Consolidated Gods move in for the Kill - London-listed Rothschild Investment Trust takes 37% of Rockefeller Financial Services private family wealth management before the great asset buying spree of 2013 under the command of Reuben Jeffrey III CEO of RFS.

From Dick Eastman

Both families have been withdrawing their money from investments to intensify deflation and prepare a distress-sale abundant buyer's market for American asset wealth. Rothschild move to absorb their proxy in America - Rockefeller positioning to buy up all of the land, bankrupt businesses and privatized public lands and assets in deflated America. This is what the deflationary recession and all the propaganda to trick you into expecting inflaiton, has been about. As Rockefeller Chase-Morgan has captured the banks of the West Coast and as laws enable the biggest corporation, public or private, to own elections, the rule of the Zionist Crime Syndicate over the American debt slave plantation is complete. But that's OK, because the Rockefellers give to art. Purchasing power has also been drained from Europe to also losen the fruit on the branch for easy picking. It all comes in 2013.

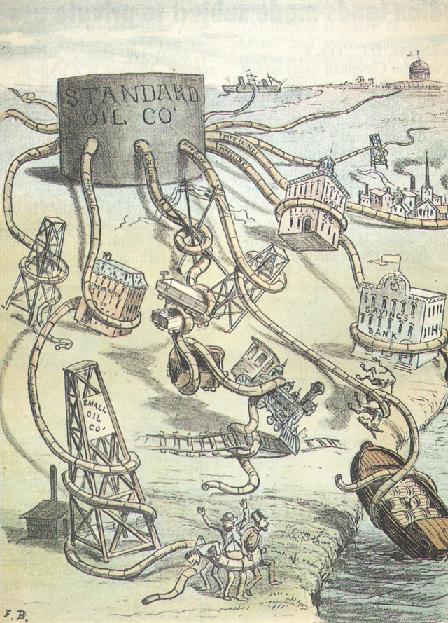

The Rockefellers have dominated the American economic scene since the rise of the Standard Oil octopus in the 19th-Century. They have the expertise to do the buying. The Rothschilds do not want to make the mistakes that creditor Japan made in buying American assets, for most of which they were practically swindled. They will buy only the best and leave the rest to dry up and blow away.

Rockefeller’s asset manager officially have $37bn in assets under management, but there is no regulation forcing truthful disclosure and it is in their interest to maintain as low a visible profile as possible. They have announced their intention to undertake aggressive acquisitions in the US when the merger is completed in the fall. 2013 will be a year when Rothschild/Rockefeller direct ownership of America becomes absolute. The two families are already flesh and blood through many marriages. The richest Jewish families united under one asset management, untold wealth, connections and holdings unreported and uninvestigated outside private merchant bank walls, but said to be in excess of 500 trillion USD around the world.

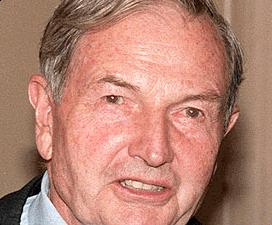

“Lord Rothschild and I have known each other for five decades. The connection between our two families remains very strong. I am delighted to welcome Jacob and RIT as shareholders and partners in the ongoing development of our investment management and wealth advisory businesses.”-- David Rockefeller.

Rockefeller Family Services CEO Reuben Jeffery is clearly dissimulating when he says that the group has just started serious thinking about what they might do only over the last few weeks. He is covering for a conspiracy that lays behind the Great Deflationary Depression. In a depression, assets are not destroyed, they only change hands. We know the money that has been drained out of domestic circulation has gone somewhere and that at some point the predators will come in for the kill of their weakened victim.

. “There is definitely a lot of thinking going on that has transpired over the past several weeks, between us and the Rothschild people, about possibilities of collaboration in terms of accessing new investors, creating new investment vehicles to offer investors, that sort of thing - and [in] various markets outside of our respective core markets, Europe and the U.S.. But the thinking on those possibilities remains in the earliest stages. ... there is a shared vision, at the conceptual and strategic level, that marrying the two names with particular products, services, geographic market opportunities, can and will have resonance. These are things we will want to act on as this partnership and overall relationship evolves."

On the Board of Advisors of the Rothschild Investment Trust, the entity that controls the English Rothschild's personal wealth are City of London minister Lord Myners, JP Morgan banker Bill Winters and Credit Suisse banker James Leigh-Pemberton.

Jacob (Lord) Rothschild has controlled RIT, or the Rothschild Investment Trust, since around 1980 when a family dispute caused him to step back from his involvement in NM Rothschild, the investment bank.

David and En-lai

David and En-lai

Jacob Rothschild, 76 commands the English Rothschild Empire, although other members of the family hold high non-administrative positions in their respective countries. Another of the family's companies, Edmond de Rothschild Group, said earlier this year they would form a new joint venture to boost their fund management and investment operations. The French and English Rothschild entities operate separately to avoid raising nationalist objections to their operations. In the US they have had to control through proxy - J.P. Morgan and the Rockefeller Family in the 20th Century.

Recall that the Rothschids were behind the French Revolution, a bloodbath of in debt French aristocracy who attempted to repudiate their debt. They bankrolled both Napoleon and Napoleon's European defeat and dictated, through Metternich, the course of the 19th century. World War I was a Rothschild device to

(2) capture the oil lands of what is now Iraq and Saudi Arabia, and 3) create a Jewish homeland in "the Holy Land" Palestine which for centuries had been under Turkish administration. etc.

Rockefeller Chief Executive Reuben Jeffery also said, "We are combining, on a macro level, two well-recognized names and families who have a long history of wealth creation and responsible stewardship." But of course, no firm, especially banks, should operate "on a Macro level," a sphere that looks at the entire economy in terms of price levels, employment levels, aggregates of production, trade, lending. This shows monopoly power, but it goes beyond monopoly power to Macro control - not control of single markets by of entire economies. Not fixing prices but fixing aggregate price levels -- and the economics analysis of this kind of operation does not exist, because Rockefeller won't fund that kind of economics and it will withdraw funding from any university harboring an academic economist who would tackle that aspect of Macroeconomics. But the economics exists and has been developed to a point of great precision of control -- so that Macro distasters, like the present world wide macro deflationary depression is in fact a controlled event, controlled behind closed private Rockefeller/Rothschild bank doors.

Banks across the world are shedding non-core assets to reduce risks and strengthen capital positions to meet tough regulations aimed at preventing a repeat of the 2008 crisis.

Reuters earlier this month reported that SocGen was in early talks to sell a Los Angeles-based asset management unit, Trust Co of the West, to its management, among other options. The French bank also has been selling billions of euros' worth of aircraft, shipping and real estate loans to shrink its balance sheet and reduce U.S. dollar funding needs.

For Rockefeller, the latest deal replaces SocGen with one of the best-known names in global finance.

John D Rockefeller: in 1882, he set up one of the first investment management businesses designed to run a single family`s money Photo: AP

By Harry Mount, 30 May 2012

You know you`ve really made it when your surname becomes an adjective.

In the late 19th century, the term `Rothschild Tudor` came into use to describe the family`s half-timbered estate cottages, sprinkled across their vast landholdings in Buckinghamshire. And in America, for more than 80 years, Rockefeller has been shorthand for `very rich indeed`. The name crops up in two classic Thirties Broadway numbers: On the Sunny Side of the Street (`If I never had a cent, I`d be rich as Rockefeller`) and the Gershwins` They All Laughed (`…at Rockefeller Centre - now they`re fighting to get in`).

That`s why, for gilded dynasty watchers, the news of a union between these über-rich clans is so delicious: Lord Rothschild`s investment trust, RIT Capital Partners, is to buy a 37 per cent stake in Rockefeller Financial Services.

The numbers involved are pretty mind-boggling. RIT has £1.9 billion in net assets; the Rockefeller company has £22 billion. As if that wasn`t enough, these companies are just minor fragments of the two family empires. RIT was only founded in 1961; the principal family bank, NM Rothschild & Sons, was set up in 1811, and is run by Lord Rothschild`s cousin, David de Rothschild.

As we will see, there are a lot of Rothschild cousins, all of them pretty deep-pocketed, and plenty of them keen on starting new ventures. It`s symptomatic of the dynasty that Nat Rothschild, Lord Rothschild`s son, didn`t join the family bank when he left university but went to Lazard, before joining an investment management company, Atticus Capital, and then setting up a vast investment vehicle, Vallar plc.

As for Rockefeller Financial Services, that was founded as early as 1882, when John D Rockefeller set up one of the first investment management businesses designed to run a single family`s money. So, as well as making a fortune from their principal company - Standard Oil - the Rockefellers have been making money from their money, as it were, for 130 years.

That is what makes these two dynasties so exceptional - not just their dizzying wealth, but the fact that they have held on to it for so long: and not just the loot, but also their family companies. Other banking dynasties have fallen by the wayside - SG Warburg, founded by Siegmund Warburg in 1946, was swallowed up by Swiss Bank Corporation in 1995; its asset management side, Mercury Asset Management, was taken over by Merrill Lynch in 1997.

Barings Bank, the oldest merchant bank in London, founded in 1762, collapsed in 1995, thanks to the disastrous £827 million punt taken by Nick Leeson. Lehman Brothers remained under family control until the death of Robert Lehman in 1969 - the bank`s collapse in 2008 was the spark that lit the greatest recession since the Thirties. And who now banks with the Medicis, the leading bankers in Europe in the Middle Ages, and the financial backers behind the Renaissance?

It`s true that enormous fortunes - big enough to match 19th-century Rothschild and Rockefeller figures - have been made in recent years. Mark Zuckerberg is thought to be worth more than £12 billion since Facebook went public this month, though that figure seems to diminish a little with each Wall Street trading day. But, still, it`s unlikely that the name Zuckerberg will be associated with dynastic wealth for more than a century, as the Rothschild and Rockefeller names have been.

Part of the reason is that dotcom fortunes, like Zuckerberg`s, can be founded within the four walls of a tiny Harvard dormitory. Great banking and oil ventures needed vast manpower, and vast representation across the world, to establish a foothold in the Victorian rich lists. Those deep foundations produce a lasting infrastructure, a lasting familial obligation to the business, and that lasting association in the popular mind between a particular surname and great wealth.

Also, the Rockefeller and Rothschild families were consciously dynastic from the moment their businesses began. The founder of the Rothschild empire, Mayer Amschel Rothschild, was born in Frankfurt, Germany, the Jewish descendant of a 16th-century Rothschild, Izaak, who took his name from the sign outside his house - `Zum roten Schild` (`At the sign of the red shield`).

It was Mayer Amschel who laid the foundations of today`s Rothschild power base, by sending his five sons off to different European financial hubs: Frankfurt, Vienna, Paris, Naples and London, where his third son, Nathan Mayer Rothschild, founded the eponymous bank in the City in 1811. Almost immediately, NM Rothschild became a major force in the City, bankrolling the Duke of Wellington during the Napoleonic Wars.

John D Rockefeller got going a little later. The son of a travelling salesman, he made a fortune in food supply, before turning to oil refining in Ohio. By 1868, he owned the biggest oil refinery in the world, in partnership with his brother.

Throughout Rockefeller history, the name has stamped itself deep into the popular psyche through its philanthropy. That first John D Rockefeller founded Chicago University and Rockefeller University, as well as the Rockefeller Foundation - backer of, inter alia, the London School of Hygiene and Tropical Medicine, and the New School in New York.

It was his son, John D Rockefeller Junior, who built New York`s Rockefeller Centre. The Gershwins were quite right in their lyrics, Manhattan`s gazillionaires did fight to get into the soaring art deco skyscraper, and it became one of the city`s biggest pieces of prime real estate: 19 buildings across 22 acres, all in the very centre of New York, between 5th and 6th Avenues and 48th and 51st Streets.

The cliché of fabulous new wealth is `rags to rags in three generations`, but each generation of the Rockefellers kept on building up the current account, while spreading the philanthropic interests. John D Rockefeller Junior gave the land for the Museum of Modern Art, stuffed the Met with medieval masonry and set up New York`s best-kept secret, the Cloisters museum, a staggering complex of five French monasteries perched on a cliff above the Hudson River.

His five sons continued the dynastic pattern - and that dynastic importance was intensified with the use of Roman numerals: JD Junior`s son was dubbed John D Rockefeller III. His brother Nelson was Gerald Ford`s vice-president; another brother, Winthrop, was Republican Governor of Arkansas. And the youngest brother, David, is still with us, at 96, now the Rockefeller patriarch and still hurling dollar bills at charitable institutions. In 2005, he gave away £64 million to the Museum of Modern Art and Rockefeller University - each.

A philanthropic streak runs through the Rothschilds, too. Jacob Rothschild`s home, Waddesdon, in Buckinghamshire - built in Rothschild Loire château style, rather than Rothschild Tudor - now belongs to the National Trust, but he continues to cram it with treasures appropriate to its Victorian builder, Baron Ferdinand de Rothschild. He also endowed the National Gallery generously during his time as chairman of its trustees, and did much to turn Somerset House from London`s biggest car park into its finest neo-classical palace.

The new union between the two clans does more than weld two vast fortunes to each other, then. It allies a pair of dynasties that have - coincidentally, independently - followed the two rules that all mega-plutocrats must obey if they want to be remembered in a century`s time. One: ensure your children feel a duty to preserve the family fortune. And, two, paradoxical as it may sound: give as much money as you can to universities, galleries and hospitals.

`How England Made the English` by Harry Mount is published this week by Viking (£20)

<http://www.telegraph.co.uk/finance/9300205/Rothschild-and-Rockefeller-their-family-fortunes.html>