IRS to Track Online Sellers' Payment Transactions Beginning Next Year

Barbara Weltman

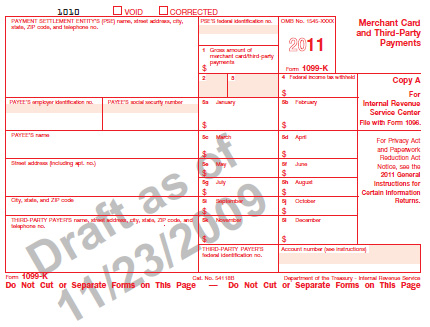

Internet sellers who don't report their sales will no longer be under the radar. Starting next year, any bank or other payment settlement company that processes credit cards, debit cards, and electronic payments such as PayPal will have to issue information returns telling the IRS what merchants receive. The new returns are Form 1099-K, Merchant Card and Third-Party Payments.

Purpose of Reporting

The IRS believes that many online sellers fail to report their transactions. Some don't report because they mistakenly believe that Internet sales are invisible. Others do so because they are trying to evade taxes.

The IRS has found that using information returns, such as W-2 forms for employees, Form 1099-MISC for independent contractors, and Form 1099-INT for bank interest, goes a long way toward improving the reporting of income. IRS computers can match income reported on these information returns with the income reported on tax returns.

Who's Subject to Reporting

All merchants who accept payments through credit cards, debit cards, gift cards and PayPal will receive information returns telling them - and the IRS - the gross amount of the merchant card transactions. This will be broken down month by month. While the form uses the word "card," the IRS has made it clear that this is interpreted broadly to include third-party network transactions (i.e., PayPal).

Exception: Very small merchants won't be issued information returns. "Small" for this purpose means annual gross sales on merchant cards of no more than $20,000 or 200 or fewer transactions. In other words, reporting is required only if gross amounts for the year exceed $20,000 and there are more than 200 transactions.

Mechanics

As it now stands (proposed regulations have not yet been finalized), gross amounts reported for merchant transactions do not take into account any adjustments for credits, cash equivalents, discount amounts, fees, chargebacks, refunded amounts, or any other amounts. It will be up to sellers to report on their returns the full amounts reported to them and then make adjustments or explanations to account for differences in what is ultimately taxable to them.

For example, a seller who is paid $1,000 by credit card for a particular transaction does not necessarily have $1,000 profit even though $1,000 will be included on Form 1099-K. The $1,000 must be reported so the return will match what's in the IRS computers, but this amount will then be reduced on the merchant's return by the cost of goods sold (what it costs for the inventory sold), merchant account fees, and other costs.

Providing Your Tax ID Number to Processors

Merchants will have to provide their federal tax identification numbers to the companies processing their transactions. If they fail to do so, they may become subject to "backup withholding," which means these companies will have to deduct and withhold income tax from reportable payments. Backup withholding won't go into effect until 2012.

Sellers who don't wish to provide their social security number to payment processors can obtain an EIN (Employer ID Number). Note that you can obtain an EIN even if you are a sole proprietorship. See the IRS website for more information.

More information on Form 1099-K

You can find more information about Form 1099-K, the new information return that payment settlement entities will use to report the gross amount of merchant card or third-party payments, on this IRS web page (PDF format).

See also, "What Every Merchant Should Know about New IRS Reporting Requirements" from this May 2009 EcommerceBytes article.

| About the author: |

|

Barbara Weltman is a prolific author and trusted professional advocate for small businesses and entrepreneurs. She is also the publisher of Idea of the Day(sm) and monthly e-newsletter Big Ideas for Small Business(R) at http://www.barbaraweltman.com/ and host of Build Your Business radio. |

March 7, 2010

www.auctionbytes.com/cab/abu/y210/m03/abu0258/s03