The Rothschilds & Rockefellers team up to buy, in a distressed market

What does the coming together of the transatlantic Bilderberg duopoly signify?

Cashing in before the storm they are busy fomenting in the Middle East breaks?

http://www.911forum.org.uk/board/viewtopic.php?p=161193#161193

Time for this monstrosity to be nationalised, or otherwise neutralised, before they drag us all to hell.

T

The Rockefeller completes another mission for the Rothschild.

Rothschild and Rockefeller families team up for some extra wealth creation

The Rothschild and Rockefeller families have teamed up to buy assets from banks and other distressed sellers in a union between two of the best-known names in financial history.

By Alistair Osborne, Business Editor - 4:51PM BST 30 May 2012

RIT Capital Partners, which is chaired by Lord Rothschild, has taken a 37pc stake in Rockefeller Financial Services, the family’s wealth advisory and asset management wing. It has snapped up the holding from French bank Société Générale for less than £100m.

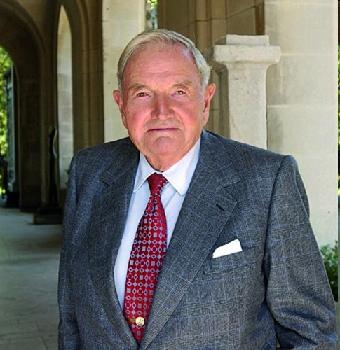

The transatlantic alliance cements a five-decade acquaintance between the now ennobled Jacob Rothschild, 76, and David Rockefeller, 96, the grandson of the ruthlessly acquisitive American oilman and philanthropist John D Rockefeller.

The two patricians now plan to capitalise on their family names to buy other asset managers or their portfolios, using their networks of top-notch contacts to ensure they get a seat at the table for any deal.

“We’ve known each other for a long time, they have a good business,” said Lord Rothschild yesterday. “We haven’t got a presence in the US and this brings together two formidable names in finance.”

He said the two firms planned to capitalise on current market conditions where banks, like SocGen in this instance, are selling non-core assets to rebuild capital ratios. “At a time when big banks are destabilised, there may well be opportunities,” he said. “We could buy an asset management company or grow one. Rockefeller already has $34bn (£21.9bn) assets under administration.”

He said David Rockefeller was still “very involved” in the business, though it is run day to day by chief executive Reuben Jeffery.

The Rockefeller group goes back to 1882, set up to invest the family money made by John D Rockefeller’s Standard Oil, the forerunner for today’s Exxon Corporation, which he built with a Darwinian aggression. “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in,” he once said.

The Rothschild banking dynasty has its roots in the 18th century when Mayer Amschel Rothschild set up a business in Frankfurt.

Lord Rothschild fell out three decades ago with his cousin Sir Evelyn de Rothschild, who then ran the UK branch of the family bank NM Rothschild. That sprang to fame in 1815 when it bought government bonds in anticipation of Napoleon’s defeat at Waterloo.

Lord Rothschild’s relations with the French side of the family have been better though and he likened the Rockefeller deal to RIT’s tie-up earlier this year with the Edmond de Rothschild Group, which has €150bn (£120bn) under management.

“We think that having that span of interests in Europe and America – as well as China – will give us a better chance of finding exceptional investment opportunities,” he said.

RIT, which has net assets £1.9bn, has had a tricky few months with the shares down about 14pc in the past year. They fell 6 today to £11.25.

Lord Rothschild said: “Everyone has been marked down. We didn’t have a brilliant year on the quoted side but we did do very well on the private side,” realising investments in North Sea operator Agora Oil and Gas and credit manager Harbourmaster.

Now that's rich: Rockefellers and Rothschilds team up

http://rt.com/business/news/rothschild-rockefeller-strategic-partnership-590/ 30th May 2012

.......Chaired by Lord Jacob Rothschild, RIT Capital Partners is a £1.9 billion ($3 billion) investment trust, which mainly focuses on capital growth through investing in a range of assets from equities to bonds and private equity from around the world. Now, the trust says it’s taking up a 37 per cent stake for an undisclosed sum in the parent company of Rockefeller & Co that was previously held by Société Générale Private Banking.

Société Générale, which has owned a stake in the Rockefeller wealth and asset management since 2008, appointed a new head of private banking in March, as it moved to overhaul the business.

The firms intend to work on investment solutions and other areas of shared expertise to further serve the needs of their clients and investors according to the statement.

The partnerships unite 96-year-old David Rockefeller, and Jacob Rothschild, 76 – whose personal ties span five decades and as stated by Rockefeller “the connection between the two families remains very strong.”

Lord Rothschild, chairman of RIT, added, “The creation of this partnership with the Rockefeller family is truly historic. We look forward to the development of our joint investment activities across the global capital markets.”

The deal is expected to be finalized by the end of September.

Established in 1882 by John D. Rockefeller, an American industrialist and one of the richest men in recent history, Rockefeller & Co provides asset management and advisory services and has $34 billion (£21.78 billion) of assets under administration.

The Rothschild banking dynasty started when Mayer Amschel Rothschild opened a business in Frankfurt in the late 18th century.

The family’s name is associated with some historical deals, such as helping finance Britain's war against Napoleon in the 19th century and raising funds for a loan allowing the British government to buy the Suez canal.