IRANIAN SANCTIONS WERE BAD FOR BUSINESS

James Hall

By now you have heard that the P5 + 1 and Iranian agreement includes a path for easing out economic sanctions. Before the political pundits inject their commentary and biases for the overall tradeoff of varied interests, it would be good to assess the economic costs computed by imposing sanction on Iran as a political stick to isolate and punish the defiant regime. As the American Empire cracks under the pressure of maintaining total conflict in the Middle East, the realities that the overall world community wants a shift in policy is certainly evident in this controversial arrangement of agreement.

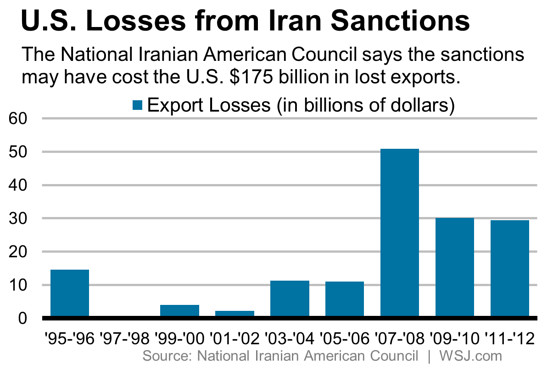

Proponents of incessant regional intervention pay an economic price as computed in Iran Sanctions Cost US Economy up to $175 Billion.

“A new report published by the National Iranian American Council today finds. Losing Billions – The Cost of Iran Sanctions to the U.S. Economy reveals that between 1995 and 2012, the U.S. sacrificed at least $135 billion and as much as $175 billion in potential export revenue to Iran.

These estimates reflect the loss solely from export industries, and do not include the detrimental economic effects of other externalities of Iran-targeted sanctions, such as higher global oil prices. Consequently, the full cost to the U.S. economy is likely even higher.”

Even so, serious students of the State Department know only too well, that there is little interest in promoting business, when trade interferes or conflicts with imposing a military presence. Now that the cries of outrage sound off, it would be worthwhile to examine some details and changes coming out of these long and exhausted negotiations.

U.S. Treasury Department statement on lifting Iranian sanctions provides links to scores of governments documents that have formed the bases of economic restriction on trade with Iran. Additional information on the FACTBOX-Sanctions on Iran's oil sector lists some of the costs from the sanction policy.

“Here is a summary of the measures currently in force, which U.S. Treasury Secretary Jack Lew has estimated have cost Iran more than $160 billion in oil revenue alone since 2012:”

Interesting if the U.S. economy lost around $175 billion and the Iranians absorbed a hit of $160 billion, just what was accomplished? No doubt the Iranians suffered more because of the restrictions on imports of much needed products and goods. Obviously that was the

intended purpose of slapping sanction on a country that will not accept the global governance of the corporatist model.

When the repeal of the sanctions starts taking effect; Iran will be the bigger winner. Since they have the most to gain it is clear why Iran wanted this deal. By their own estimates, Iran Targets 25-Year Inflation Low by 2017 as Sanctions Removed.

“The impact of lifting sanctions will help us follow on the path of lower inflation and stimulate economic growth,” Peyman Ghorbani, vice governor for economic affairs at the Central Bank of Iran, said in an interview at his Tehran office on Monday before news of the historic agreement emerged. “When these weights are lifted from the economy, then in all likelihood we can reach those goals much more quickly.”

Yet the most significant outcome will be seen that the Nuclear deal paves the way for return of Iran oil.

“A removal of sanctions on Iran’s oil exports would have implications for the oil market both in the short term and in the medium term. In the short term, Iran has significant oil stockpiled in tankers ready to be shipped to Europe and Asia – probably around 30m bbl according to indications. In the medium term, Iran will look to raise production by up to 1mb/d back towards full capacity and thereby permanently increase its oil exports. Iran has low production costs in the range of USD5-30/bl and the economy badly needs the additional export revenue, so Iran is not likely to hesitate in exploiting its full potential. Furthermore, its low-cost oil should have no problem competing for market share with higher cost European oil.”

A greater increase in oil will keep market pressure to maintain lower crude prices. However, the consequences of cheap oil add intense impact that the American domestic fracking industry will not turn around because of its higher cost of production.

Participants in this arrangement welcome the opportunity to pen contracts with Iran. Nonetheless, the prospects that the U.S. will engage in any meaningful business is remote. In order to work around the long established animosity towards American firms, the rush to do business through foreign subsidies will commence at full speed.

It is one thing to isolate and embargo a small country like Cuba, but it was always a foolish decision to inflict economic punishment on Iran to stem, any real or imaginary, effort to go nuke.

With the prospects of Cuban cigars coming to a smoke shop soon, is it not time to drop all the “axis of evil” rhetoric and enter into creative initiatives to build back business relationships that benefit from a pragmatic process of commerce?

American trade policy is on the precipice of imposing a corporatocracy global trade system. Abolishing the sanctions on Iran could attain mutually beneficial opportunities to conduct business that would not normally be achieved in the not to big to fail club of corporatists.

Sanctions are always a desperate attempt to force an unsympathetic regime to capitulate. It is a tactic of economic war and has no place in building a civilized society.

Political disputes that restrict and block constructive commerce keeps the doors lock for peaceful resolutions. Keeping the war machine in full deployment is counterproductive to building bridges of creating wealth among countries.

Ultra extremism from zealots is unbalanced no matter if they wearing a Burka, a Kippah Skullcap or an Armani suit. Promoting advantageous business transactions grow trust and expand good will.

It is time to inject common sense and get back to doing business with Iran and drop the “irrational exuberance” based upon NeoCon absurdity.

James Hall – July 15, 2015

- See more at: http://www.batr.org/corporatocracy/071515.html#sthash.I86M0f7n.dpuf