THE ELEPHANT IN THE ROOM: DEUTSCHE BANK'S $75 TRILLION IN DERIVATIVES IS 20 TIMES GREATER THAN GERMAN GDP

The Unhived Mind

The Elephant In The Room: Deutsche Bank’s $75 Trillion In Derivatives Is 20 Times Greater Than German GDP

Tyler Durden’s pictureSubmitted by Tyler Durden on 04/28/2014 14:56 -0400

http://www.zerohedge.com/news/2014-04-28/elephant-room-deutsche-banks-75-trillion-derivatives-20-times-greater-german-gdp

It is perhaps supremely ironic that the last time we did an in depth analysis of Deutsche Bank’s financial situation was precisely a year ago, when the largest bank in Europe (and according to some, the world), stunned its investors with a 10% equity dilution. Why the capital raise if everything was as peachy as the ECB promised it had been? It turned out, nothing was peachy, and in fact DB would proceed to undergo a massive balance sheet deleveraging campaign over the next year, in which it would quietly dispose of all the ugly stuff on its balance sheet during the relentless Fed and BOJ-inspired “dash for trash” rally in a way not to spook investors about everything else that may be beneath the Deutsche covers.

We note this because moments ago, Deutsche Bank did the same again when it announced that it would issue yet another €1.5 billion in Tier 1 capital.

The issuance will be the third step in a co-ordinated series of measures, announced on 29 April 2013, to further strengthen the Bank’s capital structure and follows a EUR 3 billion equity capital raise in April 2013 and the issuance of USD 1.5 billion CRD4 compliant Tier 2 securities in May 2013. Today’s announced transaction is the first step towards reaching the overall targeted volume of approximately EUR 5 billion of CRD4 compliant Additional Tier 1 capital which the Bank plans to issue by the end of 2015

Ok, so in retrospect nothing is peachy in Frankfurt, and for all the constant lies about improving NPLs and rising cash flows, banks – especially those which not even the ECB can bailout when push comes to shove – Deutsche is as bad as it was a year ago.

So, just like last year when we decided to take a look inside the company’s financials to understand why DB was scrambling to dilute its shareholders and raise a few paltry billion in cash, so this year too, we had the pleasure of perusing the European megabank’s annual report.

What we found, while hardly surprising for those who read out post from also a year ago, “At $72.8 Trillion, Presenting The Bank With The Biggest Derivative Exposure In The World (Hint: Not JPMorgan)”, is just as jarring.

Because while America’s largest bank by assets, and certainly ego of its CEO, that would be JPMorgan of course, had a whopping $70.4 trillion in total notional of derivative holdings (across futures, options, forwards, swaps, CDS, FX, and so on), Deutsche Bank once again put it well in the dust.

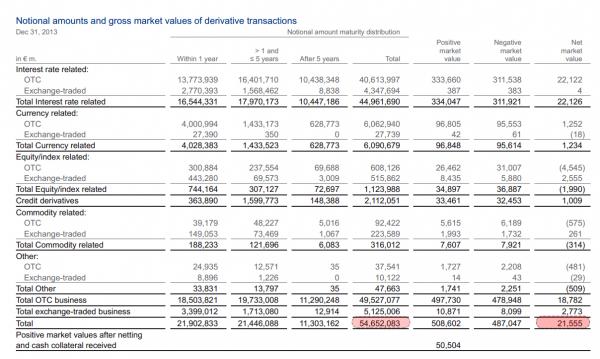

The number in question? €54,652,083,000,000 which, converted into USD at the current exchange rate, amounts to $75,718,274,913,180. Which is over $5 trillion more than JPM’s total derivative holdings.

As we explained last year, the good news for Deutsche Bank’s accountants and shareholders, and for Germany’s spinmasters, is that through the magic of netting, this number collapses to €504.6 billion in positive market value exposure (assets), and €483.4 billion in negative market value exposure (liabilities), both of which are the single largest asset and liability line item in the firm’s €1.6 trillion balance sheet mind you (and down from €2 trillion a year ago: a 20% deleveraging which according to DB “was predominantly driven by interest-rate derivatives and shifts in U.S. dollar, euro and pound sterling yield curves during the year, foreign exchange rate movements as well as trade restructuring to reduce mark-to-market, improved netting and increased clearing”), and subsequently collapses even further into a “tidy little package” number of just €21.2 in titak derivative “assets.”

And as we further explained both last year and every other time we have the displeasure of having to explain the reality of gross vs net, this accounting gimmick works in theory, however in practice the theory falls apart the second there is discontinuity in the collateral chain as we have shown repeatedly in the past (and certainly when shadow funding conduits freeze up), and not only does the €21.2 billion number promptly cease to represent anything real, but the netted derivative exposure even promptlier become the gross number, somewhere north of $75 trillion.

The conclusion of this story has not changed one bit from last year: this epic derivative exposure is the primary reason why Germany, theatrically kicking and screaming for the past five years, has done everything in its power, even “yielding” to the ECB, to make sure there is no domino-like collapse of European banks, which would most certainly precipitate just the kind of collateral chain breakage and net-to-gross conversion that is what causes Anshu Jain, and every other bank CEO, to wake up drenched in sweat every night.

Finally, just to keep it all in perspective, below is a chart showing the GDP of both Germany and Europe compared to Deutsche Bank’s total derivative exposure. If nothing else, it should make clear, once and for all, just who is truly calling the Mutually Assured Destruction shots in Europe.

.jpg)

As always, there is nothing to worry about: this €55 trillion in derivative exposure, should everything go really, really bad is backed by the more than equitable €522 billion in deposits, or just over 100 times less.

Average:

theunhivedmind says:

Deutsche Bank is insolvent and will fail shortly without further fiddles. Deutsche Bank and the Magyar Nemzeti Bank used derivative trading to fund the coup d’etat in the Ukraine. Deutsche Bank is a banking whorehouse of the Deutsche Verteidigungs Dienst intelligence operation headed in Dachau, Bavaria.

The global banking derivative debt equals at least $1.7 quadrillion now and it increases by the day. This debt alone can never be paid it far exceeds the World Gross Product. Derivative trading was aided by the removed of the Glass Steagall Act by Bill Clinton and Robert Rubin. Derivative debt has been used to aid major debt creation so the people of Earth can be further enslaved and forced into a new economic Marxist prison system. If the interest rates rise at the Central Banks then the derivatives market will collapse and take down the whole economy. I believe they plan to crash the current economy around April/May of 2015 and at the very most by 2017. The only logical way out of this fake debt is to have a debt jubilee and remove it all from the system. They may just do this but with a catch and this is why they want you all in debt so you have to fall for the catch. The catch will be you will have to wear an electronic bracelet (eventually a microchip implant) and do exactly what you are told in the new Marxist hell hole that replaces our current system. When they say you have to take vaccine A to be able to continue buying then you will have to take it or no food will enter your belly. A good way to understand how this will work is to deeply study the Obamacare from hell act.

I should remind you that New Venice (Britain) stole the U.S Navy’s carbon trading software exchange from Cantor Fitzgerald based in the World Trade Center during the 9/11 attacks organized by the Guild of Air Pilots and Air Navigators and the Most Honourable Military Order of the Bath. This carbon trading exchange was worth back in 2001 a massive $73 trillion a year and it all went into the City of London (British Empire/New Jerusalem/ancient Londinium) and then so much of this eventually wound up in the hands of the Black Prince’s (Prince Philip) puppet Al-Gore Jr with his Generation Investment Management. Is it any wonder Al-Gore Jr pushes the climate scam (mind control, social engineering and weather modification [SAG]).

-= The Unhived Mind