If the [Libor] banksters conspired to keep the interest rate low .. who indeed was the victim? (My reply - Dick Eastman)

Dick Eastman

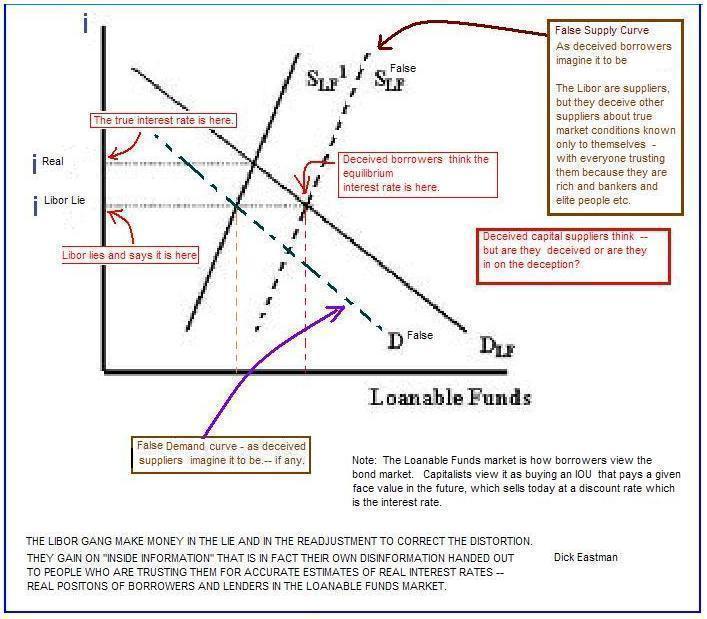

When the deliberately quote lower than what they know to be a valid approximation they are causing more borrowing to take place that would not have taken place had the real availability of loanable funds been honestly indicated by a higher interest rate. There are not really loanable funds being willingly supplied to cover all of the lending that takes place at that wrong interest rate. A crack-up must follow.

It is something like the reverse of an auction. In an auction you have a lot of prospective buyers seated before the auctioneer who is calling out prices on behalf of the seller. With the Libor you have a lot sellers of loanable funds with Libor the auctioneer representing the borrowers -- and Libor was saying "sold" at prices (interests rates) where the sale was really not being accepted -- for given levels of risk etc. It was vicious sabotage of the economy. Recall that there were a lot of sub-prime securitized mortgages of very high risk. But by Libor miscalling interest rates on solid loans, calling at lower rates than actual -- it told the lenders that risky and non-risky were essentially the same investment -- because as with most things for sale, price is to buyers an indication of quality. If they think "the market" is pricing two instruments at the same interest rate for the same time period - then people will assume that "the market" has determined that the risk levels must be equivalent for the two investment -- so the supplier of loanable funds will be indifferent between lending to high risk or low risk when other factors are equal -- because price (interest rate set by Libor) is their indicator of risk -- and they are wrong because Libor was lying to them. There has to be a big market readjustment to correct the distortion caused by Libor lies about interest rates -- either calling them too low or calling them too high. When the Libor banks and their close associates wanted to unload junk, they would call a lower than actual interest rate so that good risks would resemble the bad risks -- so they could "water down" the good risk with the bad risk they wanted to unload.

Just by knowing that people have bad information the Libor criminals could make -- take is a better word -- a lot of money. And they did. While borrowers were over extended compared to the real purchasing power that lenders were actually willing to contribute to the domestic economy.