Thirty-Nine States Don’t Have Enough Money to Pay Their Bills

SchiffGol

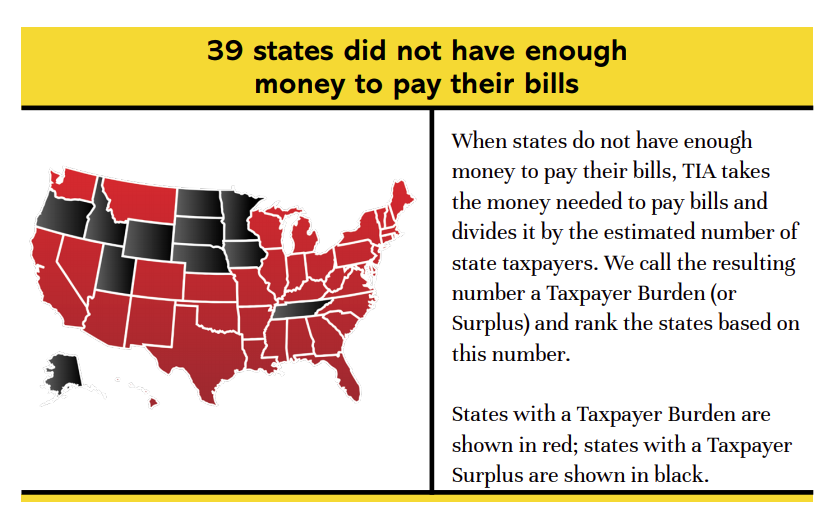

t’s not just the federal government running massive deficits and piling up enormous levels of debt. Thirty-nine US states don’t have enough money to pay all of their bills.

That was the grim conclusion of Truth in Accounting’s annual Financial State of the States report.

The report summarizes a comprehensive analysis surveying the fiscal health of the 50 states prior to the coronavirus pandemic.

Total debt for all states combined totaled $1.4 trillion at the end of fiscal 2019. This does not include debt related to capital assets.

Most of the states were ill-prepared for any crisis, much less one as serious as what we are currently facing.”

Ironically, 49 states require balanced budgets by law. As the report explains, “This means that to balance the budget … elected officials have not included the true costs of the government in their budget calculations and have pushed costs onto future taxpayers.”

The vast majority of state debt comes from unfunded retirement benefit obligations. This includes pension plans and retiree healthcare liabilities. Pension debt accounts for $855 billion and other post-employment benefits (OPEB) totaled $617 billion at the end of FY 2019.

The coronavirus pandemic and the accompanying government-imposed economic shutdowns have only exacerbated financial problems at the state level. The report estimates the 50 states could lose $397 billion in revenue.

These numbers pale compared to the debt being piled up by the federal government. But Uncle Sam has access to the Federal Reserve’s printing press and can create money out of thin air to backstop its borrowing and spending. States don’t have that option. They have to rely on accounting tricks and ultimately federal bailouts to fill their gaping budget holes. The surging levels of state debt will probably end up piled on top of the national debt.

The Financial State of the States report ranks the states by their fiscal health based on taxpayer burden. This is the amount of money each taxpayer in the state would have to pay if the state were to pay off all of its accumulated debt. (Conversely, how much each taxpayer would receive if the budget surplus was divvied up among taxpayers.)

The five biggest sinkhole states are:

- 50. New Jersey (-$57,900)

- 49. Illiniois ($52,000)

- 48. Connecticut ($50,700)

- 47. Hawaii ($31,700)

- 46. Massachusetts ($30,100)

The five healthiest “sunshine states” are:

- 1. Alaska ($77,400)

- 2. North Dakota ($37,700)

- 3. Wyoming ($19,600)

- 4. Utah ($5,500)

- 5. Tennessee ($3,400)

The only other states able to pay all of their bills are South Dakota, Nebraska, Idaho, Oregon, Iowa, and Minnesota.

Here are all 50 states ranked from financially healthiest to sickest.

1. Alaska

2. North Dakota

3. Wyoming

4. Utah

5. Tennessee

6. South Dakota

7. Nebraska

8. Idaho

9. Oregon

10. Iowa

11. Minnesota

12. Oklahoma

13. Virginia

14. Indiana

15. North Carolina

16. Florida

17. Arkansas

18. Arizona

19. Montana

20. Colorado

21. Nevada

22. Georgia

23. Wisconsin

24. New Hampshire

25. Missouri

26. Ohio

27. Washington

28. Kansas

29. West Virginia

30. Maine

31. New Mexico

32. Alabama

33. Mississippi

34. Texas

35. South Carolina

36. Rhode Island

37. Maryland

38. Pennsylvania

39. Michigan

40. Louisiana

41. New York

42. Vermont

43. California

44. Kentucky

45. Delaware

46. Massachusetts

47. Hawaii

48. Connecticut

49. Illinois

50. New Jerse