When the global housing bubbles collapse like a row of dominoes – Canadian housing bubble at apex. Real estate markets from Australia, UK, Italy, and Ireland now into correction phases.

Never in the history of our modern economic system have we had coordinated housing bubbles rage across the world like some sort of financial plague. The proliferation of boiler plate media and the ubiquitous spreading of banking debt made the real estate religion spread quicker than any time in the past. The way real estate was being played up in the media was like some sort of spiritual revival. I remember a colleague showing me a clip of a real estate seminar in California at the peak of the bubble where people looked as if they were in some sort of glorified peyote induced trance. At the core of any mania is human psychology and herd behavior. People never want to believe that their special niche market is not in some sort of bubble. On January 15 we discussed the Canadian housing bubble and many people fell off their rockers as if this was some sort of spectacular revelation. Reading through the comments on the Canadian bubble post is very reminiscent of 2007 in California where the “not in my back yard” arguments dominated the discussion. The nature of this housing bubble is global and the collapse of markets across the globe will have wide ranging impacts that are yet to be felt.

Global home values

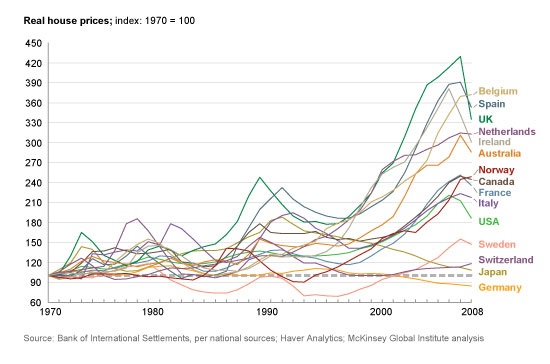

One of the stunning aspects of the global housing bubble is the synchronicity in which prices jumped:

In the late 1990s to early 2000s all prices began soaring almost in unison. At the core is the proliferation of easy access to debt and the financial system going fully into a mania with their addiction to derivatives and black box techniques of stealing from the public. If you look at the chart most bubbles are already in decline. The US market has been falling for five years now. Canada is just starting to turn.

Canada real estate bubble

It was interesting to see the responses that came from the article looking at the obvious Canadian housing bubble. Arguments ranged from:

-Our banks are not as crazy as American banks

-They aren’t making any more land!

-Uncle money bags from China is buying every piece of property

-It’s different here! Really! Trust me.

Others acknowledged a correction and many others saw the crash approaching. Take a look at this chart for Vancouver for example:

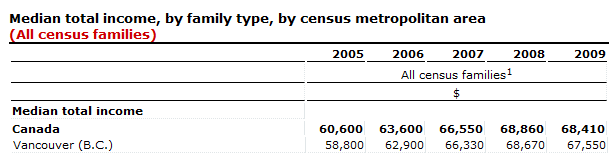

And then examine the typical household income:

The big push is coming from hot money from abroad, specifically China. These are temporary surges. This is reminiscent of pocket markets in California and Hawaii when Japan had their incredible run. These runs are always temporary in nature. They do correct. The question is how bad will the hit be when it does correct. It warrants looking at an updated chart regarding these markets:

Source: World Housing Bubble

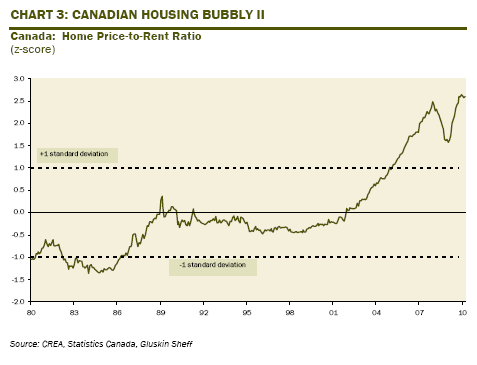

The bubble is rather obvious. Household incomes across Canada are levered with debt just like their American counterparts. One early indicator of price dislocation is with rents and home prices. This was evident here in the US in the early days of the bubble:

This bubble is ripe for popping and hot money is like any infatuation. It clouds all judgment in the short-term but has an inevitable end. Economically it is unsustainable. Folks need to do some background reading on the history of bubbles.

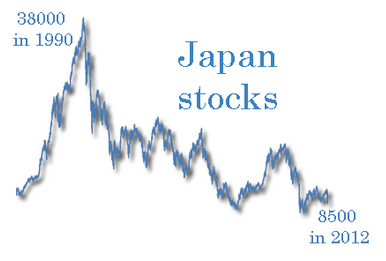

Japan stocks and land values

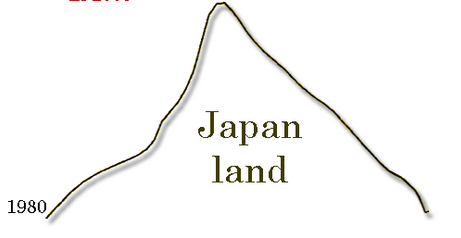

For those who can remember Japan’s major bubbles and how it impacted California this chart is very apt:

Japan is well into two lost decades for their economy. The hot money from Japan flowed into markets in California and Hawaii. At the time many thought the run would go on forever. It was different this time remember? Of course it wasn’t and the pop was deep:

When the hot money stops, you have to rely on your own financial merits especially for housing. This is why you are seeing major pricing action in places like Beverly Hills, Bel-Air, and San Marino. Ultra prime locations that are now facing price drops. There are shacks and condos in Vancouver that are insanely priced and bring back memories of Real Homes of Genius.

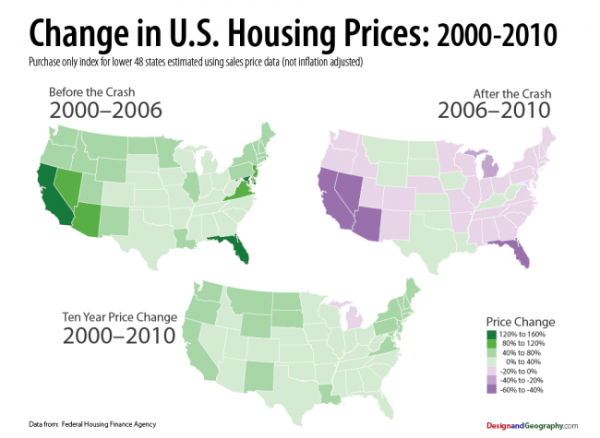

US home values

Bubbles can go on for well over a decade. When they pop, the tide goes out and much is revealed:

Source: DesignandGeography

From 2000 to 2006 home prices went nuts on the coastal regions. California and Florida went into full mania mode by having price changes of 120 to 160 percent. Then the correction came and slammed prices back down. The above chart highlights the progression of how bubbles correct. The lesson? The higher you go the harder you fall especially when you don’t have substantive real household gains with income. Leverage or no leverage, when hot money enters a market you must prepare for the inevitable ebb when it runs low or drops to a trickle.

Global housing bubbles are in various stages of correction. When each bubble pops, this will undoubtedly bring pain to local banks and force regional governments and central banks to continue on the bailout path. There are few things that unite this world but our love affair with real estate seems to be a very common one.