GEAB N°72 is available! Global systemic crisis - Second half of 2013: The reality or the anticipation of the Dollar collapse obliges the world to reorganize on new fundamentals

According to our anticipations, this reorganization which will only start to become a reality with the September G20 unfortunately risks taking place in a hurry since our team envisages the first major fears over the Dollar during the March-June 2013 period.

A phrase by Antonio Gramsci (1) splendidly describes the long, dangerous transition period that we are currently living through: “The old world is dying away, and the new world struggles to come forth: now is the time of monsters”. This period will finally come to an end but the monsters are still restless.

With no surprise, one of the powerful factors which will accelerate the United States’ loss of influence in the world relates to oil. In fact we are witnessing the last days of the petrodollar, the key element of US domination. This is why we have decided to deal with the world oil problem at length in this GEAB. We are also publishing the GEAB Dollar-Index and Euro-Index to follow currency developments more reliably in the current monetary storm. Finally, as usual, we finish with the GlobalEurometre.

In this public announcement for the GEAB N°72, our team has chosen to present a series of converging indices on the crisis which leads it to keep its “global systemic crisis” alert in force for the March-June 2013 period, as well as its anticipation of the risk of “Icelandisation” in the management of the banking crisis.

A flurry of signs of crisis, or why we are keeping the March-June 2013 alert

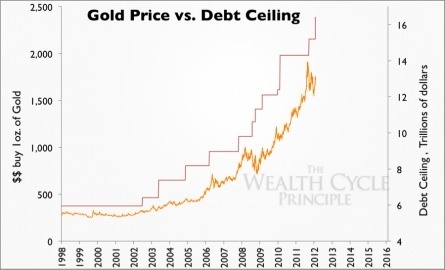

In deciding to separate the debates on the budgetary cuts/increase in taxation and on the debt ceiling (2), the Americans have doubled the shock to come: there was only one at the end of February/beginning of March, there is now another in May. This separation reveals the Republicans’ strategy clearly. Of course they will exert a power struggle to the maximum over raising the debt ceiling to reduce spending further, but they will ultimately feel obliged to vote for a rise in order not to be held responsible for the cataclysm which would follow a payment default (3). On the other hand the consequences of the budgetary cuts envisaged for March 1st, though certainly not painless, are far from being as traumatising and the Republicans have really decided to negotiate a sizeable reduction in the public deficit under penalty of leaving the last resort of automatic cuts at work.

Fortunately a “dam” has been built to avoid the waves: Egan Jones, the credit rating agency, less biased than its three big brothers (the one which has already downgraded the US three times to AA-), has been banned from rating the country for 18 months (7); what a happy coincidence! And amongst the three major credit rating agencies, S&P is being prosecuted (8), the only one which dared to downgrade the United States; a second happy coincidence! The others have just to watch their step.

This “dam” although futile especially reveal the fears at the highest level in 2013 and is only one more sign of the shock’s imminence. It’s also from this perspective that the January 1st 2013 decision should be read on the unlimited current account guarantee by Federal Deposit Insurance Corporation (9) (FDIC): by guaranteeing them only up to $250,000, 1,400 billion dollars are no longer guaranteed (10), which could conveniently avoid a FDIC bankruptcy in the event of a problem…

And apparently the insiders of world finance are also preparing themselves: enormous short bets have been placed for expiries through the end of April (11); two Swiss banks are changing their status so that their partners are no longer personally liable for the bank’s losses (12); Eric Schmidt has sold 2.5 billion dollars worth of Google shares (13); etc.

But it’s not only the markets which are preparing for the worst. The US government itself seems to be expecting disorder and a great deal of violence: first of all it is arming its department of internal security (Department of Homeland Security) with 7000 assault rifles) (14), then Obama is signing a law allowing the pure and simple execution of Americans posing a vague “imminent threat” (15), to the great displeasure of a section of US public opinion…

Bank failures: Towards an « Icelandation » of the banking crisis’ management

These « too big to fail » banks are in fact gorged of public and private Western debt from which they gained their profits and power. In past GEABs our team had already established the link between a bank like Goldman Sachs for example and the Knights-Templar (18), a medieval military order which had grown excessively rich on States’ backs and which King Philip the Fair put an end to, taking their gold for his state coffers. One can see certain current trends following this thread: the efforts of certain States requiring banks to separate investment and deposit banking (19) would in fact ensure that the first’s difficulties don’t overly impact the second; along the same lines, all the lawsuits of which certain very large banks are deservedly currently the object (Barclays, etc… (20)) can also be seen as a means of recovering money from the banks to re-inject it into the states’ coffers or the real economy…

The major countries’ leaders will probably not decide to “blow up” a bank but one thing is certain, that the motivation and the means to save banks in difficulty will have no relationship from now on with those which had been implemented in 2009. If any leniency could be shown for the “too big to fail”, like Bank of America which seems to be ailing (21), at it is certain that those in charge will be accounted for the mistakes to the maximum.

But whatever this period’s management policy, as we had anticipated in the GEAB n°62 (“2013: end of the domination of the US Dollar in the settlement of the world trade”), this new shock will accelerate the loss of US influence and in particular of their ultimate weapon, the Dollar.

Notes :

(1) See Wikipedia on this Italian thinker.

(2) Source: The New York Times, 23/01/2013

(3) Two examples of thinking on the consequences of a US payment default: American style, Preparing for the Unthinkable: Could Markets Handle a US Default? (CNBC, 17/01/2013), and Russian style: Could the Russian economy withstand a U.S. default? (RBTH.ru, 04/02/2013).

(4) The kind of reasoning that prevails in US markets, “if the economic news is good, so much better because the economy is improving; if it’s bad, so much better because the Fed will intervene”, shows the extent to which they are disconnected from reality. Which is characteristic of a dysfunctioning power on the edge of the cliff.

(5) Cf. CNBC, Major Flu Outbreak Threatens to Slow Economy Further, 10/01/2013.

(6) Source: ZeroHedge, 07/02/2013

(7) Source: US Securities and Exchange Comission (SEC), 22/01/2013

(8) Source: Wall Street Journal, 04/02/2013

(9) Source: FDIC.gov

(10) Source: BusinessFinance, 19/07/2012

(11) Source: Do Wall Street Insiders Expect Something Really BIG To Happen Very Soon? Activist Post, 07/02/2013

(12) Source: Après plus de 200 ans d'existence, deux banques suisses font leur révolution (After an existence of more than 200 years, two Swiss banks are having their own revolution), Le Monde, 06/02/2012

(13) Source: Forbes, 11/02/2013

(14) Source: The Blaze, 26/01/2013

(15) Source: Le Monde, 06/02/2013

(16) Like Icesave, the Icelandic bank that the authorities let drop; and particularly after a referendum they didn’t take on re-imbursement of the bank’s debts. Source : Wikipedia

(17) Source: La Tribune, 07/02/2013

(18) Source: Wikipedia

(19) Source: Reuters, 02/10/2012

(20) Just to realize the phenomenon’s extent, go « bank + sued » in Google.

(21) Source: The Frightening Truth Behind Bank Of America's "Earnings", ZeroHedge (17/01/2013)