Municipal Bankruptcies and more on the way

James Hall

Even to the casual observer, the financial condition of government budgets are under severe stress. Taxes have gone up consistently and have outpaced any meager adjustments in income for most taxpayers. No one can reasonably expect that municipal financing is assured by simply raising assessments and rates to keep their bloated bureaucracies solvent. Since the middle class has never recovered from the money centered meltdown, the average community struggles with diminished resources.

Add into this equation the prospects of an even worse financial collapse, the question needs to be asked, just how municipal jurisdictions will cope with the reality that even more properties will go off the tax rolls.

A measure of last resort might well be bankruptcy, assuming your state allows for such relief. Chapter 9 - Bankruptcy Basics seem straight forward.

“The purpose of chapter 9 is to provide a financially-distressed municipality protection from its creditors while it develops and negotiates a plan for adjusting its debts. Reorganization of the debts of a municipality is typically accomplished either by extending debt maturities, reducing the amount of principal or interest, or refinancing the debt by obtaining a new loan.”

The resources on Bankrupt Cities, Municipalities List and Map, provides valuable information.

Overall bankrupt municipalities remain extremely rare. A Governing analysis estimated only one of every 1,668 eligible general-purpose local governments (0.06 percent) filed for bankruptcy protection from 2008 through 2012. Excluding filings later dismissed, only one of every 2,710 eligible localities (not all states permit governments to file for bankruptcy) filed since 2008.

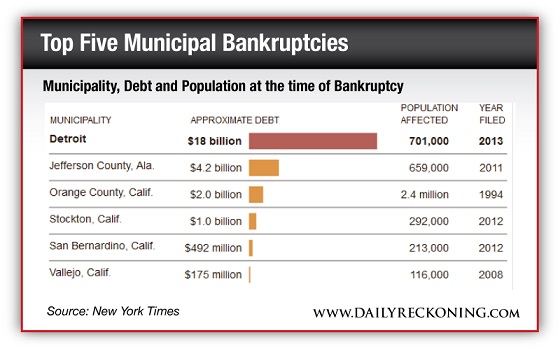

List of Bankruptcy Filings Since January 1, 2010

All Municipal Bankruptcy Filings: 51

General-Purpose Local Government Bankruptcy Filings (9):

-- City of Hillview, Ky.

-- City of Detroit, Mich.

-- City of San Bernardino, Calif.

-- Town of Mammoth Lakes, Calf. (Dismissed)

-- City of Stockton, Calif.

-- Jefferson County, Ala.

-- City of Harrisburg, Pa. (Dismissed)

-- City of Central Falls, R.I.

-- Boise County, Idaho (Dismissed)

Most financial analysis does not forecast that the risk of government authority default is high. Yet in this never ending bond financial environment, many jurisdictions have abandoned a pay as you go standard. Borrow from tomorrow to pay for the shortfall of today is not sound fiscal policy.

The actual circumstance from one of the above cited cities presents a potential legal strategy that can overturn the apple cart. The 'B' Word: Is Municipal Bankruptcy's Stigma Fading?

“Fiscally distressed cities have sought relief by raising taxes and cutting services, but they often hit a brick wall when it comes to contract adjustments. And even in cases where they can negotiate a new labor agreement, existing pension agreements have legally been untouchable.

That was until Central Falls, R.I., declared bankruptcy. The finance-strapped town of 20,000 people, located on the northern outskirts of Providence, had been trying to renegotiate its pension contracts for months with no success. When it filed for bankruptcy protection in August 2011, the slate was essentially wiped clean. The city immediately moved to change its labor and retiree agreements. The new deal hammered out by Central Falls and the unions was essentially what the city had wanted all along, says Ted Orson, the attorney for the city’s receiver. The final agreement slashed pensions by 55 percent (although funding from the state’s general assembly reduced that cut to 25 percent for the first five years).

The difference, Olson says, is that Central Falls was the first city to use bankruptcy to make good on its promise to cut pension benefits. “Up until Central Falls, there was never what we call an ‘or else,’” Orson says. “There wasn’t any leverage to make concessions. However, after Central Falls, when [the labor unions] saw what happened, they understood it’s better to negotiate a better agreement than to be in a position where something can be forced on you and you might not like what it is.”

This resolution can be a profound game changer. When the time comes during the next and graver economic crisis, the bean counters will look to any alternative to paper over their books, even if that means reneging on former contract agreements.

How the courts will come down may have less to do with case law than for granting continuity of governance.

It is not simply an alarmist scare, since The Fed is doing workshops on municipal bankruptcies now. When the central bank sends out a warning notice, the hazard danger surely is rising.

“We at the New York Fed are committed to playing a role in ensuring the stability of this important sector,” he said, referring to the sordid finances of state and local governments. But he wasn’t talking about future bailouts by the Fed. He was issuing a warning to municipalities and their creditors about “the emerging fiscal stresses in the sector.”

It’s a big sector. State and local governments employ about 20 million people – “nearly one in seven American workers.” The sector accounts for about $2 trillion, or 11%, of US GDP. And its services like public safety, education, health, water, sewer, and transportation, are “absolutely fundamental to support private sector economic activity.”

Well, the too big to fail mentality has just hit the next level. And with this mindset the incompetent and corrupt municipal administrators just get more comfortable in their leather chairs. According to Zacks, the Muni Bond Market Size is, “As of the end of 2011, the latest year for which comprehensive data is available, the principal value of the roughly 1 million outstanding municipal bond issues totaled $3.7 trillion, according to the U.S. Securities and Exchange Commission.”

How much more will this amount climb when municipal budgets experience even greater deficits?

Finally, examine the facts within the article, How Democrats Pillaged Chicago Toward Bankruptcy. “Currently the City of Chicago admits to having $26.8 billion of unfunded pension liability. Since there are almost exactly one million households in the city, each household owes the city $26,800 dollars to fund their pensions.” The precedent of Central Falls, R.I needs to push Rahm Emanuel to face reality.

James Hall – September 30, 2015

http://www.batr.org/negotium/093015.html