Bond Market to Obama: Oh No, You Can't...

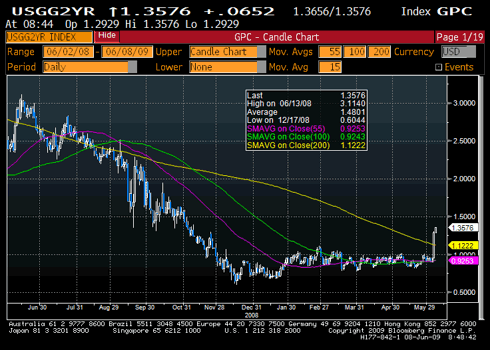

While the long end of the US bond market has been selling off for several weeks now, with 10 year yields over 3.9% and approaching twice the levels seen at the peak of the depression / deflation hysteria, late last week 2 year bonds also began to slump dramatically. Yields surged 34 bps on Friday and the market is now implying a Fed rate hike by end 2009, and a series of quarter point moves every couple of months through 2010. This move, if sustained, has major implications across asset markets.

It would prove broadly dollar positive and commodity and equity negative. I wrote a couple of weeks ago that the Fed might be forced into a premature rate hike to defend its credibility, and the bond vigilantes are demanding a clear exit strategy from the emergency actions taken last Autumn. Bond markets globally are following suit; even German 10 years are above 3.7% and 2 years above 1.7%.

Is this just bond market 'normalization' after yields were pushed to unsustainable levels by a flight to safety in recent months, or does it represent a more sinister funding crunch?

Globally, we have about $12trn in government bond issuance this year, and the heavy auction schedule, even through the usually quiet Summer season, makes the odds of a major auction failing uncomfortably high. It's notable in this context that only about $22bn of the $787bn Obama stimulus plan has been spent so far, and there must be a growing risk that the plan will have to be scaled back to reassure bond investors.

Given that the multiplier effect of government spending is only marginally positive at best, and the offsetting 'crowding out' impact it creates on private capital, that may be no bad thing. This avalanche of supply, competing with a surge in equity issuance and other private sector capital demand, is clearly one key issue driving higher yields. Another is rising medium-term inflation expectations, as reflected in commodity markets.

It's notable that foreign central banks from China to Brazil have avoided long duration US bonds in recent months, focusing their purchases at the short end. This, I think, clearly reflects a growing inflation risk premium being attached to US assets. Not only have CPI expectations, as reflected in the TIPS market (which I called as a bargain last December when implied inflation was zero) risen to about 2% annualized, but both Germany and China have openly criticized the risks inherent in Fed reflation policy, notably the experiment in quantitative easing to boost money supply.

Given the likely anemic nature of a recovery, it seems a bit early for bondholders to panic about an imminent tightening move, but if this sell-off doesn't stabilize soon (and technically the 10 year looks poised to test 4%), it will certainly act to undermine the euphoria apparent in emerging markets and commodities, and curtail the Obama administration's more ambitious spending plans.

Disclosure: Non

seekingalpha.com/article/141956-bond-market-to-obama-oh-no-you-can-t