Donít Fight The Fed: Yellen Spoke, Junk-Bond Market Listened

Wolf Richter

The junk-bond market had been on a relentless tear since late summer last year, driving values to insane heights, with yields so low that they were reminiscent of Treasuries before the financial![]() crisis.

crisis.

But much of this junk debt is near the bottom of the corporate capital structure, and there often aren’t any asset![]() left to back them. When the company buckles under the load of its debt and falls on its face, junk-bond holders take losses that range from massive to total. These bonds are called “junk” for a reason.

left to back them. When the company buckles under the load of its debt and falls on its face, junk-bond holders take losses that range from massive to total. These bonds are called “junk” for a reason.

Only this time, investors aren’t being compensated for the risks they’re taking.

And there are signs that markets are becoming increasingly illiquid, exacerbating the problem when the sell-off starts. It’s the nightmarish condition when buyerssuddenly evaporate just as the sellers start lining up. It’s the foundation of crash.

These two items – junk debt and illiquidity – were among the things that Fed Chair Janet Yellen, in her remarks last week, singled out as she was trying to very gingerly prick the greatest credit![]() bubble in history. For years, the Fed’s QE and ZIRP have driven yield investors – including institutions like insurance companies – to near insanity as they were pushed to pick up the worst junk with the greatest risks just to get yield that would be a least a little above inflation, and that desperate demand has driven down yields on high-risk debt to ludicrously low levels. Yellen called it “the reach for yield behavior.” No Fed governor had ever before singled out individual market segments [Read... Yellen Warns Investors].

bubble in history. For years, the Fed’s QE and ZIRP have driven yield investors – including institutions like insurance companies – to near insanity as they were pushed to pick up the worst junk with the greatest risks just to get yield that would be a least a little above inflation, and that desperate demand has driven down yields on high-risk debt to ludicrously low levels. Yellen called it “the reach for yield behavior.” No Fed governor had ever before singled out individual market segments [Read... Yellen Warns Investors].

And junk bonds sold off. The High Yield Corporate Bond Fund (HYG) had been conquering new highs in a rising-wedge pattern since the sell-off last summer. But after Yellen’s propitious words, it broke down, dropping below its 50-day moving average. Investors have gotten the message: don’t fight the Fed.

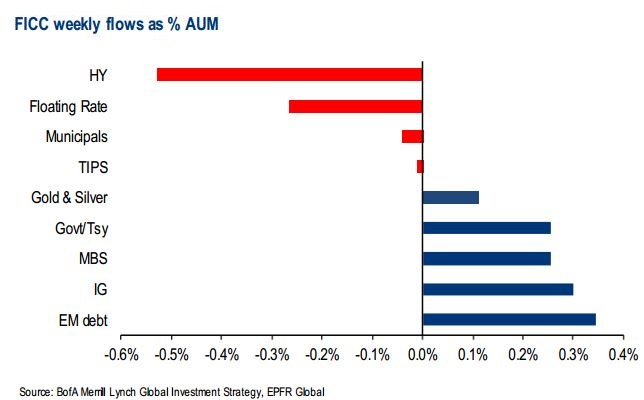

It had been a thrilling, awesome, profitable ride since last summer, but now forget it. Last week, high yield funds (“HY” in the chart below, via OtterWood Capital Management) experienced their largest outflows since August 2013 during the final spasm of the semi-panic that the Fed’s taper tantrum had caused:

But unlike last summer, this time the Fed is serious – and not just talking. QE will be tapered out of existence by fall this year, and as Yellen put it so cleverly, trying not to panic anyone: If a couple of conditions are met, “increases in the federal funds rate target likely would occur sooner and be more rapid than currently envisioned” [read.... Yellen Warns Investors ].

Now Christine Hughes, Chief Investment Officer at OtterWood Capital Management![]() , weighs in. No screaming and shouting, and no storming off the set, à la Rick Santelli at CNBC. Using her calm, soothing voice as a hammer, she demolishes junk bonds in this chilling must-see video. Watch it in “full-screen” mode so you can see the crucial charts better.

, weighs in. No screaming and shouting, and no storming off the set, à la Rick Santelli at CNBC. Using her calm, soothing voice as a hammer, she demolishes junk bonds in this chilling must-see video. Watch it in “full-screen” mode so you can see the crucial charts better.

VIEW VIDEO http://investmentwatchblog.com/dont-fight-the-fed-yellen-spoke-junk-bond-market-listened/#geXFv3W8RJQK6psV.99