PORTER: A HIDDEN REASON BEHIND THE RECENT STOCK RALLY

Porter Stansberry

From Porter Stansberry in Stansberry Digest:

Over the past few months, I (Porter) have introduced you to a few unique financial indicators.

First, I showed you the sectors of the market that I believed best represented the excesses of the previous bull market – the “lions.”

They are emerging-market stocks – as represented by the iShares MSCI Emerging Markets Fund (EEM) – which have boomed on the back of a massive credit bubble created by the bond market… U.S. transportation stocks – as represented by the Dow Jones Transportation Average Index (^DJT) – whose rail components have soared thanks to the debt-fueled growth of domestic oil production… oil and gas firms – as represented by the Market Vectors Unconventional Oil & Gas Fund (FRAK) – whose components are the debt-fueled domestic oil and gas producers… and perhaps most representative of all, risky corporate debt – as represented by the iShares iBoxx High Yield Corporate Bond Fund (HYG)…

*

*

*

*

*

*

*

*

*

*

.png)

As you can see, despite a big rebound since January, these sectors have yet to break through to important new highs, and their annual returns are all still negative.

About a month ago, I expanded our indicators by showing you the market’s “deviants.” These are individual stocks that represent the worst of the excesses we’ve seen in the most recent bull market. I believe these stocks will have to be restructured – whether in bankruptcy court or by large asset sales – before a new bull market can begin.

These stocks were state-run oil company Petrobras (PBR), a leading issuer of emerging-market debt… Chesapeake Energy (CHK), a natural gas producer and the leading U.S. debt-fueled “fracker”… Santander Consumer USA (SC), the “dark angel” of subprime auto lending… high-yield debt issuer Valeant Pharmaceuticals (VRX)… and Navient (NAVI), a leading lender for college-aged travel and boozing (I mean, “student loans”).

Like the lions, these deviants have soared since their lows in January, moving up about 30% on average. Even so, these stocks are still way down over the last year, by about 50% on average…

.png)

So… what’s happening? What’s behind the huge rally in the most troubled parts of the market? Here’s one possible answer…

Investment bank JPMorgan (JPM) is the “prime broker” for most of the world’s big hedge funds. These funds have seen large redemptions lately as many of them had piled into stocks like Valeant and Sun Edison, which have completely blown up.

To meet redemption requests, the hedge funds have had to sell assets and close out positions, including short positions. And according to JPMorgan, March saw the largest volume of hedge-fund short covering since the financial crisis. The huge rebound in the “lions” and the “deviants” reflects short covering – a short squeeze brought on by hedge-fund redemptions.

Of course, only time will tell if I’m right about that. But if I am right, these stocks will soon resume their collapse. If I’m right, May will see carnage in these names. Just wait.

The ‘Crony Capitalism Indicator’

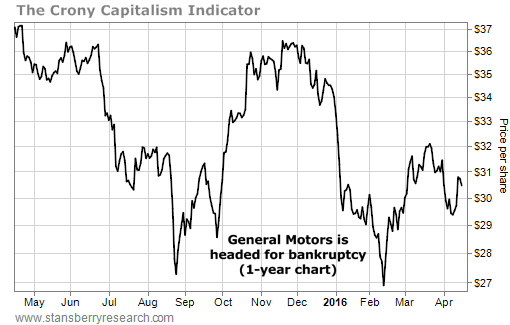

Today, I have a new indicator for you to watch. I call this stock – and there’s only one for now – the “crony capitalism indicator.”

It is our old friend General Motors (GM). New readers might not be familiar with my famous series of “Letters From the Chairman of General Motors.” In those Digest essays, which began in 2007, I warned of the company’s impending bankruptcy. At the time, the company still had a $40 billion market cap.

By pretending to be the company’s chairman, I told subscribers what was actually happening in the company – things that, for some reason, no other journalists would discuss. (General Motors and its dealers had long been the largest newspaper advertisers in the country and one of largest TV network advertisers, too.)

My hypothesis has been that the new GM is the love child of the Democratic party and the leading example of U.S. crony capitalism. I’ve been relentlessly critical of the 2009 GM bailout. As I followed the $50 billion that the U.S. Treasury “invested” in the business, I found that nearly all of the funds went to the United Automobile Workers (“UAW”) union (as did almost all of the preferred shares that would continue to drain capital out of the business for years after the crisis).

David Stockman – the famous economist, former head of President Reagan’s economic team, and former private-equity investor in the auto business – argued in his book The Great Deformation that a real GM bankruptcy would have seen the company reduce its number of brands, plants, and employees significantly. As he wrote…

GM would need 16 U.S.-based plants, not 47. This drastically downsized production complex, in turn, would have required a total of only 25,000 hourly employees… Thus the “bailout” was really about the transfer of GM’s bad debts to the taxpayers, not its need for Uncle Sam’s cash during bankruptcy and most certainly it did not involve any “need” on the part of the American economy for the company’s remnants outside a potentially viable GM Lite; that is, there was no need for 30 redundant plants, 40,00 excess UAW wage workers, and GM’s dead-in-the-water car brands like Pontiac, Hummer, Saturn, and Buick.

Today, GM is using every bit of the credit bubble to maintain its sales momentum. It’s copying all of the same tricks that led it to bankruptcy in the first place. “I’ve seen this movie before; it’s not a pretty ending,” Mike Jackson, the CEO of AutoNation (which owns 373 new-car dealerships), told the New York Times. “Manufacturer incentives are at a dangerous level.”

Having worn out subprime lending, the new game is leasing. In March, leases accounted for more than 30% of all “sales” – a new record “beating” a mark set before the financial crisis. Car companies have to borrow billions to finance leases. Then they’re on the hook for the resale value of these cars.

http://thecrux.com/porter-whats-really-behind-the-recent-market-rally/

Trouble is, a lot of people who take out leases don’t make any down payment at all. They can simply return the car if the economy shows signs of trouble. And even if the consumer keeps the car, heavy lease volumes today will depress the prices of used cars two years from now. That means a lot of the money the carmakers are claiming in profits today will wind up as losses tomorrow.

Consider one example from the New York Times‘ story…

Derrick Oxender, a commercial property owner in Ann Arbor, Mich., still had a few months to go on the three-year lease for his 2013 Ford F-350 diesel truck. He was paying $825 a month based on its list price of about $58,000.

But a salesman from his Ford dealer called and said he could turn in his 2013 truck and lease a 2016 model, loaded with extras like heated rear seats. Although his new F-350 is priced at $71,000, he got a new lease with a monthly payment of just $695. “You have to be stupid not to do it,” Mr. Oxender said.

When people are doing something stupid, there’s always a winner and a loser. U.S. auto dealers now have 3.8 million new cars in inventory – the most in 10 years. On top of this huge pile of cars, credit-monitoring firm Experian notes that 1.8 million leased cars will hit the market this year, providing a much cheaper alternative to a new car. The only way carmakers have out of this jam is to make “stupid” deals… but that will only kick the problem down the road.

The fundamental problem is a huge amount of overcapacity in the auto sector. Piling billions in debt on top of that weak foundation will never make the problem better. It will only make the problem bigger. And so we’re going to keep our eye on GM, with the knowledge that it will surely go bankrupt again… and probably a lot sooner than anyone thinks.

http://thecrux.com/porter-whats-really-behind-the-recent-market-rally/