The problem with LaRouchonomics - Apologist for Alexander Hamilton and FDR - Pseudo-scientific charlatanism – Douglas and George vs. Fabian socialism

Dick Eastman

A follower of LaRouche versus Social Credit – Dick Eastman's reply

Someone wrote an essay in defense of LaRouche and against Social Credit:

"Rouse Up, O Young Economists of the New Age!"

LaRouche and his followers are charlatans. They have nothing. Everything they say is name-dropping – "from the standpoint of blah blah blah" without ever showing the work – because there is none to show. LaRouche sells a dimension that he invents and that he says ordinary science ignores – based on abstract theories of Plato (with his dimension in which the ideal or perfect is more real than the physical world we know) and Gottfried Liebniz (with his fictitious monads – another reality-behind-reality metaphysical theory). He does the same with geometries based on different assumptions than those that obtain in our usual measurements and constructs – adding additional dimensions or changing assumptions (instead of the linear axes of Cartesian space and Euclidean assumptions, substituting convoluted mathematical equations) – but what does LaRouche do with that? Does he really use Riemannian geometry to discover Plato's metaphysical universe – a reality that corresponds to our flatland as a cone, and where what we see as spirals are really a single "direction" on cone-surface space? No. LaRouche uses Riemannian geometry as poetic metaphor: he doesn't go there; he doesn't pull technologies from there. LaRouche is, as I said, merely dropping names: stealing the prestige of Riemann to support his charlatanism – his new Pythagorean mysticism now phony pseudo-science. LaRouche also takes principles of engineering and physics and "rediscovers them in the economics field" – only he adds nothing that wasn't there already.

And his Hamiltonian "American System" is also a fraud. Hamilton was an agent of the Bank of England; and what he favored was any goverment expenditure that would build a big national debt – any government-financed "improvement" that would require borrowing. Henry Clay was a similar fraud – Clay, like Daniel Webster, being on retainer to Nicholas Biddle, of the Second Bank of the United States.

LaRouche is a fraud. He has some things right; but he ends up favoring big government spending projects: a war economy without the war, but with the same confiscation of private wealth and freedom, for big political pork projects. LaRouche thinks FDR and Bill Clinton were great presidents.

As if restoring Glass-Steagall (repealed under Bill Clinton – ironically enough) would solve the current pressing economic mess. The LaRouchies are delusional in their pseudo-analysis.

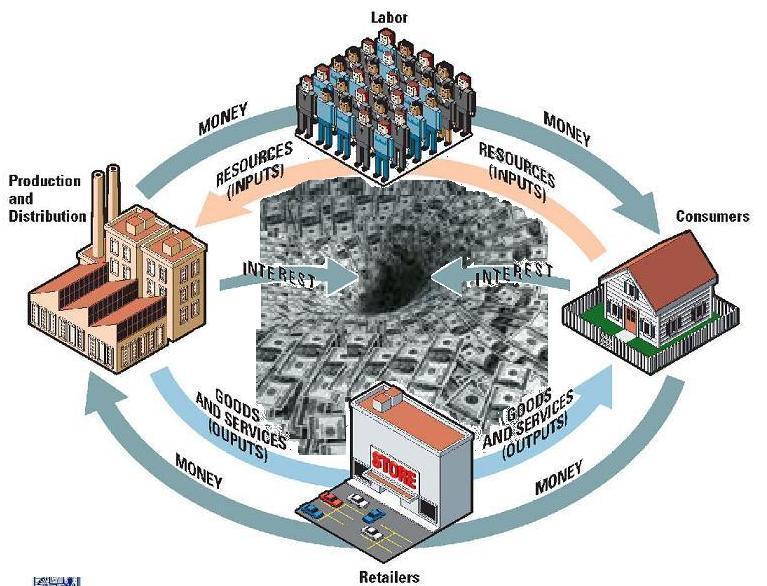

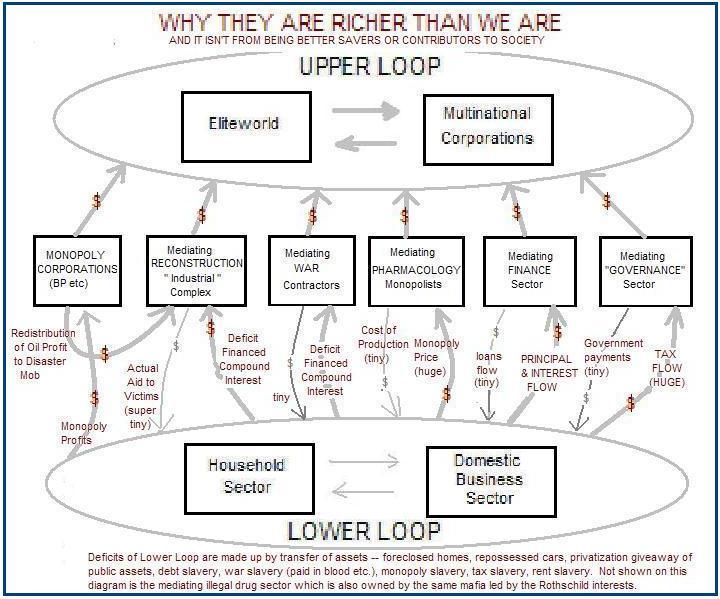

The Glass-Steagall Act of 1933 solved one problem only; and Glass-Steagall was circumvented by Supreme Court decisions and inventive loophole moves (like the invention of so-called non-bank banks). In the 1920s, Baruch, Morgan and Rockefeller combined in an effort to raise the stock market to build up potential energy for the Great Crash of 1929 – for which (Rothschild agent) Bernard Baruch sold short – and in which all those assets came into the hands of the investment bankers, as the ticker got three hours behind and the Morgan-Rockefeller-Baruch club started to buy up those shares which people, with all of that commercial-bank-loan-financed margin-callable stock, had purchased instead of buying into the Calvin Coolidge prosperity. It was, in fact, this practice of enticing savers who deposited money in banks for real economy investments, to, instead, buy paper shares in the secondary New York stock market – which actually produced very little new investment – that was the beginning of the real lower-loop deflation (which is not visible when one mixes the upper and lower loop activities in common statistics).

At the Crash, everyone who bought stock through the commercial banks was severely hurt or wiped out. The Glass-Steagall bill merely closed the barn door after the horses had absconded. It is worth noting that Glass-Steagall was already gutted by Supreme Court rulings of the mid-1980s that allowed banks to establish discount brokerage facilities, and granted commercial banks limited authority to underwrite and deal in commercial paper and mortgage debt. A return to Glass-Steagall would do nothing. Too many tricks have been devised to go back there. What is needed is the complete elimination of investment banking floating corporation stock, and of open market operations trading back and forth loanable funds and government securities. Glass-Steagall was the sand wall of a sand castle built near the water at low tide. Besides, the big investment banks have already swallowed up the commercial banks. They own them in a variety of ways. If Glass-Steagall were reimposed, the big owners of these combined commercial/investment institutions would merely reorganize: they would split them up into the two kinds, still owning both and still controlling both with interlocking directorates.

C.H. Douglas and Sidney Webb disagreed from the first. The Fabians were always against social credit.

There was also no common ground between Fabianism and Henry George's single tax (on land, to prevent the capture by the rentier and land speculator of surplus land that should go to the worker, the entrepreneur and the public sector).

The Fabians were elitists who wanted a socialism that left their particular elite set in charge. C.H. Douglas and Henry George wanted to disempower elites with, respectively, social credit and the single tax. These two men tower far above the socialism of the Fabians. I would add that H.G. Wells was also bigger and too independent to fit under the Fabian umbrella – although he did in his early years attend meetings, along with George Bernard Shaw. As for Shaw, he found Henry George first; and then, looking for more to read – there really was no more to read – found Karl Marx. Without stopping to consider the contradictions, Shaw founded the Fabian Society with Sidney and Beatrice Webb; the Webbs took it over and gave it their own stamp. Shaw went on writing plays and so on – also somewhere adding Friedrich Nietzsche to his heterogeneous intellectual mix. He never did reconcile those different schools of thought; and as a playwright, critic and political pundit, didn't even try.

So, Henry George had no connection whatsoever to the Webbs and the Fabians: they were not guided by his book Progress and Poverty at all. And Douglas and the Fabians were at odds from the very first conversation between Douglas and Sidney Webb. Also, A.R. Orage picked up Douglas and social credit after the Webbs had left the magazine The New Age (not to be confused with the current "New Age" fad in occult religion, etc.). Alfred Orage was clearly putting something in his magazine that was an alternative to Fabian socialism; and of course the Fabians knew it. Also, the Fabians had abandoned the magazine The New Age, where they used to publish their articles. They broke on ideological grounds: the Fabians going on to perfect the conspiracy of today, and Orage taking The New Age toward social credit. Once again, the LaRouche group have misled people: dropping names and then mixing in falsehoods.

Henry George ran for mayor of New York City, because that was the center of national power. He lost there, because that power rejected him. Had he run for mayor of another city, or for governor of California, he likely would have won. Henry George was very popular in the U.S. – as far as men with sensible economic and sociological theories can be popular against the loud seductive voice of the Money Power in a deflationary world.

Henry George was for the elimination of land rent – replacing it with the single tax on land. Land rent is the object of speculation – especially in the U.S. at that time. Henry George correctly pointed out that the United States was settled first by land speculators who bought up the likely locations of towns and cities; then workers, engineers and farmers – the builders of those towns and cities – would have all of their created value – all of the wealth they earned – taken away in high rent.

The fact is that speculation and rent go hand in hand for the ruling elites. Take Britain with their House of Lawyers – all on retainer to the City of London – and their House of Landlords. They let Ireland starve, rather than reduce the tariff on imported U.S. corn. During the mass deaths of the great potato famine, they still would not reduce the tariff, because the famine meant high prices for British agriculture – which could be robbed from the British tenant farmer though higher land rents. This kind of pro-tariff thinking is close to LaRouche – and far indeed from Henry George. LaRouche understands nothing of Henry George's program or the problem it solves.

The essay's author calls social credit names and makes several false statements about it.

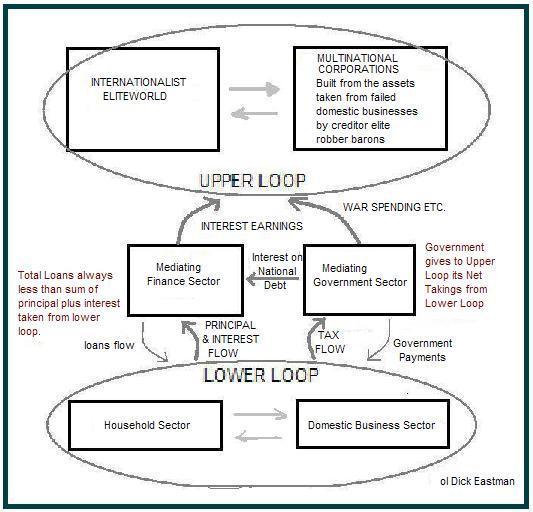

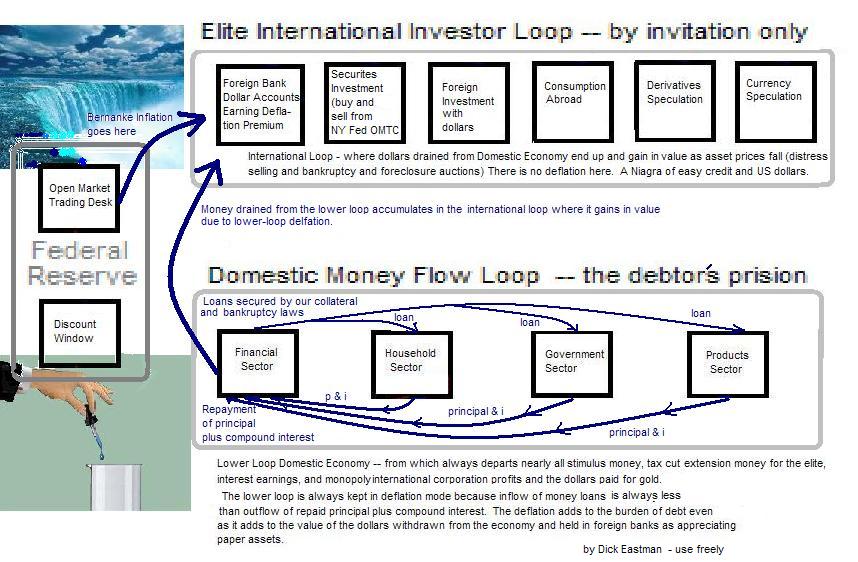

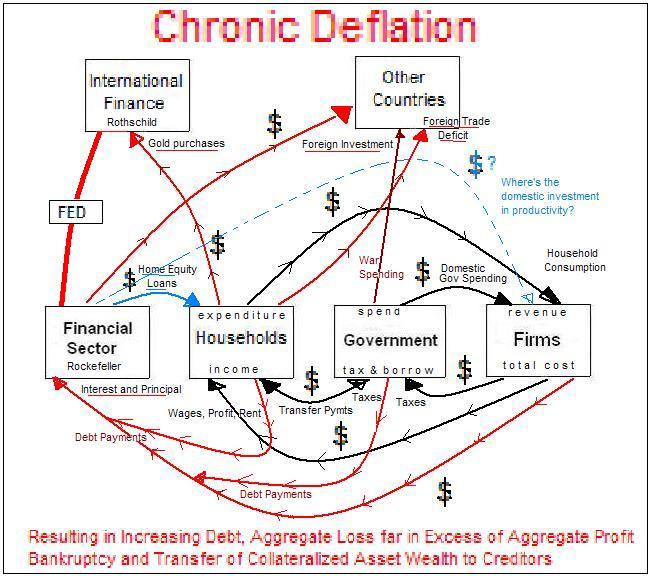

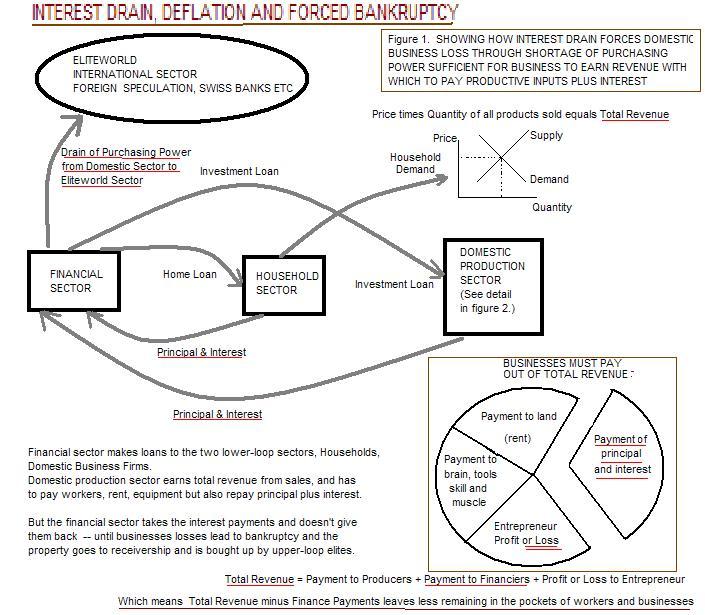

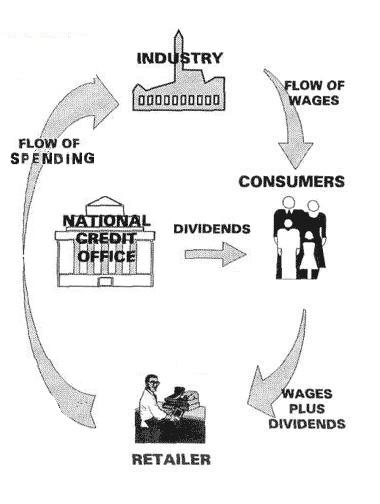

First he says that it "sees purchasing power as the single greatest factor in economics". The truth, however, is that social crediters from Douglas through Soddy up to today, say that consumption is the purpose of an economy, and that lack of purchasing power is the cause of depressions. The lack of purchasing power is brought on by prices that must cover all of the producers' expenses, including financing – where the financing charges are both principal and interest, but the interest is not provided by the bankers whose loans constitute the money supply. (This is my version. Douglas would say that not enough money goes to incomes for incomes to be able to buy the goods at prices that cover all costs, including the costs of financing. Douglas summarized this by saying that the prices of products must total A + B while distributed income to buy the goods only equals A, so that goods remain unsold: there is a shortage of purchasing power – a shortage of "aggregate demand" – a problem of underconsumption. Now that is a heck of a lot different than this LaRouche groupie is telling you.)

Here is how this LaRoucher muddies the water:

"Seeing purchasing power as the single greatest factor in economics, “social crediters” advocate the public distribution of credit to consume the increasing number of goods and services made possible by technology."

This statement makes it sound like social crediters view the basic problem as having consumption keep up with what technology can produce, as if the problem is in the real economy rather than in the monetary system. The problem of our economy is the financial and monetary system. Technology is not the problem. The market system is not the problem. Social crediters believe in the market system: and more than believing in it, they actually understand why it is not working as it should. That reason is interest drain robbing the people of purchasing power. This built-in tendency toward deflation can be speeded up by banks when they deliberately curtail lending and actually call in loans – giving creditors a deflation premium windfall on the IOUs (bonds) they hold. All of this is missed by this LaRouche follower.

The LaRoucher goes on to expound more falsehoods. He writes:

"But Social Credit suffers from the fundamental flaw of viewing “production” as an automatic process where the bounty will continue upward and consumers simply lack the credit to partake."

What is this deception – other than attacking a strawman that looks a lot like a socialist or communist who doesn't understand and respect the market system and what is required for a market system to succeed? The social crediter understands perfectly that the market system is driven by individuals seeking advantage from selling products to earn money to buy the things they want. The money provides the incentive to produce. The money is effective as an incentive because it buys things. Profit is what maintains entrepreneurship that hires and organizes labor, land and tools to produce products for sale. The entrepreneur who produces what people want – at the least cost – can make a good profit. The man who fails at entrepreneurship – who makes something that people don't want at the price his costs require him to charge – experiences a loss and faces business failure if his entrepreneurship does not improve. But social credit sees a problem in that there is insufficient purchasing power for even good entrepreneurs to break even. There is a shortage of buying power, of hiring power, of debt-paying power, due to the drain of interest. There is nothing automatic in production: every social crediter understands that. It is a falsehood to say that they don't understand that. Social credit exists to remedy the reason why production fails to be profitable, despite the fact that people want the good and that the good can be efficiently made. That reason is the shortage of purchasing power, caused by interest charges – by excess debt bringing about deflation. It is impossible that this LaRouche follower has adequately studied social credit – and impossible that he is being honest when he misrepresents social crediters' position so completely.

Next the fellow writes:

"The one-time popularity of social credit can be attributed to its focus on interest as the bane of mankind, divorced from any notions of production, trade, employment and other considerations of political economy. Like Georgism, it is a free trade doctrine that focuses on a limited technical feature of the economy."

Actually, the "focus on interest" is a recent innovation. Douglas avoided framing the "A + B Problem" in terms of "B" being interest alone. He put other "non-distributed" costs in as well. The new American populist version, of the last six or so years, puts: 1) net interest drain of purchasing power; 2) banks curtailing new lending, relative to the closing of paid-up loans; and 3) the deliberate calling in of loans – as the three causes of deflationary depression, of underconsumption, of aggregate business and home mortgage failures.

There is no reason to call the social credit analysis a "free trade" doctrine. "Free trade" today means finance capitalism: it means unregulated foreign investment/speculation – as overseen by the big banking interests who profit from manipulations of currency exchanges, futures markets, wars, monetary expansions and contractions. Free trade means Rockefeller and Rothschild have their way internationally. It means that and nothing else.

Social credit looks at monetary manipulations by commercial banks, by bondholders, by central banks and by governments. Its proponents look at the plumbing of the economy and find the leak that is causing the shortage of purchasing power – that causes purchasing power to be inadequate to mediate all of the production and distribution that can be done to improve people's positions through mutual cooperation. The artificial shortage of populist purchasing power prevents the free-market development of technology and the rewards for application of that technology.

LaRouche wants the government to do big Stalinist technology – and to hell with the consumer. LaRouche wants to fund behemoths such as Halliburton to build giant projects – forgetting about the consumer: that is, the household, the family, the individual. Big Government and Big Corporations – with the fig leaf of the promise that with LaRouche's insights "from the standpoint" of Plato, Leibniz, Nicholas of Cusa, Alexander Hamilton, Riemann, FDR and Bill Clinton, there will be so much technological improvement that somehow paying the interest on the borrowing that financed all of this Big High-Tech Pork Spending will not be so bad. But why not? How is protectionism – tariffs on competing goods from abroad – going to solve the interest problem?

The American populist social credit reform does not require tariffs; but it requires balanced trade. It requires that our imports must be paid for by our exports – or else we do without. Also, we require that foreign lending not be allowed. LaRouche's heroes Hamilton, Clay, FDR, Clinton, all favored borrowing from Rothschild. LaRouche simply says debt doesn't matter once the big technologies that call on Platonic forms accessible through Riemannian geometry are brought into play – once the greater "flux density" of new technologies is employed. In other words, LaRouche's super science from beyond the Euclidean universe is going to make our debts unimportant.

LaRouche and his followers make noises like they are addressing the monetary problem; but they are not.

LaRouche and his followers make noises like they are addressing the monetary problem; but they are not.

Money – as it currently exists – gets in the way of the realization of technology to meet human ends; and LaRouche introduces no new way of financing. His innovation is only that he advocates investing in smarter things – investing in things that only someone who understands monads and Platonic forms and Riemannian differential geometry will know to invest in: this making so much wealth that the way it is financed will not be a burden. But that is the lie of Alexander Hamilton; the lie of Henry Clay; and the lie of Lyndon LaRouche. The dollars determine who gets the economic pie that is produced – in this world and in LaRouche dream space. The financial and monetary systems are set up so that increasing ownership of whatever is made goes to the financial sector – and not to the business sector, the household sector or even the government sector.

Note that the financial sector elites own the corporation stock as well as the bonds: they gain from monopoly ownership and from interest and from speculation in a rigged game where they control expansions and contractions of credit that produce booms and busts – from each of which, boom and bust, they position themselves to profit. Under the LaRouche system, that will not change. The bigger the LaRouche investment, the more the financiers will end up holding in their pockets. LaRouche never considers the way that wealth is distributed under his system. He simply promises to cover all problems with new production; but it is only infrastructure. LaRouche does not put money in the people's hands so that they can direct production through household demand. He is such a dazzler at dropping names and talking over people's heads; but his "program" is still a lie all the same. The system that he assures you is out of your sight, does not exist; or if it does, Lyndon LaRouche certainly has no clue how to find it. He is a scammer; and all of his followers are either scammers too, or else college kids who prefer the LaRouchies' bait of scientistic scam over the libertarians' bait of gold-standard "freedom" or the communists'/socialists' bait of raw power over other people.

The LaRouche follower goes on:

"The US Constitution gives Congress the power to pass laws to provide for the “common defence and general welfare.” The general welfare clause was put to the test and upheld in McCullough vs. Maryland, which upheld the constitutionality of a national bank."

The idea is that the low-interest loans will go to government projects.

"Publicly-funded infrastructure and publicly-financed and -supported industry are central to the American System. How would Georgism create a transcontinental high-speed rail network? How would social credit bring back the textile industry? How would Distributism undertake a massive national project like NAWAPA? ... “Central planning” does not need to involve some politburo running every lemonade stand. But some allowance needs to be made for Congress to initiate projects of widespread importance and distribute credit via a national bank to employ private industry in the completion of said projects. Our national laboratories linger in obscurity. Our sovereign credit is deferred to the private Federal Reserve. Our bridges, roads and waterways are eroding. Private companies will do the work; but only effective central planning can set the priorities and start the process."

Hamilton and Clay – Hamilton against Jefferson, and Clay against (Jeffersonian) John Calhoun – backed a Bank of the United States, which engaged in grand speculations and fostered land development – but always with speculation preceding. And once things were built up, that same National Bank would arrange a deflationary panic so great that all of what was built would pass into the hands of the creditors in Philadelphia, New York City and Boston. Low interest rates – easy terms, from a national bank along the old "American System" model of Nicholas Biddle (ultimately Rothschild) – served to build up assets destined to fall into the hands of the lenders. LaRouche doesn't fix the problem. LaRouche doesn't acknowledge the problem. LaRouche sweeps it under the carpet – where it will jump out and bite you in the ass AFTER you have taken LaRouche's poison pill.

The LaRoucher draws a pretty picture:

"If Americans make our own iPads (with better safety, wages and working conditions), we get the iPads, the jobs and the circulating credit. The Chinese can then do the same and grow their own middle class. It is to the benefit of all but the British Empire for all people to be more advanced, more prosperous and more secure. We must abolish predatory free trade but promote cooperative development between nations."

Sounds great, doesn't it? But did you notice that he hasn't told you how you get there? Will it happen automatically from protective tariffs? Will it happen from big government projects financed at low interest by a national bank?

Think about it. Suppose right now we put up big tariffs to keep out all of those Chinese goods. And suppose the national bank offers interest-free loans to every firm that applies to produce goods to replace the imports. Who would build an American iPad factory when Americans don't have the purchasing power to buy the product – and to pay for the new factory, and for the factory that makes the iPad manufacturing machines that are needed, and so on? If there is no money in the hands of the people, how can making these more expensive products be profitable?

LaRouche would use interest-free loans as a subsidy. But why build even a subsidized factory if the public doesn't have the purchasing power to buy the product? What is LaRouche's answer? He depends on workers who are building the vast infrastructure items, to be the ones who go out and spend the paychecks to make the demand for non-government-financed production take off. But how long will that take? And how much infrastructure must you build before the public – buying more expensive local goods – has enough earned income to be able to support widespread American production? This is a very serious problem. LaRouche is doing what the communist central planners under Stalin did: working on big industrial projects and infrastructure projects, with easy credit and help from Rothschild – letting the "second string" economy take care of consumers. Actually, the dot-com scandal was very much like the economy would be under a LaRouche regime: easy credit for the chosen industry, followed by a drying up of easy credit, and all of the assets going to the bankers – swallowed up by the big monopoly corporations that the creditors own. That is what always happened in the "American System" of old. That is what must happen when finance is a sweetheart relationship between a National Bank and Congress.

The fellow concludes with these words:

"As the utopian illusions of libertarianism disintegrate, we must be careful not to be sucked into the quasi-socialist spawn of the Fabian Society. Anything short of the American System is a half-measure or a lie. Your enemy is not big government, Jews, communists or the Catholic Church, but “the British Empire” – a transnational system of financial speculation, cartels, war machines and its attendant propaganda and elaboration. We are fighting a war against illusions, lies, provocations and terrorism. The only way to win is to abandon the gambits offered to you by your enemy, and embrace the only tradition that can win."

And what is the "British Empire" but Rothschild and other banking houses of the City of London? And what is Rothschild but an elitist Jew? And what is Rothschild's politics if not Zionism? Who is behind Israel? Who owns the corporations through holding companies and other means of concealment? Who owns the debt? What does LaRouche propose to do about the trillions of dollars of debt owed by the U.S.? We don't need tariffs to stop imports. Our credit is dried up. We can no more import the goods we need any more than can Greece. A tariff would only be a fig leaf – a scapegoat to explain the end of imports that is already inevitable.

The bottom line is that LaRouche does not provide what the country needs to lift the survival rate among American start-up businesses and existing businesses. What the country needs is increased demand: purchasing power. And the money must not be funneled first through building some new super railroad across the country – a railroad that will go into receivership as soon as the "national bank" decides it is time to gather up the eggs that the chickens have laid, that is, as soon as it decides to contract purchasing power.

LaRouche has fixed nothing with his scheme.

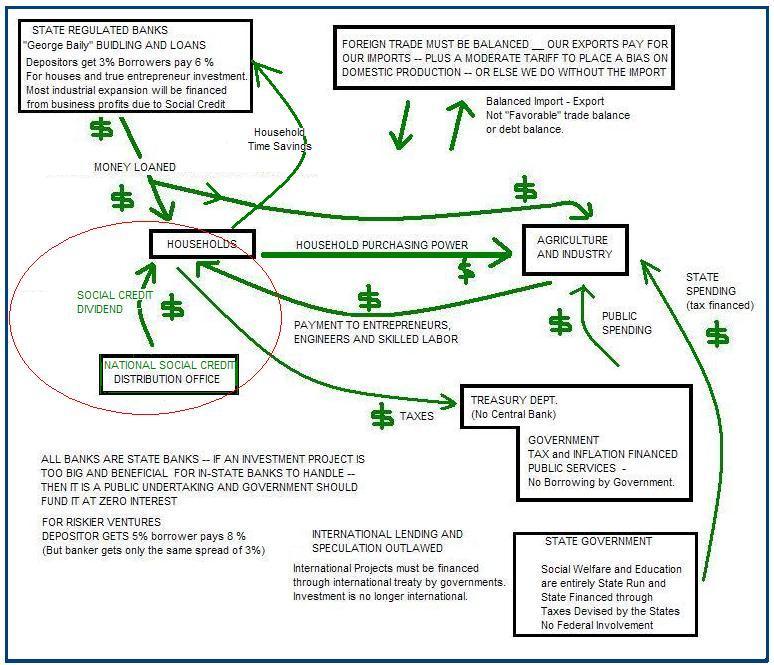

What will fix the economy is the American populists' version of social credit:

1) Repudiate debt to the bankers who have defrauded us with their system where all of the money is loans that have to be paid back as principal plus interest. The terms are impossible to meet in the aggregate; and the bankers know this. That is fraud.

2) Switch to a fiat currency and a banking system that requires 100 percent reserves for loans. Banks can loan what savers put in time deposit savings accounts, but not a penny more. That is how we eliminate the fractional reserve banking system.

Having created a fiat currency and having ended the fractional reserve money system, we next completely separate money creation from the banking function. Banks will have nothing to do with money creation.

3) Originate all new money in the household sector, as the National Household Dividend will be issued to each citizen by the Department of Commerce. The household – that is, the consumer – will be the first spender of all new money. In this way, consumer demand will direct the market economy. Consumer sovereignty will be a reality, rather than Rothschild sovereignty and Rothschild theft.

4) Break up monopoly power, primarily through ending the corporation structure – the legal personhood of corporations. Instead, we will have exclusively the single proprietorship or the partnership – with full liability for the owners in all that they do. There will be none too big to fail, because there will be none very big. And there will be no central planning, because the consumer with money to spend will be the force and direction who signals to the entrepreneur, and who holds out ample reward for the entrepreneur to make rebuilding the American economy a profitable and satisfying thing.

5) Draft all corporations involved in the war industry – an idea of Warren Harding's – so that no corporation makes a penny, but all of its officers and staff make soldier's pay until the war is over and the corporation goes back to peacetime production – and conversion to non-corporation structure.

6) End government deficit spending. The people will have cash; and if the people want a public good, such as a bridge or a giant project to water the plains or flood Death Valley to make a mini Mediterranean Sea and enough hydroelectricity to power both L.A. and San Diego – or not, as they choose – they will be able to afford a lobby for the common interest. They will have money and leisure enough (not having to work to pay interest on the national debt and their own debt as well) to become a force in politics and elsewhere. We will have a Jeffersonian Republic – not a Hamiltonian/LaRoucheian Marriage of Big Bank, Big Government and Big Corporations.

Dick Eastman

Yakima, Washington

"If you ain't for everybody, you ain't nobody."

Further information:

http://www.abeldanger.net/2012/08/the-problem-with-larouchonomics.html