the average American imagines the big picture, an entirely different perspective surfaces.

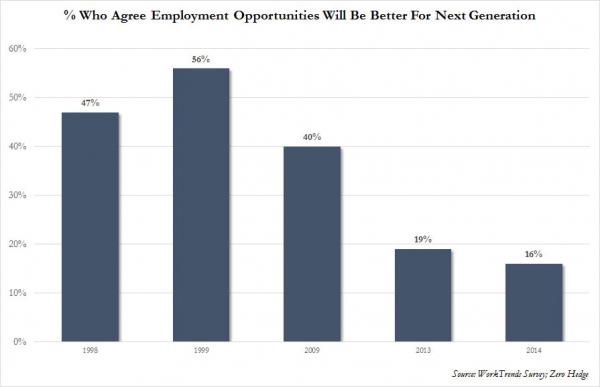

Case in point. When surveyed about employment opportunities for the next generation, only 16% of those surveyed in a recent study believed opportunities would be greater for the next generation. That’s down from 56% in 1999, a staggering loss of 40 percentage points. Which data set do you think paints a more accurate picture of the confidence level of average Americans? My view: the latter.

Strong Vodka In Kiev?

Did you hear? Russian tanks crossed the border into the Ukraine again. This must be the 5th claim of tank and armored vehicle crossing. The previous four “incidents” didn’t happen; I discussed this on the Aug. 17th SD Weekly Metals & Markets show and in this important story at The News Doctors that was totally ignored by all Western-based media. Needless to say, one does have to wonder what they’re drinking in Kiev.

Reports about Russian soldiers being captured in Eastern Ukraine are more credible. It wouldn’t be surprising to learn that Russia is coordinating and training Eastern Ukrainian separatist forces, much like how the CIA and US special forces operate. But events are happening at a rapid pace and it will take a few more days to assess this latest round of claims by Ukraine and the West.

The UN Security Council met this week, and they proved to be more interested in currying favor with the West’s position rather than calling for calmer heads and an investigation into this claimed border crossing. Click here and here for background.

If we operate on the assumption that European-based sanctions might very well fall apart come this winter given that 40% of Europe’s natural gas comes from Russia, what does that mean for the timeline of NATO policy on Ukraine? There’s no way Europe is going to tolerate people freezing to death during the winter. Russia holds a natural gas trump card when it comes to any further escalation of the sanctions regime. Unfortunately, one could make an argument that those interested in war will read this situation as justification for speeding up agitation for war. Let’s hope I’m wrong.

On that cheery note, thanks for tuning in, and to our American-based audience, enjoy the long holiday weekend! — Eric Dubin, analyst and managing editor, The News Doctors

PS: Dave Kranzler and I talked with Rory at The Daily Coin Thursday afternoon. If you’re thirsty for another podcast, click here.

http://thenewsdoctors.com/big-picture-western-world-is-sleeping-part-1-eric-dubin-and-dave-kranzler/

theunhivedmind says:

I’ve spoken for many years how pandemics and biological attacks are a great way to cover-up economic collapse. First of all the bankers behind the planned collapse (The Worshipful Company of Mercers) can blame the collapse on the biological threat and move the attention away from banking houses. Secondly the people will accept being forced to stay in their houses meaning there will not be any rioting etc since everyone fears the contagion. Thirdly the military will have the right to shoot anyone on sight out when they shouldn’t be and this will also promote fear and stop attempted riots. When the economy collapses all hell will break loose and no amount of police can contain the mass public so serious measures are needed and a pandemic or illusion of one can cover all bases without a need to go to drastic measures. Think about it! I was right just before the crash of 2008 when a few months later they announced the Swine Flu prior to serious financial issues. It could all be happening again shortly but I think Avian Flu or Pneumonic Plague will be real pandemics where as Ebola may be an illusionary one.

-= The Unhived Mind