THE CHINESE SUPER -RICH ARE ABOUT TO FLOOD THE US REAL-ESTATE MARKET

Lucinda Shen

After yet another drop in the Shanghai stock market and Hang Seng index on August 6, Daniel Chang heard his cell phone ping.

The real-estate agent was on a business trip in Shanghai, and he was mid-bite during a dinner when he saw his phone light up from a message on his app, WeChat.

It was a Chinese client concerned over a $6 million property she was about to buy in New York City. She was visiting New York at the time.

"I don't know if I can do this," she told him over voicemail. "I might have to back out."

She wanted some time to reconsider, she said, and maybe recoup her losses on the Chinese stock. She was considering dropping the $600,000 she had already put down on the cooperative — she had already lost as much on the stock market.

Then, over the course of a week, the Shanghai Composite had a brief and unsteady rise, while the yuan devalued by 3.2%. Chang's client surveyed the apartment one more time.

She closed the deal.

Chang's client is one of the group of wealthy Chinese caught in between a rock and a hard place: Leave their assets in China to potentially weather additional market volatility and yuan devaluations — or put it in real estate that is now more expensive than just a few weeks earlier.

"Lots of my clients have been hit heavily by the equity market," Chang, who was once a vice president at HSBC's private bank, told Business Insider through a series of interviews. "But that only makes them more determined to diversify out of China."

Sotheby's HomesA $6.5 million property being sold by Chang.

Sotheby's HomesA $6.5 million property being sold by Chang.

The chaos of the past few weeks is likely to lead to an acceleration in the rate of real-estate purchases by wealthy Chinese buyers in the US and elsewhere.

"[Chinese] Investors who were looking at investing overseas may bring forward their purchases," James MacDonald, head of Savills Research in China, wrote in an email to Business Insider. "While some of those that may not have been considering the purchase of property in the U.S. may now look at doing so."

The Chinese see US real estate as a relatively moderate risk, high-return investment, Svenja Gudell, the chief economist at real-estate-research site Zillow, told Business Insider. Especially if buyers anticipate further RMB devaluation and market volatility.

Wealthy Chinese are already the largest group of foreign real-estate buyers in the US, with 16% of the single homes and condominiums purchased by foreign buyers snapped up by Chinese last year, according to the US National Homebuyers Association. They were trailed by Canadians, who bought 14% of homes.

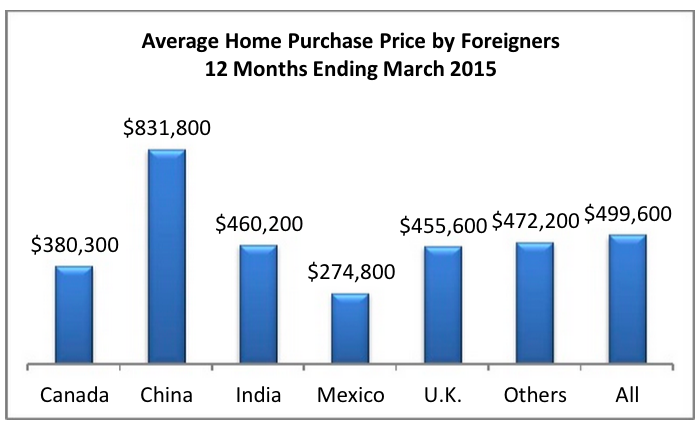

These houses are typically more expensive properties, worth an average $831,800. Domestic buyers average $345,800 on a new single-family home, according to the US Census Bureau.

National Realtors Association

National Realtors Association

Brokers in the US can see the shifting sentiment among their Chinese real-estate clients.

Emma Hao, a broker for Douglas Elliman who specializes in Chinese clients, told Business Insider she's already felt an increase in urgency among her buyers to purchase property in the US before the yuan devalues further.

"Because they are insecure about the economy and the politics, with the RMB devaluation, the stock market got mashed, and the real estate in China is a big bubble — there is nowhere to go."

Chinese homebuyers also like the US real-estate market as a base for children who have been educated abroad, and as way to diversify holdings.

Andrew Wu, a real-estate agent at Daniel Gale Sotheby's who caters to Chinese luxury-real-estate buyers in Long Island, told Business Insider: "They're looking for a safe haven, and the real-estate market has always been looked upon as a safe haven for Chinese buyers."

ReutersChinese President Xi Jingping.

The US is also seen as more politically and socially stable, according to Hao. Chinese President Xi Jingping started focusing on an anti-graft campaign back in November.

Many of China's rich have ties to the political figures, and many will look for somewhere to stay away from government scrutiny, Hao said.

"Because of the crackdown, many people got thrown into prison, and the political people are always connected to the rich people — they do business. They need their help," she said. "People worry about their own position."

More and more Chinese buyers will also be eyeing residential property as an investment, according to Gudell, the chief economist at Zillow.

She said she expects to see a different kind of Chinese buyer seeking property in the US: A reduction in buyers looking for homes, but an increase in those looking for investment properties.

"Where they are buying will also be different. The investor will buy in higher-tier neighborhoods, such as New York or Los Angeles," she said.