THE COMING ENERGY SHORTAGE WILL EXACERBATE PEAK GOLD & SILVER

SD Contributor SRSrocco:

THE US ENERGY POLICY IS COMPLETELY F.O.S.! – We are SERIOUSLY SCREWED!

The reason why I have been writing a great deal about energy is due to the fact that energy is money. Gold and Silver are only a physical accounting of energy. Without ample energy supplies, gold and silver cannot be mined commercially.

The U.S. energy policy promoting LNG because they believe we have 100 years of natural gas reserves is plain insanity. Oil is even worse.

Break-even for the average well in the Bakken is probably $100 a barrel.

PEAK GOLD & SILVER will come sooner than later…

I have been spending a great deal of time sifting through updated SHALE GAS & OIL DATA.

The CURRENT DELUSION is to push LNG- Liquid natural gas (-260 degrees) as a source to power the U.S. commercial trucking fleet. The reasons stated are due to the current extremely low price of natural gas as well as the supposed huge domestic reserves.

I am starting to find out that the SHALE GAS reserves have been grossly overstated. Furthermore, I believe the recent downgrades of shale gas reserves by the USGS are only the beginning. I think we are going to see additional downgrades as the data from the shale gas industry makes its way into the public domain.

As I mentioned before, over $8 billion dollars were written down (1H 2012) from large companies such as BP and BHP Billiton due to shale gas reserve downgrades. Funny, the companies are stating the huge impairments are due to the low price of NatGas. This is a nice cover story for those who don’t have good functioning brain stems, but the truth of the matter is…. its due to a loss of reserves… PERIOD.

The shale gas Players such as Chesapeake were suffering negative cash flow due to a low price of natural gas plus the high cost of continued drilling. In order for these companies to continue their SHALE GAS FACADE, they drilled a few wells and proved up supposed huge reserves, in which they unloaded these supposed reserves to companies for a great deal of money.

Then these shale gas companies took this money and used it to continue drilling which made a larger glut of gas on the market, that pushed natural gas prices even lower. Thus, their cash flows are even worse than before…LOL.

We are going to see SERIOUS ADDITIONAL IMPAIRMENT CHARGES on supposed shale gas reserves year end 2012.

The reason why I have been writing a great deal about energy is due to the fact that energy is money. Gold and Silver are only a physical accounting of energy. Without ample energy supplies, gold and silver cannot be mined commercially.

The U.S. energy policy promoting LNG because they believe we have 100 years of natural gas reserves is plain insanity. I have a great deal more to share when I finally get the research finished and an article to post.

PEAK GOLD & SILVER will come sooner than later…

THE GREAT BAKKEN OIL FIELD MAY PEAK SOONER THAN EXPECTED

I will end my posts on this positive note. For those who still don’t believe in peak oil (i.e… Porter Stansberry), I would like to present the following graphic:

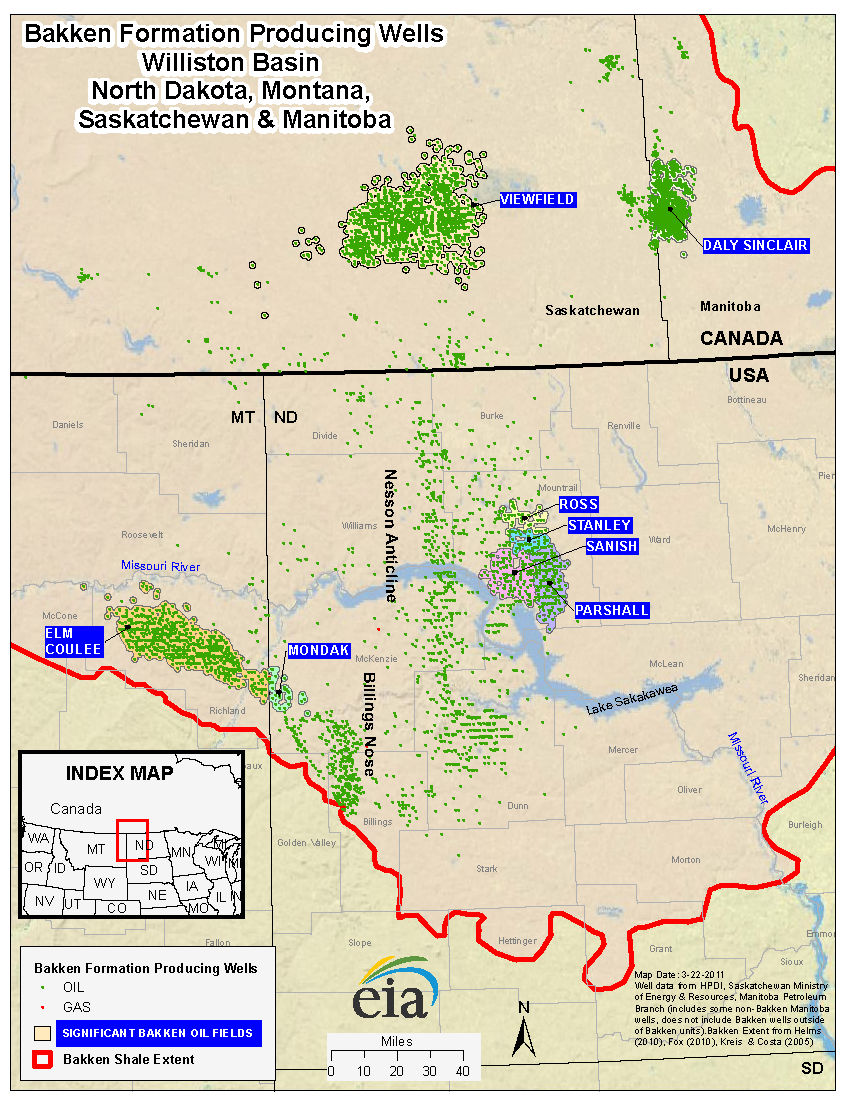

This map comes from the wonderful folks at the EIA. Here we can see the entire Bakken field is outlined in red. The green areas denote the sweet spots where drilling has already been saturated. There are those who think the entire area is full of oil… it is not.

According to the work by Rune Likvern:

The post shows estimates of break even prices for the “average” (pro forma) well at around $80-$90/bbl. That estimate does not include full life cycle costs, acreage costs etc.. I hold it more likely that the break even cost for the “average” well in the Bakken formation presently is around $100/bbl when all costs are included.

Well, isn’t that quite interesting. Break-even for the average well in the Bakken is probably $100 a barrel. Those who are counting on DEFLATION, better realize this is much different than the 1930′s when the cost of a barrel of oil was only $1.27 (1929 before the depression). Thus, the cost of producing the barrel of oil based on an EROI of 100/1 (in the 1930′s) was a lousy $0.02 cents a barrel (rounded higher.

When the price of oil fell to $0.65 a barrel in 1932, the oil tycoons were still making $0.63 profit for each barrel! Sure it wasn’t as much as they were making in 1929, but who cared if the oil was flowing like water.

Today, we have a much different picture… especially in the cost of producing shale oil in the Bakken. If it is true that break-even is nearly $90-100 a barrel… there ain’t a whole lot of bacon fat left in that balance sheet!

ONE DAY… THE OIL ANALYSTS MAY BE SLEEPING WITH THE FISHES…

Check out these similar articles:

- Peak Oil: Myth or Fact?

- THE FORCES COMING IN THE GOLD & SILVER MARKET ARE TREMENDOUS: PEAK SILVER IS AT HAND!

- Sprott Buying Energy Shares

- Chris Martenson: Peak Oil Will Change Life As You Know It & So Will the Coming Collapse

- Peak Silver Rev

http://www.silverdoctors.com/the-us-energy-policy-is-completely-fos/#more-14823