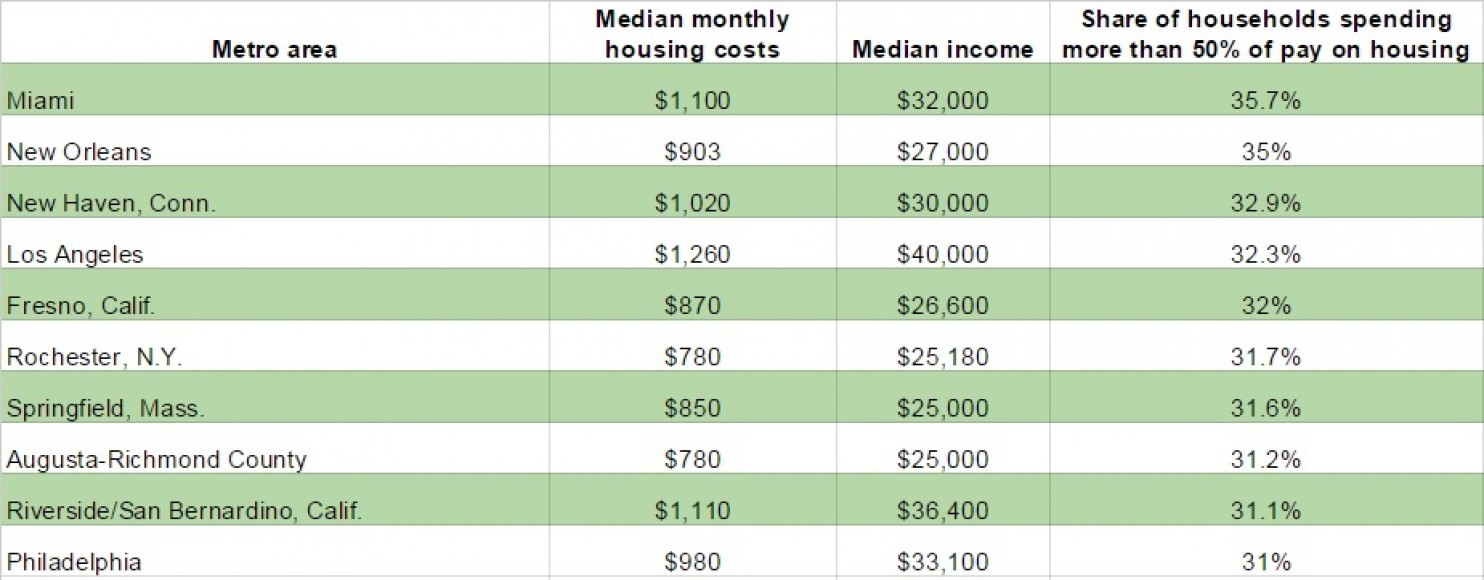

THE CITIES WHERE AMERICANS ARE MOST LIKELY TO SPEND MORE THAN HALF OF THEIR PAYCHECK ON RENT

Jonathan Marte

More people than ever are renting instead of buying homes, but being a renter isn’t getting any easier.

For many households, the monthly rent check is so big that it eats up the majority of their paycheck — and the burden is growing. Some 20.7 million rental households — or about half of all renters– spent more than 30 percent of their income on housing in 2013, according to a report from the Harvard Joint Center for Housing Studies. About 11 million of those households spent more than half of their paycheck on rent and utilities, up 37 percent from 2003, the study found. (Financial advisers typically recommend that people spend less than a third of their pay on housing costs.)

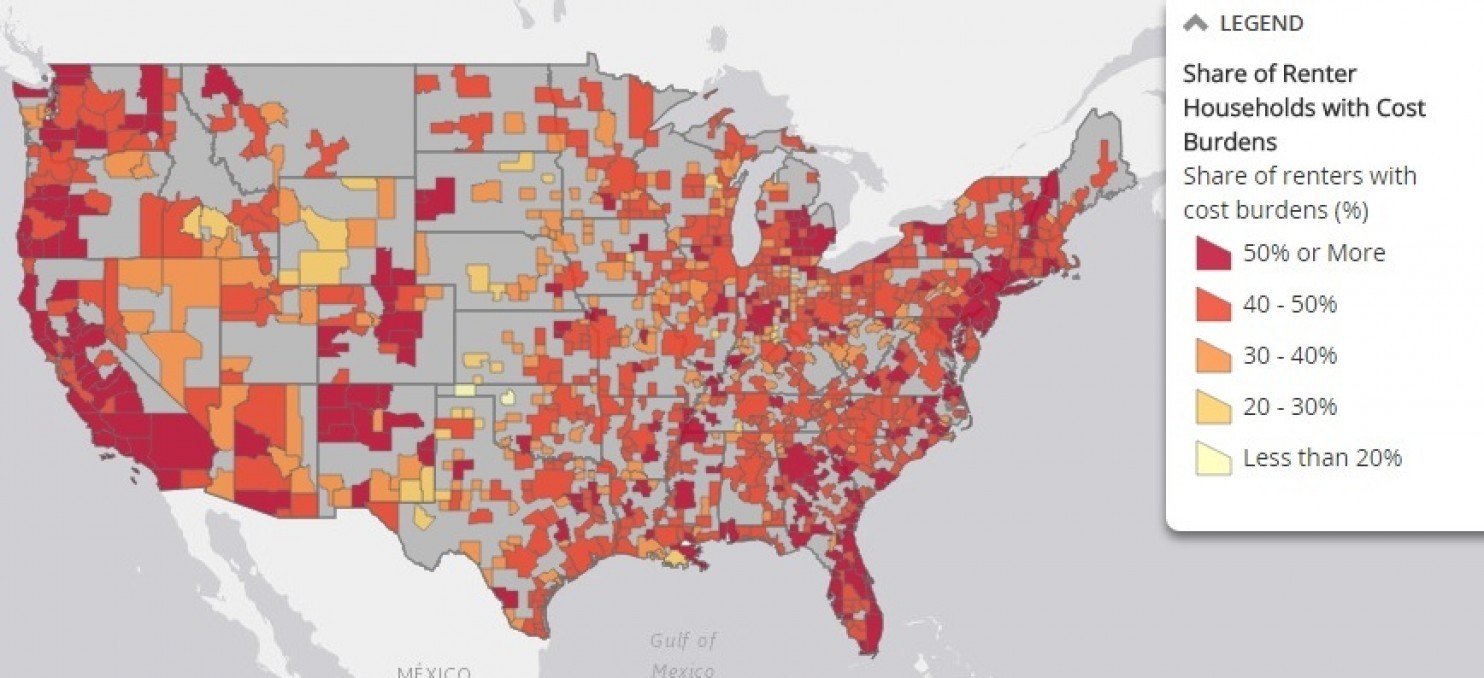

As the map below shows, renters in cities that people expect to be expensive, like New York City, San Francisco and Washington, D.C. aren’t the only ones struggling to pay the bills. “The rental housing crisis is everywhere,” says Angela Boyd, vice president of advocacy at Enterprise Community Partners, an organization that advocates for affordable housing.

Take Miami, where close to 36 percent of renters spent more than half of their pay on rent and utilities in 2013, the highest of the 100 metro areas studied in the report. Someone earning the median household income of $32,000 and paying the median monthly rent bill of $1,100 would spend 39 percent of their pay on housing.

The share of households where people spend more than 30 percent of their income on housing. Click here for an interactive version of the map. (Credit: Harvard Joint Center for Housing Studies)

In some cities where housing is less expensive, wages are still not high enough to make the rents there affordable.

In New Orleans, for instance, 35 percent of renters dedicate more than half of their pay to housing, the second highest share for the cities studied. Many people working in tourism and hospitality, a major industry for the area, might have low-paying jobs that make it harder for them to afford the median rent bill of $900, Boyd says.

About a third of the renters in cities that have lower-than-average housing costs, like Rochester, N.Y. and Fresno, Calif., also spend at least half of their paycheck on rent.

Middle class families are among those struggling the most. The number of people making between $45,000 and $75,000 who spent more than 50 percent of their income on housing increased by 72 percent between 2013 and 2003. For people making between $30,000 and $45,000, the number of renters in that position increased by 69 percent.

The cheapest apartments are being snapped up quickly. The number of available units that cost less than $800 a month fell by 12 percent in 2014 from the year before, according to the report. In many metro areas like Washington, D.C., much of the rental housing being created consists of luxury apartments, which come with an unexpectedly higher price tag, Boyd says.

Those higher rent costs are making the process of saving for a down payment very, very difficult, Boyd points out. “You’re looking around and saying I cant afford to buy a home, and I also can’t afford to rent one of these luxury apartment buildings,” she says.

But for people with sufficient savings, it’s a great time to be a homeowner. About 19 million homeowners — about one in four — spent more than 30 percent of their income on housing in 2013, the lowest share in a decade.

http://www.washingtonpost.com/news/get-there/wp/2015/07/15/the-cities-where-americans-are-most-likely-to-spend-more-than-half-of-their-paycheck-on-rent/?tid=sm_tw