Banks gone wild â The temporarily embarrassed millionaire syndrome. Bailout recipient JP Morgan Chase pays CEO what amounts to 843 times the median US household income.

Too big to succeed

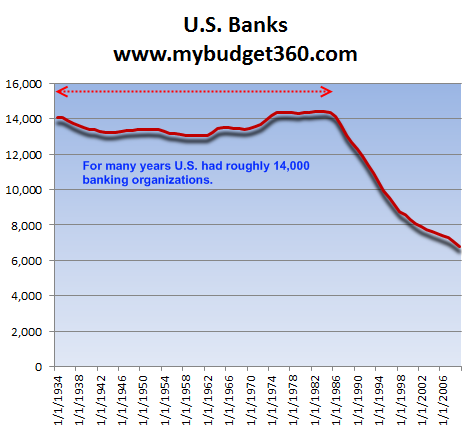

Source: FDIC

The above data is gathered from the FDIC and reflects the number of institutions measured by the organization. I found it interesting that from 1934 to 1986 the United States always had roughly 14,000 banking institutions. Keep in mind that during this time we did not have a banking crisis like the one we are currently experiencing. The Great Depression came about because of the massive speculator nature of Wall Street during the 1920s. Whenever banks are allowed to go off and do their own thing it usually means that the country will either have a depression or a massive recession. The spoils go to the top while the public cleans up the mess. Ultimately having good competition even in the capital markets is important but the above chart shows the contrary is happening.

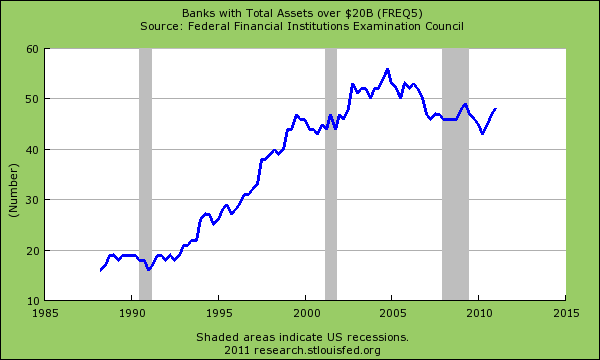

If we look at the growth of massive institutions it usually coincides with the above:

The correlation is near perfect. During the mid-1980s the growth of too big to fail banks started moving in earnest. This might have been perceived as a positive but keep in mind that only a few years later we had the S&L crisis. What led to the S&L crisis? Imprudent real estate lending. After 747 S&L institutions failed we still did not learn our lesson and that is why we had the mother of all real estate bubbles in the 2000s. The too big to fail had their hands deep in this mess and they are rewarded with growth:

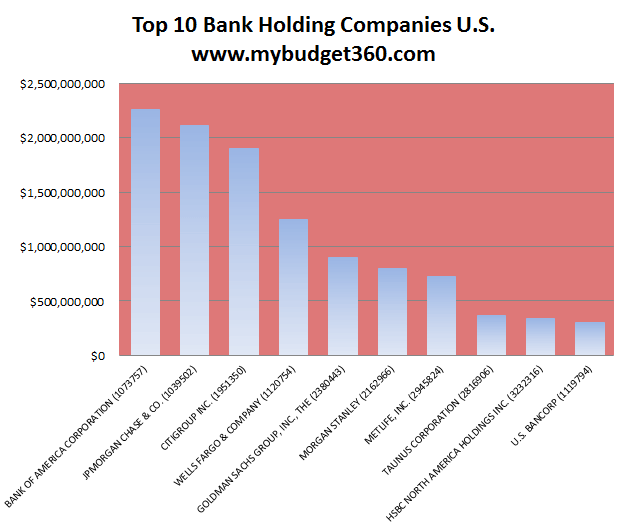

The top 19 banks hold over 50 percent of all banking assets. 105 banks hold close to 80 percent of all banking assets. So that leaves nearly 7,000 banking institutions to fight for the last 20 percent piece of the pie. Now keep in mind why this happened. This was organized and setup by the Federal Reserve and the U.S. Treasury. The Federal Reserve was the brainchild of the big banking powers of the early 1900s. Their goal was to reduce competition and allow for the aggregation of power in the hands of the few. It is no surprise that even a century later one of the people instrumental in this move, J.P. Morgan has the number two bank with his name on it and the bank has over $2 trillion in assets. How well has this accumulation of banking assets in the hands of the few helped most Americans? It hasn’t and in fact we just had the worst recession since the Great Depression. 45 million Americans on food stamps would argue we are still in a recession.

Does the average American realize where he or she stands?

I think the above chart shows the reality between aspirations and reality. Many Americans aspire at being the next Donald Trump but in reality, many are simply trying to pay their bills. 1 out of 3 Americans has no savings so it is unlikely they will have a Hotel in Manhattan with their name on it. Someone once said many Americans simply feel like temporarily embarrassed millionaires. This is why many times they vote for policies that actually hurt their own bottom line. I can see that. The mythology of being massively wealthy, even if it means accumulating wealth through oligarch ways that don’t even have a basis in actual capitalism. That is right, the captains of financial industry are largely politicians since many of these banks would be gone if the free-market did its jobs and they didn’t have politicians bailing them out (remember the $700 billion Paulson 3 page save me memo?). They were rescued and protected by the average American making $25,000 per year. And as you are aware, your tax dollars are going to good use:

“(Reuters) Dimon’s total compensation jumped nearly 1,500 percent to $20.8 million in 2010 from $1.3 million a year earlier, based on the U.S. Securities and Exchange Commission’s compensation formula, a regulatory filing showed.

Dimon did even better in terms of the value of money and shares actually received: his salary, bonus and stock and options from grants made largely in previous years that were actually exercised in 2010 were worth around $42 million.

By way of comparison, real median U.S. household income was just $49,777 in 2009, according to the U.S. Census Bureau.”

The CEO of JP Morgan, one of the big beneficiaries of the bailouts, received in his total compensation 843 times the median household income of the United States. This is where things stand. And how many people is JP Morgan kicking out of homes this year? How about the WaMu portfolio with all those toxic loans. What about the service fees now charged to customers in onerous ways? This is what we reward in America. There is nothing wrong with rewarding say Apple for providing iPods or iPhones that people choose to buy without governmental coercion. But here we have a bank that is largely benefitting simply by its connections to Washington D.C. and their service is gouging average Americans even further. Where is the benefit of the too big to fail for the public?

Until Americans realize that many of these CEOs and organizations really do not represent their best interest, they are going to lionize individuals and companies that would love nothing more than to fire them and take every last cent that they have. In fact, some are even considering electing a person like this as Presiden

April 13, 2011