THE TWO-INCOME TRAP FOR AMERICANS: HOW DUAL INCOME HOUSEHOLDS ARE A FINANCIAL NECESSITY IN A TIME WHEM THE MEDIAN PER CAPITA WAGE IS $27,000

My Budget 360

Recent Social Security data released this month revealed that income disparity is only growing in the United States. The released figures show that the median per capita wage in the US is $27,519. Given the costs for college, healthcare, and housing many households are simply falling out of the middle class. The two income household is now the common default for Americans. However, in many cases the two income household has arisen primarily for economic necessity. Many households today simply cannot get by on one income earner. Especially if a family has children, childcare is expensive and a good portion of any additional income is diverted into this expense. The decline of the middle class household would be more dramatic if it were not for the emergence of the dual income household. Given demographic trends, it appears that we have peaked in this category and many young Americans have no choice but to live in households with multiple streams of income. Many Americans learn the hard way that the two income household may actually be a trap.

Two income trap

Inflation is an insidious form of money destruction. The Fed would like you to believe that there is only very little inflation going on but I would ask you to look at the costs of higher education, housing, cars, food, and healthcare and ask yourself if inflation is absent. Primarily because of this destruction of purchasing power a single-income household in 1970s was better off than a dual-income household in the 2000s:

This is an interesting perspective. While the nominal amount of income for a dual-income household is higher, fixed costs are also much higher. In fact, the household in the 1970s had more disposable income adjusting for inflation than the dual-income household of today. How is that possible? You have to realize that many middle class families have gone into massive debt just to keep up with what they perceive to be a middle class life. If both spouses are working and children are involved, childcare is not a cheap expense. This can eat up a good portion of any additional earned income. Also, children are not cheap and require added expenses (i.e., healthcare, school, food, etc). So you are left with this situation where a household may be earning more but in the end, discretionary income is less after expenses are factored out.

Many of these dual-income households are now witnessing their kids going off to college. There is a massive student debt bubble raging in this country. Parents are largely unable to fund the cost of their kid’s college education so many simply go into massive debt. Another trap given that many recent young graduates are finding it difficult to manage their large debt loads.

While the rise of dual-income households is not a new trend what is new is that we seem to be reaching a peak here.

Both spouses working

Of married couples, 67 percent are in dual-income households. This is a large jump from the 1960s. However as the chart above highlights this may have peaked sometime in the last decade. The recession has been tough on households. Given that the 2000s were the decade of the real estate bubble, many of the jobs that were lost after the crash came from fields where the majority of workers were men (i.e., construction, etc). Because of this shift after the recession, men and women are nearly equally represented in the workforce:

Many households have but no choice to have two workers. The fact that the Social Security data shows that the median per capita wage is $27,519 we then begin to realize that many Americans are simply treading water. We then have stats showing that 1 out of 3 Americans have zero saved up and that 53 percent of Americans own no stocks.

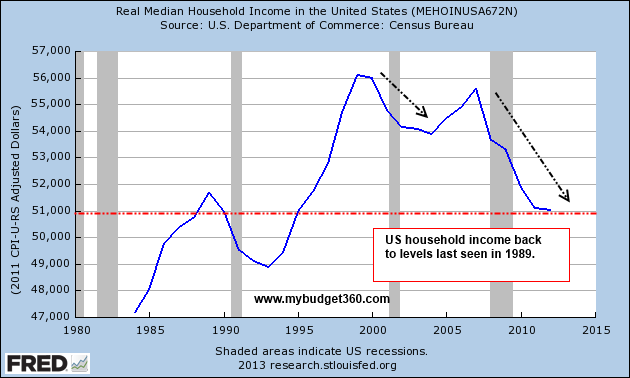

The two-income trap is real and has only become a larger phenomenon after this financial crisis. If we look at household income, adjusting for inflation it is back to where it was nearly a generation ago.

Household income

Inflation has ravaged household balance sheets especially when it comes to income:

US household income is now back to where it was in the late 1980s adjusting for inflation. Try sending your kid to a private college that costs $50,000 per year when you are only earning $50,000 a year as a household. Is it any wonder why student debt is now over $1.1 trillion? The two-income trap is a part of life for many and only reveals the slow demise of the middle class in the US. We’ve highlighted the alarmingly high number of Millennials living at home because of the current economy. Some are working thus creating households with three (or more) income streams. Yet even then, many are still just getting by. Welcome to low wage America. This dual-income trap makes sense considering the fastest growing employment sectors come in the low-wage food and entertainment fields.

.jpg)

.jpg)

.png)