CHINA-LED BANK WILL 'KEEP AMERICA HONEST', PROVIDE ALTERNATIVE TO IMF, NOMURA SAYS

Tyler Durden

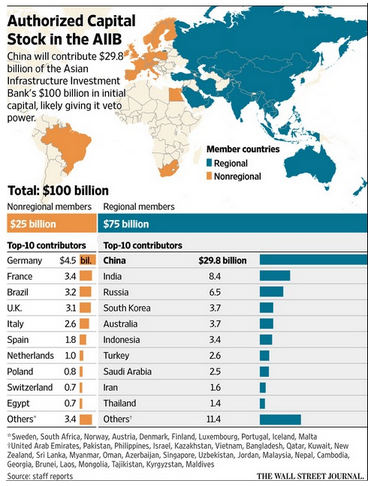

The membership drive and subsequent launch of the Asian Infrastructure Investment Bank has been a favorite topic of ours since the UK threw its support behind the China-led venture in March.

London’s move to join the bank marked a diplomatic break with Washington, where fears about the potential for the new lender to supplant traditional US-dominated multilateral institutions prompted The White House to lead an absurdly transparent campaign aimed at deterring US allies from supporting Beijing by claiming that the AIIB would not adhere to international standards around governance and environmental protection.

In the weeks and months following the UK’s decision, dozens of countries (including many traditional US allies) expressed interest in the new lender and by the time the bank officially launched [12] late last month, the US and Japan (who dominate the IMF and ADB, respectively) were the only notable holdouts.

As we never tire of discussing, the reason the AIIB matters is that it represents far more than a new foreign policy tool for Beijing to deploy on the way to cementing its status as regional hegemon.

The lender’s real significance lies in the degree to which it represents a shift away from the multilateral institutions that have dominated the post-war world economic order. In short, it’s a response not only to the IMF’s failure to provide the world’s most important emerging economies with representation that’s commensurate with their economic clout, but also to the perceived shortcomings of the IMF and ADB. The AIIB isn’t alone in this regard. Indeed, the BRICS bank can be viewed through a similar lens.

It’s against this backdrop that we bring you the following insight from Nomura’s Richard Koo, who suggests that the Greek experience with the IMF shows how the institution sometimes fails to deliver and by extension, how important it is for the countries in need to have more than one option when it comes to securing crucial aid.

* * *

AIIB a way around western opposition to IMF and World Bank reforms

In light of US and European opposition to IMF and World Bank reforms, few should have been surprised that China decided it made more sense to create a new institution than to stand around waiting for the status quo to change. Eventually it announced the creation of the AIIB.

Europe quickly declared that it would participate in the new institution. I see this as an attempt to smooth over relations with China after its earlier reluctance to allow the nation a more prominent role at the IMF.

The US administration, while arguing China’s voting rights needed to be expanded to make the IMF a truly global institution, ultimately faced opposition from the legislative branch of government. The end result was a significant loss of US influence with both Europe and China.

AIIB gives alternative to countries in need of help

The US sought to expand China’s voting rights and thereby maintain the IMF and World Bank’s central positions in the global economy because allowing the creation of a similar institution would give cash-strapped countries more than one “lender of last resort” to turn to.

Until now the IMF was the only choice for countries in need of financial assistance, which meant they had no choice but to accept the economic and fiscal reforms it demanded.

But if the IMF has competition, countries in need of help will most likely shop around for the institution offering the easiest terms, which means necessary reforms may be delayed.

China may also create an alternative to IMF

In its current form, at least, the AIIB has a different role from the IMF; it is designed to provide development funds, much like the World Bank or Asian Development Bank (ADB). Given that the World Bank and the IMF were created as a pair under the postwar Bretton-Woods regime, US officials may be concerned that China will come up with a sister institution to the AIIB that has an intended role similar to that of the IMF.

If the IMF’s rival is heavily under China’s influence, countries receiving its support will rebuild their economies under what is effectively Chinese guidance, increasing the likelihood they will fall directly or indirectly under that country’s influence.

Lending of development funds to the countries of Asia by a Chinese-led AIIB will also bring about an increase in the nation’s influence throughout the region. That would be of concern to the US, which has succeeded in extending its own influence in the area via the World Bank and IMF.

IMF and the US fundamentally misread Asian currency crisis

There is something to be said for the US argument that there should be only one refuge for economically troubled nations which takes responsibility for ensuring they carry out necessary reforms. However, that view is based on the underlying assumption that the US and the IMF will correctly diagnose the problems it encounters.

In reality, the US and the IMF completely misread the Asian currency crisis that began in 1997, and their errors caused tremendous damage to crisis-struck countries in the region.

The decision of many Asian countries to participate in the AIIB is probably due in part to a distrust of the US born during the currency crisis.

In that sense, I think the AIIB may come to play an important role in keeping America honest.

It is difficult to say at this point whether the AIIB will have a negative or a positive impact on the global economy. At the very least, however, I think the emergence of an international institution with a viewpoint different from that of western creditors will help enhance the quality of debate over emerging economies’ debt problems.

http://www.zerohedge.com/print/509860