BANKS TURN DOWN DEPOSITS AS STEALTH NIRP TAKES HOLD

Tyler Durden

Back in February, we noted [13] that NIRP had officially (albeit technically) arrived in the US as JP Morgan announced it was preparing to charge some large institutional customers for deposits.

Between the squeeze ZIRP has put on NIM and regulations around so-called “hot money,” banks quite simply do not want certain types of deposits and when trying to talk customers out of putting their money in the bank didn’t work, some financial institutions simply resorted to charging fees.

As we discussed months ago, if the cost of funding isn’t zero, banks are no longer interested, which means if the Fed finally does raise short term rates, other sources of funding will be far more attractive. Besides, it’s not as if banks don’t have enough deposits. On the contrary, they’re inundated and deposit to loan ratios have plunged in the post-crisis years. Here’s how we put it earlier this year: So now that the Fed may be finally pushing back on the commercial banks, and telling them that the cost of deposit funding is about to go up, banks themselves are pushing back on the Fed, and signalling that thanks to the trillions in fungible QE liquidity, they don't care if the Fed hikes rates, as they are now proactively seeking to purge deposits from their balance sheets.

If you needed still more evidence that what one might call “stealth NIRP” has taken hold in America, consider the following from WSJ [14]:

U.S. banks are going to new lengths to ward off a surprising threat to their financial health: big cash deposits.

State Street Corp., the Boston bank that manages assets for institutional investors, for the first time has begun charging some customers for large dollar deposits, people familiar with the matter said. J.P. Morgan Chase & Co., the nation’s largest bank by assets, has cut unwanted deposits by more than $150 billion this year, in part by charging fees.

The developments underscore a deepening conflict over cash. Many businesses have large sums on hand and opportunities to profitably invest it appear scarce. But banks don’t want certain kinds of cash either, judging it costly to keep, and some are imposing fees after jawboning customers to move it.

The banks’ actions are driven by profit-crunching low interest rates and regulations adopted since the financial crisis to gird banks against funding disruptions.

The latest fees center on large sums deemed risky by regulators, sometimes dubbed hot-money deposits thought likely to flee during times of crises. Finalized last September and overseen by the Federal Reserve and other regulators, the rule involving the liquidity coverage ratio forces banks to hold high-quality liquid assets, such as central bank reserves and government debt, to cover projected deposit losses over 30 days. Banks must hold reserves of as much as 40% against certain corporate deposits and as much as 100% against some deposits from hedge funds.

Yes, that’s right, banks are forced to hold either Fed reserves or USTs to guard against the dangers associated with...cash.

That sounds strange on the surface, but it all comes back to the fact that fractional reserve banking is just one giant ponzi scheme. It’s a confidence game, plain and simple. I, the bank, take your money which I claim you can have back any time you want or need it, and then I go and lend that money out to someone else who might not pay it back for decades, if at all. If you - or, more accurately, a bunch of yous - come beating down the doors all wanting your money back at once, I won’t be able to give it to you because I lent it out to someone else. So the idea is to make banks guard against that possibility by identifying the types of depositors who are likely to come wanting large portions of their money back in a pinch and make financial institutions hold reserves against that funding.

Well, if I’m the bank and I’m going to have to hold reserves against your cash and on top of that my NIM is already in the doldrums, plus I’ve got plenty of deposits, plus the cost of deposit funding is about to rise possibly before I can realize any kind of rebound in my margins, why do I want your deposits when I’m already awash with fungible liquidity?

The answer is: I don’t.

Here’s WSJ again [14]:

The push comes as the globe is awash in cash, reflecting soft economic growth and low interest rates that limit investment. Some asset managers have been increasing the amount of cash they are holding in their portfolios, in part because of an increased focus by the Securities and Exchange Commission on liquidity management in mutual funds.

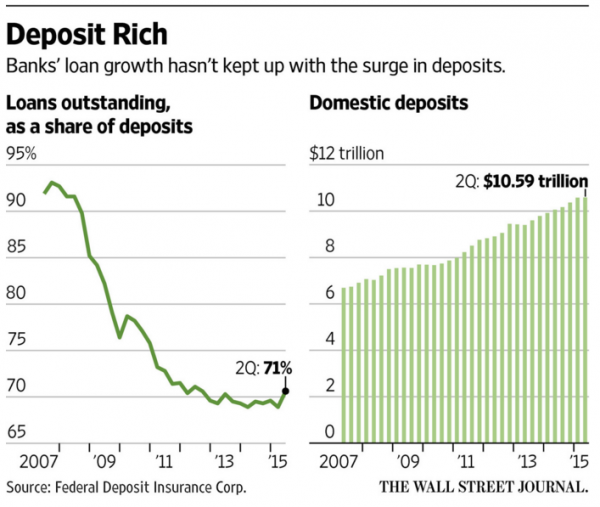

Domestic deposits at U.S. banks in the second quarter hit $10.59 trillion, up 38% from five years earlier, Federal Deposit Insurance Corp. data show. Loans outstanding at U.S. banks as a share of total deposits tumbled to 71% from 78% in 2010 and 92% in mid-2007, before the financial crisis, the data show.

Jerome Schneider, head of Pacific Investment Management Co.’s short-term and funding desk, which advises corporate and institutional clients, said that as a result of the bank actions, he and his customers have discussed as cash alternatives boosting investments in U.S. Treasury bonds, ultrashort-duration bond funds and money-market funds.

When it comes to cash, Mr. Schneider said, “Clients have been put on warning.”

Banks are struggling to generate returns for investors. A low-interest-rate environment squeezes bank profits by narrowing the spread between the rate they lend at and their borrowing, or funding, cost.

Deposit fees are particularly significant at State Street because its primary business is custodying client assets, including holding cash for clients rather than seeking to lend out those funds, as other banks typically do.

State Street customers earlier were told that fees were possible on accounts whose nonoperational balances had grown, the people familiar with the matter said. There is no minimum deposit size that triggers the fee, which varies and is applied case by case to new and existing clients, the people said.

“The persistence of the current rate environment requires that we take action consistent with prudent financial management with certain accounts that continually maintain significant excessive cash balances,” State Street said in a statement to The Wall Street Journal.

BNY Mellon and Northern Trust haven’t yet begun charging to hold clients’ cash, people familiar with the matter said.

A Bank of New York spokesman said the bank hasn’t ruled out doing so in the future.

Since last year, Bank of America Corp. has told some institutional clients that they will need to move their deposits or pay to keep them at the bank, people familiar with the matter said.

And while small depositors are for the time being immune, anyone who has dealt with a TBTF bank in the post-crisis years knows that there are enough fees levied on a variety of services and transactions to take the real return on your savings into negative territory.

Of course everything described above represents a kind of de facto NIRP rather than de jure NIRP, but as those who followed last month's FOMC decision closely are no doubt aware, one dot now suggests that the US is about to take an officially sanctioned trip into the Keynesian Twilight Zone:

Links:

[1] http://www.zerohedge.com/users/tyler-durden

[2] http://www.zerohedge.com/taxonomy_vtn/term/113

[3] http://www.zerohedge.com/taxonomy_vtn/term/7841

[4] http://www.zerohedge.com/taxonomy_vtn/term/10727

[5] http://www.zerohedge.com/taxonomy_vtn/term/10414

[6] http://www.zerohedge.com/taxonomy_vtn/term/9244

[7] http://www.zerohedge.com/taxonomy_vtn/term/10024

[8] http://www.zerohedge.com/taxonomy_vtn/term/9345

[9] http://www.zerohedge.com/taxonomy_vtn/term/11149

[10] http://www.zerohedge.com/taxonomy_vtn/term/9486

[11] http://www.zerohedge.com/taxonomy_vtn/term/8882

[12] http://www.zerohedge.com/taxonomy_vtn/term/10139

[13] http://www.bloomberg.com/news/articles/2015-10-20/cdo-revival-led-by-hedge-funds-pinning-hopes-on-smallest-banks

[14] http://www.wsj.com/articles/big-banks-to-americas-companies-we-dont-want-your-cash-1445161083

[15] http://www.zerohedge.com/sites/default/files/images/user92183/imageroot/2015/10/LoanToDeposit.png

[16] http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2015/09/FOMC%20negative.jpg

http://www.zerohedge.com/print/515222

.png)

.png)