Weâre All Homeowners Now: 10 Reasons to be Cautious About This Housing Rescue Plan for Motherland USA.

“I’m shocked, shocked to find that gambling is going on in here!” -Captain Renault, Casablanca

Many of our elected officials were “shocked” and astounded to realize that the entire economy has turned into a glorified casino. Ironically, the quote above comes from Casablanca which translated into English means Whitehouse. How appropriate given the circumstances. How the economy can go from fundamentally sound earlier in the week to flat out meltdown mode where Hank Paulson had to not only use his bazooka, but also had to use his rocket propelled grenade with a nuke tip while jumping out of a window launching ninja stars and slapping the markets with brass knuckles is really amazing. This goes to show how quickly we can adapt our thinking. Remember long ago on the weekend of September 6th and 7th 2008 when most Americans were only coming to terms with the largest bailout known to humankind of Fannie Mae and Freddie Mac? As it turns out, it only took 2 weeks before we ended up pushing the easy button:

Well as it turns out, we’re all homeowners now. We went overnight from a tough stance of no bailouts letting Lehman Brothers go into bankruptcy this weekend to the biggest socialist intervention into the markets on Thursday. I’m just calling what occurred by its true name. This was the biggest socialistic move into the markets ever and will put the U.S. taxpayer at risk to the tune of probably $1 trillion. It makes the $30 billion pumped into Bear Stearns look like pocket change. Sure makes the $100 billion in proposed healthcare spending look like a bargain! We all will need healthcare after people realize the magnitude of this market intervention.

I understand that the politics of the situation forced both parties to concede to the current moment. They really had no choice and given that this is an election year, I have already braced myself for such a move. Think about it for a second. The ad hoc bailouts were simply not solving the problem and Americans were seeing their home prices fall off a cliff. The systemic risks were not being addressed. That is, until the United States decided to go socialistic. In fact, it was a tumultuous week all over the world. In Russia, the Micex and RTS exchanges were closed on Wednesday and Thursday after epic losses. That is right. Russia flat out decided to shut down the market. They also decided to inject liquidity into the market since they had fallen by 55% from their May peak. Yet we do things bigger here.

In conjunctions with the massive new bailout which I will discuss in detail later, the SEC also decided to ban short sellers on 799 financial stocks. Looking at the list is like looking at a FBI Wanted List of the most responsible for the housing mess. My take on the strategy of all this is as follows:

(a) The government allowed Lehman Brothers to fail as the sacrificial lamb. This allowed the “no bailout” stance.

(b) The no bailout stance only lasted until we bailed out AIG a few days later.

(c) The market wasn’t buying this so they called in the big guns

(d) Short selling and the U.S. Motherland bailout hit rumor mills late in the trading day on Thursday making stocks soar. Keep in mind stocks opened much lower on Thursday and turned around to have a late 1 hour massive rally.

(e) Word is out that we are going to have the bailouts

(f) It just happened that this Friday was triple witching day. A day when stock index futures, stock index options, and stock options all expire on the same day. This happens once every 3 months.

(g) Massive short squeeze rally.

(h) Currently the short ban is only for a couple of weeks just coincidentally enough time to piece together some legislation for the new U.S. Motherland “bad bank” to be created to off load toxic debt.

I’ve been getting a ton of e-mail of people here in California thinking this is somehow going to boost housing prices in the state. They are going to be in for the shock of their life. If they haven’t noticed already, the Hope Now Alliance, FHA Secure, the lifting of jumbo loan caps to $729,500, and the Housing and Economic Recovery Act of 2008 did nothing for prices here because these bailouts are for the cronies! In addition, many of these programs are voluntary so no bank is going to voluntarily modify a loan out of good will. Why do this when you can call on your comrades and have them bail you out? And there is a little thing called employment and income that isn’t so good here. We just went into the stratosphere hitting a statewide 7.7% unemployment rate.

10 Reasons to Be Cautious About Rescuing the Motherland

Reason #1 - The Fundamentals are not Sound

Whenever someone starts arguing that the fundamentals are sound you can rest assured something is horrible and unsound. But make no mistake, we have been in this situation before. Have you noticed that all of a sudden people are referencing the Great Depression over and over? How can we be teetering near an economic depression if we aren’t even in a recession!? Here are some quotes from the Great Depression from The Great Crash by John Kenneth Galbraith:

“On Tuesday [October 22, 1929], Charles E. Mitchell dropped anchor in New York with the observation that “the decline had gone too far.” (Time and sundry congressional and court proceedings were to show that Mr. Mitchell had strong personal reasons for feeling that way.) He added that conditions were “fundamentally sound,” said again that too much attention had been paid to the large volume of brokers’ loans, and concluded that the situation was one which would correct itself if left alone. However, antoher jarring suggestion came from Babson. He recommended selling stocks and buying gold.”

“Eugene M. Stevens, the President of the Continental Illionois Bank, said, “There is nothing in the business situation to justify nervousness.” Walter Teagle said there had been no “fundamental change” in the oil business to justify concern; Charles M. Schwab said that the steel business had been making “fundamental progress” toward stability and added that this “fundamentally sound condition” was responsible for the prosperity of the industry; Samuel Vauclain, Chairman of the Baldwin Locomotive Works, declared that “fundamentals are sound”; President Hoover said that “the fundamental business of the country, that is production and distribution of commodities, is on a sound and prosperous basis.” President Hoover was asked to say something more specific about the market - for example, that stocks were now cheap - but he refused.”

A reason to be cautious about the bill is the fundamentals of our economy are not sound. Here are a few reasons:

-The housing market is still falling and inventory in housing is still high

-Unemployment is still growing

-Large entitlement programs will start coming due for baby boomers soon

-We have incredibly large deficits

-There has been nearly $5 trillion housing equity destroyed and $4 trillion in stock market value has evaporated since this correction started

Do those look like good fundamentals?

Reasons #2 - A New RTC?

Aside from the massive cost of the program let us examine the logistics. First, there has been comparison to the Resolution Trust Corporation (RTC), which was used during the S & L Crisis to liquidate assets from failed institutions. Between 1989 and 1995 the RTC closed or resolved the accounts of 747 thrifts with assets amounting to $394 billion. The major difference with this current program and we’ll write more when we get the full details is they are planning to purchase bad debt from current solvent intuitions to liquidate. The RTC for the vast majority of institutions simply dealt with liquidating the books once the thrift was taken over and had already failed.

With that said, many institutions in order to participate will need to take a steep discount on their debt. This may in fact turn currently solvent institutions insolvent. For example, an institution with Pay Option ARMs with a buyer currently paying $1,500 a month but is looking at a recast in 2 years where his payment will jump to $3,000, is actually a massive asset on the book of the institution. Yet we all know from current data that once the recast hits, they will very likely default. Thus if an institution wants to participate, they will be forced to realize a loss and bring it on the books. Yet how can they bring a loan like this on the books if the buyer is technically still current? With $500 billion of Pay Option ARMs out there, will the new bad bank program allow such loans on their books? That is yet to be seen.

I’m not sure how this will resemble the RTC since they are going to be dealing with live institutions. Which institutions you ask? Try looking at the 799 financials on the short ban list and you’ll get a good idea.

Reason #3 - Flood of new Inventory

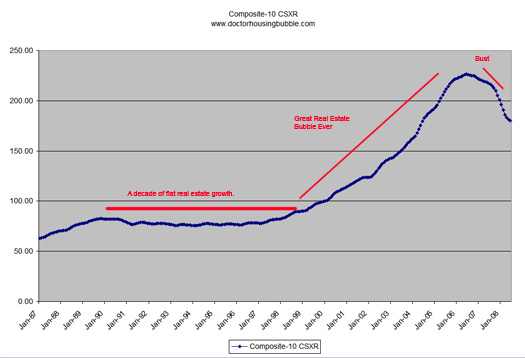

In the early 90s we had a declining housing market across the country. Take a look at the Case Shiller Index chart:

As you can see, in the early part of the 90s prices slightly went lower. Some even argued that the RTC pushed prices lower because they added much more housing inventory on the market. As anyone knows, more supply with the same demand will lower prices. Another problem with this new plan is that we already have record amounts of inventory. How are they going to avoid flooding the market with more inventory? Keep in mind that the longer they hold these properties and assuming housing prices still continue lower, the bigger the taxpayer expense gets. After all, we’re all homeowners now and there are only 2 ways we make money when we own homes. We either flip it for a profit or rent it out. Somehow I doubt the government is going to become a landlord.

Reason #4 - You Can’t Force People to Buy

Even assuming that we dump every single piece of toxic waste into this new bad bank, you still have to have a populace with growing unemployment and weak income. Unless Fannie Mae and Freddie Mac are planning to go no-doc and bring back NINJA loans there are now standards. In fact, one of the reasons the market has slowed down is there are so few qualified buyers out there. Did they somehow disappear over night? Absolutely not. We simply added a touch of standards and the market came to a grinding halt.

In addition, how are you going to convince people that are watching this current mess and are psychologically hit to buy? That multi-generation mantra of “real estate never goes down” has been destroyed for a generation of Americans. You cannot bring that back with legislation. People are going to be more cautious and selective when buying a home. In addition, a weak economy normally causes people to hold off on large purchases. Unlike the government, people do not have an unlimited line of credit to the Treasury. Even though it is their money, they are not part of the crony circle which makes up 2% of the population.

Reason #5 - Wolf in Sheep’s Clothing

You’ll be surprised as the months go along who was short this market. The flavor for the next few days is the idea that short sellers caused this mess. Forget about the shady mortgage brokers, fast talking real estate agents, the rampant fraud, eager flippers, the Wall Street greed of securitization, and incestuous crony capitalism that went on for a decade unimpeded. As it will turn out, you are going to realize that many of these investment banks and hedge funds were the largest beneficiaries of the short market. Now, there will be plenty of ammunition against these folks. This isn’t a new phenomenon. Let us take a trip down memory lane:

“The bankers met twice on the 29th (October 29, 1929) - at noon and again in the evening. There was no suggestion that they were philosophical. This was hardly remarkable because, during the day, an appaling rumor has swept the Exchange. It was that the bankers’ pool, so far from stabilizing the market, was actually selling stocks! The prestige of the bankers had in truth been falling even more rapidly than the market. After the evening session, Mr. Lamont met the press with the disenchanting task of denying that they had been liquidating securities - or participating in a bear raid. After explaining again, somewhat redundantly in view of the day’s events, that it was not the purpose of the bankers to maintain a particular level of prices, he concluded: “The group has continued and will continue in a co-operative way to support the market and has not been a seller of stocks.” In fact, as later intelligence revealed, Albert H. Wiggin of the Chase was personally short at the time to the tune of some millions. His co-operative support, which if successful would have cost him heavily, must have had an interesting element of ambivalence.”

There are now reports that certain hedge funds, investment banks, and institutional investors will be brought to testify regarding their trades. Oh what a tangled web we weave.

Reason # 6 - We are not Unique in Bailouts

Bailouts are nothing new and are practiced all over the world. The Chinese government put in about $350 billion into the largest banks in China over the past decade. Many of these banks were largely insolvent because they were lending under political pressure and throwing money at declining industries.

European banks only provide insurance up to 20,000 Euros in comparison to our $100,000 per FDIC insured account (by the way, another bank failed this Friday). Denmark, Norway, Finland, and Sweden during the 1980s had much of their banking system nationalized. Taxpayers initially took a hit but in the slow end, may have even turned a profit. Given the absolute magnitude of this bailout, there will be MAJOR losses. For someone to say we may turn a profit with a straight face has not looked at any Real Homes of Genius properties and their accompanying mortgages.

Many on the street clamoring for bailouts need to be careful for what they wish for. Let us look at what happened to a few of the recent bailouts:

Bear Stearns shareholders got $10 per share. People need to be careful what they wish for. To make this even remotely palatable to the American public, any institution participating in this program will take a major hit and may likely put themselves up for insolvency. It will be an expensive proposition. In fact, this may simply be a preemptive move to create a major garbage dump for all the impending bank failures that will be happening over the next few years. Out of 8,430 8,429 commercial banks it is estimated only half will survive after all is said and done.

Reason #7 - $1,000,000,000,000

Barclays has come out and stated that the U.S. may need to borrow $700 to $1 trillion to fund the biggest rescue of any financial system since, you guessed it, the Great Depression. This sum is so large that it may in fact put our AAA rating as a country at risk. The U.S. National Debt already stands at $9.7 trillion and we have yet to enact the Housing and Economic Recovery Act of 2008 which will probably eat up $200 billion and this current plan will add an additional $700 to $1 trillion in debt. In one month we are looking to increase our national debt ceiling by 10 to 12 percent. Like I said a few months ago, who really believed that $25 billion figure from the CBO? Bwahaha! That figure was probably for the printing and binding budget of the new bad bank legislation.

In the meantime the GSEs will be buying up mortgage backed securities (MBS) as detailed in the Fannie Mae and Freddie Mac bailout plan. With similar authority the U.S. Treasury will also buy mortgage backed securities. We are all now homeowners! The U.S. homeownership rate by the end of this month will be 100%.

Reason #8 - Can we Bailout the American Worker?

Since 1978 worker pay has been lagging behind. Total debt has been growing at such a rapid pace, that total debt now exceeds total employee compensation. I think this graph sums it up nicely:

Source: Sudden Debt

Instead of focusing on sustainable and good job creation we have been focused on keeping this debt Ponzi scheme going for way too long. Henry Ford was chastised for raising the wages of his workers but he knew that people with money (not massive debt) would ultimately end up spending. Even though many bought cars on installment plans their debt to income ratios were modest compared to where we are today. Now back then the debt world wasn’t that large. Fast forward to today and you realize that any feeling of real gains was simply a façade being masked by debt. We financed our current “prosperity” completely on debt. The current market correction is simply bringing things back to reality.

In addition, 30%+ of all job creation since 2000 was directly or indirectly related to real estate. Was the apex of our economic system basically selling houses to one another in an endless of orgy of price pyramids? Hard to believe that in such a fiercely competitive world we would dedicate such a large amount of resources to such an unproductive activity. Instead of looking at engineering innovations or biotechnological advances for the well-being of our society, we instead wasted an entire decade figuring out the best way to put granite countertops on a central kitchen island. How funny that a political platform so bent on no new taxes didn’t even “blink” when it came to backing a $1 trillion bailout.

Reason #9 - I Think I’m Turning Japanese, I Really Think So!

An astute reader sent me a link to an October 1998 article talking about the zombification of the Japanese market. I have argued many times that we are going to likely see a deep L shaped recession like Japan’s for a variety of reasons. Just to give you a peak into the future, this experiment has already been done:

“(New York Times October 13, 1998) The possibility of a way out of the financial crisis sent stocks surging today, with shares of the nation’s banks jumping an average of 8 percent. The Nikkei index of 225 shares rose 5.24 percent, to 13,555.01, in a big comeback after last week’s plunge. United States markets also rose on optimism about a solution to Japan’s financial problems.”

“The law enacted by Parliament today allows the Government for the first time to deal with large, failing banks by nationalizing them, liquidating them or transforming them into publicly owned ”bridge banks,” which take over the good loans and good borrowers and try to collect on the bad loans. It would establish a public institution to resell the good assets and deal with the bad ones in a process also used by the American Resolution Trust Corporation, which helped clean up the savings-and-loan crisis in the 1990’s.”

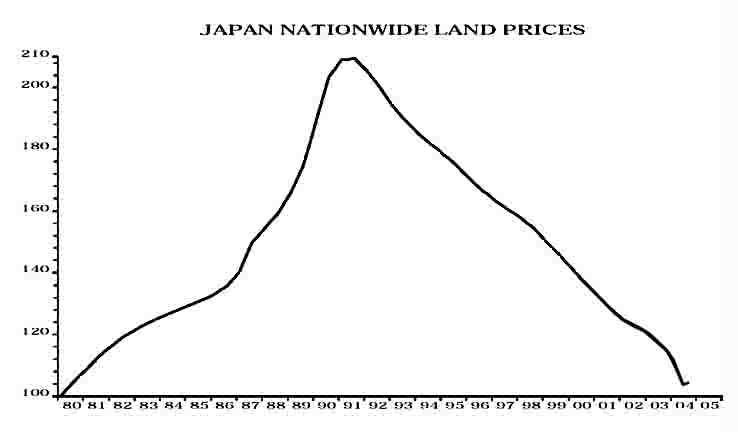

At the time of the above proposal, they were talking about injecting $400 billion into the markets. How did that turn out? Let us take a look:

So what happened in Japan? After a 1 year 7 month bull run, the market shot up from 12,879 in early October of 1998 to 20,434 in April of 2000. This was a stunning increase of 58% in less than 2 years. Well as you can see from the graph, even after 10 years, the market has yet to see prices of a decade ago. What happened to real estate from 1980 to 2005 in Japan?

Scroll up and take a good look at our Case-Shiller graph. Do you notice a resemblance?

Reason #10 - Blame the Wrong People

You know you have reached the absolute peak of madness when you start pointing fingers at the wrong culprits. Blaming short sellers is one. Trying to blame the mainstream media is another. And trying to convince people it is patriotic to buy stocks has got to be the final straw. Even the comedy shows are starting to pick up on this economic mess. Stephen Colbert was asked about diversification and he stated that he was diversified since he had money stuffed under his couch and mattress. Humor at a certain point lightens the mood. Even in the Great Depression humor was used:

“In March 1930, following a flood of optimistic forecasts by his subordinates, Mr. Hoover said that the worst effect of the crash upon unemployment would be ended in sixty days. In May Mr. Hoover said he was convinced “we have now passed the worst and with continued unity of effort shall rapidly recover.” Toward the end of the month he said that business would be normal by fall.

What was perhaps the last word on the policy of reassurance was said by Simeon D. Fess, the Chairman of the Republican National Committee:

“Persons high in Republican circles are beginning to believe that there is some concentrated effort on foot to utilize the stock market as a method of discrediting the Administration. Every time an Administration official gives out an optimistic statement about business conditions, the market immediately drops.”

Welcome to the bad bank era. Get ready for a decade long malaise just in time to go with the 76 million baby boomers who will start to retire in droves. We’ll have to wait to see the final details on this plan to discuss further.