Oppressive Health Insurance Companies.... Some Real Evidence

Dear friends,

We have all been exposed to some ugly demonstrations of behavior in response to the much-needed efforts to develop healthcare reform, but how many of us are aware that self-serving corporate interests like health insurance companies and Big Pharma are behind the instigation and manipulation – the fear-mongering that has dominated the media and upset so many Americans, stampeding them into confusion and displays of ugly behavior? Will the powerful lobbying power of these companies divert our legislators from serving the needs of the American people?

This is a major concern of mine and my own professional and personal experiences, working in the healthcare field, give me a validated cause for concern that unsavory influences will destroy this much needed reform, unless we know the facts and take more action.

So, let me share with you some information that is beyond ugly politics – inviting you to take a real glimpse of what is happening behind the scenes. I offer this because the media are doing a really poor job of putting out the whole picture. Then, you will be closer to being able to make an informed choice about where to put your support.

First, immediately below, is an farsighted article I wrote over ten years ago describing my experience with a real-life situation where I was witness to the death of a friend caused by an HMO’s negligent care. I could share a number of other first-hand stories of ruined lives (the industry calls it managed lives) at the hands of managed care. While the article is written from the perspective of mental healthcare, it is relevant to all healthcare.

Below my article, I am posting some recent articles off the Internet that will provide you some insight to the real manipulations behind the scenes. I invite you to take the time to understand what is really going on in the fiasco to reform healthcare in America.

Granville Angell, EdS, LPC, NCC

HOW MANAGED CARE WRECKS OUR LIVES

A Personal Odyssey

Eddie winced in pain as he sat up in his bed to talk with me about his new diagnosis of pancreatic cancer. I had stopped by after hearing the news from another friend that the "experts" had sent him home to die. The visit would have been painful enough for me if he had been one of my counseling clients, but Eddie was my neighbor and we had built a friendship around our mutual interest in ultralight flying. Though feeling quite ill, he was angry. As he shared the experiences leading to his diagnosis, I came to realize that we shared another common interest: our mutual loathing of managed care.

Eddie was like so many of us in present day society. He worked hard, taking pride in his good craftsmanship and among the work benefits he and his wife brought into their lives was a health policy administered by a managed care organization (sometimes referred to as MCO, HMO, or PPO). When he first began to have significant pain, he went to his managed care physician for a diagnostic consultation. His condition was attributed to musculoskeletal problems and he was sent home with no further testing and medication appropriate to his diagnosed condition. However, his pain became increasingly worse and Eddie made repeated visits, insisting that the good managed care doctor do more diagnostic testing to find the true cause of his pain. The doctor refused, insisting his original diagnosis was accurate.

"He wasn't bent over this chair, crying in pain half the night." Eddie gestured toward an easy chair in his bedroom as he painfully adjusted his position to continue his story. He went into detail, describing how he repeatedly asked for a CAT scan, or some type of advanced testing. As I listened, it occurred to me that Eddie had not been aware of the doctor's managed care enforced policies against "unnecessary" diagnostic testing. You see, everything in managed care policy is driven by the bottom line, because managed care is business. By allowing himself to become assimilated into that business-oriented system, whatever Hippocratic inspired healing ethics the doctor had brought to his practice had been sacrificed to the greed of managed care. Everything might have been different had Eddie known that when he first sought the doctor's care.

Finally, there came a time my gentle easy-going friend left his wife in the waiting room and confronted the doctor alone. She heard him through the door, loudly demanding a CAT scan or else . . . He got the scan, but it was too late. By the time the cancer was discovered, it had expanded and metastasized to a degree that conventional treatment intervention was not even considered.

As Eddie concluded his story, I could feel the hair standing on the back of my neck. What ironic, synchronistic fate had delivered me to sit on the edge of his bed to hear this story of twin cancers; one invading and destroying my friend's body, while the other invades and destroys the health of an entire society. Already, I had come to know managed care too well.

At first, I had not paid much attention to the gradual emergence of this big-business oriented approach to solving our nation's health care problems. I remember my daughters' pediatrician emotionally declaring he would have nothing to do with PPOs or any other system that could come between him and his patients. I remember echoing his sentiments, but I had not yet opened my full time private counseling practice. So, my first personal experience with managed care came as a shock.

At the end of the 80's, during which I had clinical oversight of a small adolescent treatment facility, I began to get intrusive phone calls at work. Usually calling at inconvenient times, like when I was on my way to do group therapy, these callers identified themselves as HMO case managers or reviewers for some of our patients. They demanded the most intimate and personal details on our patients, and after not having seen the patients, they brazenly attempted to dictate the treatment plans. Routinely, they pressured for premature discharge. My most notable recollection was the managed care-driven premature discharge of a sexually abused 16 year-old back into the hands of her abusive parents before we could complete treatment and arrange more suitable custody. Shortly thereafter, funding for the facility was dropped and I decided to enter full-time private practice.

From its inception, I made a commitment that my private counseling practice would have no involvement with managed care, nor with health insurance companies engaging in similar practices. Managed care's intrusion in mental health care is more treacherous, if not more dangerous, than it is in the medical field. Under this system, there is no true privacy or confidentiality for clients seeking counseling or other mental health services. The release signed by the client at the beginning typically includes a subtle authorization for all interested parties to have access to the client's personal information. These interests are not one or a few ethical health professionals like the old days. They are "moneyed interests" who consider themselves as having an "investment" in the "managed life" of the client. Who might be these "moneyed interests?" Depending upon the circumstances, we may be talking about a parent insurance company which releases personal information to the Medical Information Bureau for other insurance companies and interests to access. Employers can get this sensitive and personal information. So can banking and loan agencies, not to mention nosey neighbors who have the right connections.

Counselors and other therapists assimilated by managed care no longer operate according to the professional ethics and principles they were trained to follow. Not only is client confidentiality gone, but they have abdicated control of treatment to the self-serving interests of a big business-based authority. That authority requires a DSM-IV Psychiatric Diagnosis for every client -- whether the client needs it or not -- in order to authorize treatment. In the old days, such diagnostic "labels" were applied for purposes of understanding psychiatric illness and allowing professionals to communicate and collaborate in providing treatment for specific patients. Even then, when those labels leaked into the public domain, there was pain and embarrassment for the patient and family. Today, a psychiatric diagnosis is a trade-off for a limited, standardized, "cost effective" minimal intervention that may not meet the unique needs of the client. In exchange, the diagnosis creates a semi-public record that can be used to deny everything from further treatment to career advancement; from insurance to financial loans.

Finally, managed care companies reportedly handle confidential information carelessly (Clifford, 1997), to include lost reports; authorizations mailed or faxed to the wrong person; accidental chart switching and unauthorized client information being exchanged between HMO and employer.

The erosion of privacy in mental health care is aptly summarized by Steven Shearer, Ph.D., and Jeffrey Barnett, Psy.D., (1988) in the (Baltimore) Daily Record:

It is now naïve for any of us to believe that insurance benefits can be used to pay for mental health treatment with any expectation of confidentiality. In this age of industry and governmental data bases, medical information has fewer legal protections than our videotape rental records and may sometimes be electronically accessed as easily as credit information. [Note: This article was written before the development of HIPAA Law, which purports to protect patient rights, but really only warns the patient of the inevitability of his medical information being electronically shared between all interested participating parties. I support appropriate electronic sharing between treatment professionals who have the patients’ needs as their primary interest; not use of those same records as documentation to limit or deny needed treatment.]

The circumstances briefly described above lead to an obvious conclusion. When using the "benefit plans" of managed care organizations to finance their counseling, clients may be taking major risks with their futures. Their personal disclosures can cause more damage to the clients than if they kept their thoughts to themselves. To the extent that they become aware of this fact, they will increasingly feel less safe about opening up in the counseling relationship. How ironic, that one setting where people historically have come to feel safe to disclose the most vulnerable aspects of their lives is subjected to invasion by these pirates of therapeutic parlance. Indeed, there can be no true therapeutic relationship without the establishment of trust and security that comes in a confidential professional relationship. From the very beginning, information shared is not used in the best interests of the client. Everything disclosed is subject to the scrutiny of a managed care reviewer whose primary goal is keeping costs down -- not supporting the therapeutic interventions most necessary for the clients' needs.

Under examination, the argument of managed care proponents (generally managed care companies and their lackeys) that health care professionals need oversight to keep costs down falls flat. To whom would you rather trust your health? People who spent several years in college learning how to make lots of money, or people who spent several years in college learning how to heal? A review of the soaring costs of health care during the rise of the era of managed care clinches the point. Almost daily now, we hear in the media of how the self-serving policies of some managed care organization has led to increased morbidity or death for another unfortunate victim of this horrendous system.

Behavioral healthcare, as they now call it, is especially subject to the manipulations of managed care. Unlike mainstream medicine with its backbone in the physical sciences, the mental health disciplines are built primarily on the "softer" sciences of psychology, sociology, and human development.. The practice of counseling and psychotherapy is more of an art than the practice of medicine. Behavioral healthcare reviewers cannot possibly come to "know" the client and effectively influence clinical decision making by reading records and talking to the counselor or therapist on the phone. Rather than respecting the "softer" basis underlying the knowing, intuiting and empathizing tools used by those of us who are good at our work, managed care reviewers manipulate this "softer" science to the interests of their companies. They seek to limit treatment to maintain the bottom line. They simplify and over-standardize treatment in a way that discounts individual differences. Psychotherapeutic treatments and modalities based on these "softer" sciences cannot be as solidly established, standardized or predictable as can those in the field of medicine. Where standardized treatment approaches have caused serious problems in medicine, this philosophy rigidly applied to the behavioral sciences can be routinely catastrophic where individual differences are not taken into proper consideration. Over time, professionals who become assimilated by managed care tend to find their original ethics warped by managed care philosophy.

Lloyd A Wells, Ph.D., M.D., in an enlightening journal article entitled, "Psychiatry, Managed Care, and Crooked Thinking" (1998), decries the impact managed care has had on medicine and psychiatry. He emphasizes that in contrast to the traditions of medicine (including the psychotherapeutic traditions that grew out of it), managed care has few traditions. He states what is becoming overwhelmingly apparent to all of us who see the fulfillment found in healing as the primary motivation behind our work. Managed care relies on the ethos of the marketplace. It is marked by "ethical shabbiness and . . .logical fallacies." The traditions and philosophic underpinnings of business have been so imposed upon the healthcare field that practitioners are beginning to accept them and to develop, "the same style of skewed thinking." In the words of Dr. Wells, "Without a research base . . . managed care companies . . . do not acknowledge principles of medicine . . . (and) Decisions are presented in pseudoscientific verbiage but are driven by the marketplace."

Thus, from the beginning, I have honored my original commitment not to have any part in practicing my counseling under managed care. As this reprehensible system of healthcare anchored itself and metastasized into the community, it ate up doctors' practices one by one. Between two and three years ago, managed care assimilated the family practitioners who literally built my counseling practice with their referrals. The doctors liked my work and insisted that I become paneled in the managed care companies, so they could continue to refer to me. I explained to them how managed care may be manageable in a medical practice, but ethically impossible in a counseling practice. They understood. They have even tried to refer, when possible, the diminishing trickle of clients not involved in managed care. But my caseload of clients dropped off drastically as even my own client cost-saving and sliding fee scale measures failed to compensate. Like organized crime, managed care seeks to eliminate those who don't join their ranks. My good friend and colleague, Mickey Skidmore, ACSW, defines the modus operandi of managed care companies as, "nothing short of extortion."

As managed care continued to impact my practice, the news of its failures continued to grow. Cardiologist Paul Casale, MD, in a report to the American Heart Association (1997), indicated that HMO enrollees with cardiac disease are twice as likely to die after a heart attack as those covered by the old, traditional fee-for-service coverage. A recent California state survey, reported on by David R. Olmos of the Los Angeles Times (1997), found that 42% of respondents had problems in managed care health, citing many complaints of denials or delays in getting treatment. An article archived on the Modern Healthcare web site (DeMoro, 1997), outlines, "The pain and suffering felt by the very real victims of the cost cutting the industry touts as a grand success," including needless deaths precipitated by delayed, refused and mismanaged treatment. In "What is the Value of a Voice?" (1998), ex- MC Medical Director Linda Peeno, M.D., provides an insider's view of the ethical depravity to be found in a managed care company's policies of denying treatment for "unnecessary" care.

As managed care encroached on my previously fulfilling livelihood, my righteous indignation grew even faster than my pockets emptied. But the more I studied the circumstances, along with the harm this system is causing its victims, the more convinced I became in my stance against managed care. Especially over the past two years, my family has faced significant financial struggle. Recently, I came across an email reply I made to a counseling graduate student who inquired about sources of counselor burnout. Suggesting the impact of managed care as a primary cause of modern day counselor burnout, my reply was uncomfortably candid, terse and to the point:

I have stayed true to the ethics that are part of my spiritual self and that are also what were taught in my graduate program at the University of Florida. . . . For this, my experience has been to face extremely trying times, financially and personally. The burnout I experience comes from seeing my previously growing practice eroding away as previously referring physicians are forced to send their patients to managed care therapists. What is the reward for doing the right thing? I believe that participating in third-party-focused treatment in mental health betrays the sanctity of the client-counselor relationship and equates to selling one's professional and personal soul! Yet, for me, the daily agony of wondering if I can continue to meet my financial obligations holds no measure to the sense of personal, professional and spiritual erosion I would increasingly feel in betraying my clients for a few pieces of silver.

. . .Over twenty years ago, when I was a graduate student in counseling, such arrangements for provision of treatment would have been unthinkable. If the basis of ethics rests on the heritage of a consensus of universally-recognized truths about honor and honesty in human relationships, how can any of us in mental health justify participation in managed care? This is a system that threatens professional burnout for those who abstain, but guarantees soul-level burnout for those who sell-out their clients by joining the system. This is my well-informed, deeply felt and painfully-considered opinion.

At first, almost daily, I questioned myself about my decision to hold out against managed care. I questioned my own worth, professionally, as managed care therapists moved in to take the referrals I previously received. I thought a lot about the meaning of honor and integrity. How could so many therapists sign the "gag clauses" in their contracts that restricted them from informing clients of the risks? Why would ethical companies need gag clauses in the first place? How could so many therapists place loyalty to the company over loyalty to the client? The past several months have been especially challenging as I have come to explore other options in addition to counseling that might allow a sustainable livelihood. I could work on my writing. Going back to flying helicopters, or even construction work, seemed far preferable to the sense of dishonor I would feel in selling out my clients.. Then, gradually, it began to appear that the sleeping public was beginning to wake up.

A slow rolling groundswell of dissatisfaction against HMOs, PPOs and the like has begun to sweep across the country. It is gratifying to see increasing reports in the media regarding the inefficacy of managed care. Colleagues who previously cajoled me for "taking a one man stand" are beginning to break ranks with the system. Recently, I received a gratifying call from a respected friend and colleague. This clinical psychologist shared his decision to remove his practice from managed care; thus re-opening himself to me as a referral resource for my most seriously disturbed clients. Things are beginning to turn around, as there are more and more of us who are either holdouts or dropouts against managed care. I keep telling myself that if I survived as a helicopter ambulance pilot in Vietnam, and if I survived working in a corrupt state prison system, surely I can hold out against the corruption of managed care in America. Prospective clients are increasingly exploring the security and confidentiality offered by my counseling services and deciding they are well worth the modest sliding scale fees. Somehow, I'll get my daughters through college and maybe I'll even afford to get my ultralight plane flying again.

But, for now, I know the decision to hold out was the right thing to do. There is the satisfaction that I continue to have no part in a greedy, self-serving health care delivery system that is bringing harm to so many people. But holding out is not enough. Managed care poses significant dangers to all of us (except for the top 23 corporate fat cats who collectively hold about $7 billion in stock) and information about those dangers must be shared. I need to do that for my family and myself. I need to do that for the people. And, I need to do that in memory of my friend, Eddie.

Granville Angell, Ed.S., L.P.C., N..C.C._________ BIBLIOGRAPHY BELOW

© 1998 by Granville Angell. All Rights Reserved: Permission granted to copy and share without modification, in any medium, online or in print, except for profit.

BIBLIOGRAPHY

Granville Angell, Ed.S., L.P.C., N.C.C. (No Date), The Risks of Managed Care [Online]. Available: http://www.transitions-counseling.com/the_risks_of_managed_care.html [1997, December, 22]

Ruth Clifford, Ph.D. (No Date), Confidentiality of Records and Managed Care: Legal and Ethical Issues [Online]. Available: http://www.ccemhc.org/confid.html [1999, April 3].

Illinois State Medical Society (No date), What Is "Unhealthy" About Managed Care? [Online]. Available: http://www.isms.org/index.html [1998, September 22].

Rose Ann DeMoro, Managed Care's Seamy Side: It's Time To Fight Back As Executives Get Rich and Patient-Care Standards Drop. Modern Healthcare, January 20, 1997.

Ivan Miller, Ph.D. (1998). Eleven Unethical Managed Care Practices Every Patient Should Know About (With emphasis on mental health care) [Online]. Available: http://www.nomanagedcare.org/eleven.html [1998, September 19].

News & Trends, Are HMOs Trouble For Cardiac Patients? Business & Health, December, 1997.

Linda Peeno, M.D., What is the Value of a Voice? U.S. News and World Report, March 9, 1998.

Steven Shearer, Ph.D., and Jeffrey Barnett, Psy.D., Managed Care Erodes Privacy of Mental Health Care Patients. The Daily Record (Baltimore), January 14, 1998.

Lloyd A. Wells, Ph.D., M.D., Psychiatry, Managed Care, and Crooked Thinking. Mayo Clinic Proceedings, Vol. 73, No. 5, May, 1998

Today, more experienced and refined in their tactics and from behind the scenes, these corporate interests are leading the charge against healthcare reform. Read below for the evidence.

WellPoint, United Healthcare Accused Of Illegal Actions

The insurers pressured employees to lobby against healthcare reform, Consumer Watchdog alleges.

The nation's two largest health insurers have been pressuring employees to lobby against healthcare reform in Congress in violation of a California law against coerced political activity, a consumer group alleged Wednesday.

Consumer Watchdog in Santa Monica has asked California Atty. Gen. Jerry Brown to investigate its claim that UnitedHealth Group and WellPoint Inc. pushed workers to write their elected officials, attend town hall meetings and enlist family and friends to ensure an overhaul that matches their interests.

Christine Gasparac, a spokeswoman in Brown's office, said the call for an investigation was being reviewed.

In a website message to the company's 75,000 employees, UnitedHealth's executive vice president and chief of medical affairs, Reed Tuckson, said he had "strong concerns" with some of the proposals and called for a bipartisan plan -- shorthand for heeding Republican opposition to any government-run option. He urged workers to contact an "advocacy specialist" with the company's lobbying group to "educate and assist" them in getting involved, including during working hours.

WellPoint, whose Anthem Blue Cross unit is the largest for-profit insurer in California and employs 8,000, took a more overtly negative tack.

"Regrettably, the congressional legislation, as currently passed by four of the five key committees in Congress, does not meet our definition of responsible and sustainable reform," Anthem said in a company e-mail last week. The proposals would hurt the company by "causing tens of millions of Americans to lose their private coverage and end up in a government-run plan."

The appeals amount to illegal coercion under California law, Consumer Watchdog research director Judy Dugan said. "While coercive communications with employees may be legal, if abhorrent, in most states, California's labor code appears to directly prohibit them," said Dugan, citing sections forbidding employers from "tending to control or direct" or "coercing or influencing" employees' political activities or affiliations..

The insurers denied their suggestions were inappropriate or aimed at defeating reform.

"Assertions that UnitedHealth Group has encouraged employees to attend anti-reform rallies are completely false and untrue," said Cheryl Randolph, spokeswoman for the Minnesota-based insurer.

The company provided employees with details of "the constructive proposals we have made publicly to help reduce costs and unnecessary administrative spending in order to expand access to care," Randolph said, adding that involvement was voluntary.

"WellPoint has not been contacted by the California attorney general and has not seen any complaint; therefore, we cannot respond to any questions at this time," said spokeswoman Cheryl Leamon of the Indianapolis-based insurer.. "We believe it is important and permissible to provide up-to-date information about health reform to our associates."

One legal expert said proving a violation of the law might not be easy.

"I think it's tacky, in the least, and it risks creating the kind of bad publicity that Consumer Watchdog is trying to bring to it," Henry T. Greely, a professor at Stanford Law School, said of the insurers' alleged efforts to enlist employees in the debate. "Certainly, anything heavy-handed would be grossly inappropriate. But it may be difficult to draw the line between informing people and improperly coercing them."

Michael Waterstone, a Loyola Law School professor, said the California statute protecting employees from undue influence in political matters is unique to the state and has been used successfully to sue violators in the past.

The UnitedHealth letter went out to employees from the insurer's lobbying group, United for Health Reform, which Dugan said was trying to rally employees to protect their leading stake in the health insurance industry.

"They want to be absolutely sure that there is no public insurance option that will compete with them," Dugan said.

Contact the author at: carol.williams@latimes.com

Pre-Existing Health "Conditions" -- Cops, Firefighters, Expectant Dads, and Those Suffering From Allergies, Acne and Toenail Fungus Are Uninsurable According To Internal Documents

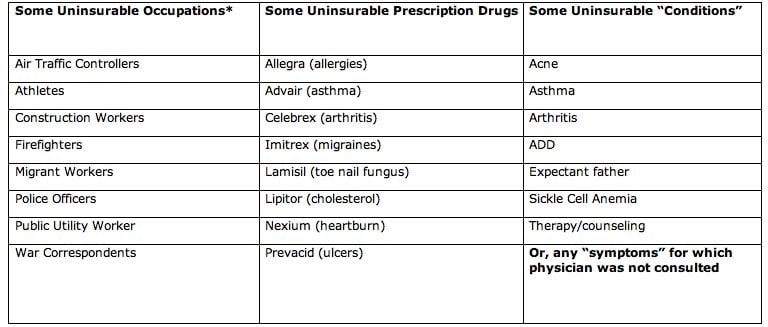

WASHINGTON, D.C. -- In the wake of news reports that a history of domestic violence is considered a "pre-existing condition" by many health insurers, today Consumer Watchdog released internal insurance company documents showing that firefighters, police officers, war correspondents, expectant fathers, pregnant women and patients with asthma, acne, allergies, and toenail fungus will often be denied health insurance policies.

The internal insurance company documents – known as "underwriting" guidelines – reveal that insurers deny applicants based on occupation, age, weight, use of a wide range of common prescription drugs, minor health conditions or mere “symptoms” that have not been reported to a physician. In some cases, instead of denying coverage outright insurance companies will sell policies to these applicants but only at exorbitant costs.

“These documents show that just giving the insurance industry an uncontested franchise by requiring Americans to buy policies will not solve the health care crisis. Americans need a strong 'public option' which would not have the tendency to game the system like private insurers and strong regulation to watch over the industry day-to-day,” said Jerry Flanagan, Consumer Watchdog's Health Policy Director.

*Blue Shield of California & PacifiCare (subsidiary of UnitedHealth Group).

*Blue Shield of California & PacifiCare (subsidiary of UnitedHealth Group).

"These documents show why health care reform must include serious curbs on insurance companies including regulation of rates and practices so insurers can't continue to price gouge or find new ways to refuse customers as part of their business model," said Carmen Balber, Consumer Watchdog's D.C. Director.

Download the underwriting documents at:

* PacifiCare (subsidiary of United Health Group).

* Blue Cross of California (subsidiary of WellPoint Inc.).

* Health Net.

Click here to read Consumer Watchdog's policy recommendations to regulate health insurance rates and practices in the report "Regulation, Not Deregulation: The Prescription for Lowering Health Costs Without Cutting Coverage (With or Without a Public Option)".

- 30 -

Consumer Watchdog is a nonpartisan consumer advocacy organization with offices in Washington, D.C. and Santa Monica, CA. Find us on the web at: www.ConsumerWatchdog.org.