Meanwhile In Shanghai Residents Form Lines To Sell Yuan, Buy Dollars

The Unhived Mind - dave Gonzales

Meanwhile In Shanghai Residents Form Lines To Sell Yuan, Buy Dollars

Tyler Durden’s pictureSubmitted by Tyler Durden on 01/10/2016

http://www.zerohedge.com/news/2016-01-10/meanwhile-shanghai-residents-form-lines-sell-yuan-buy-dollars

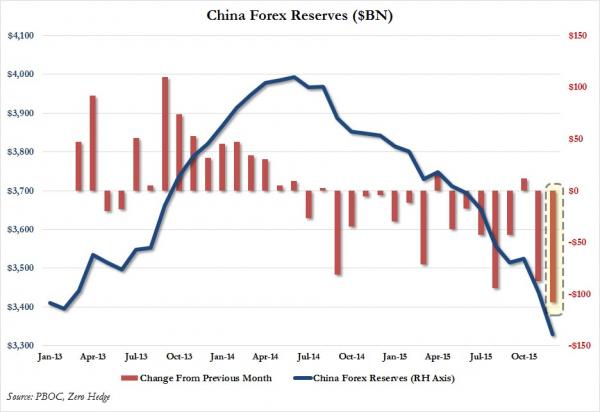

On Thursday, as the world was focusing on the collapsing Chinese exchange rate, we noted that in a more troubling development, in December Chinese FX reserves declined by a record $108 billion, bringing the total drop for 2015 to over half a trillion, and the cumulative decline since Chinese reserves starting dropping in mid-2014 to just shy of $1 trillion.

But why if China has been so keen on devaluing its currency – at least since the formal start of the devaluation on August 11 – was it selling so many USD-denominated assets? The answer: because if the PBOC did not step in and halt the decline (by liquidating reserves) the drop would have been even greater, suggesting that the capital outflow from China is orders of magnitude worse than either Beijing, or Chinese analysts would like to admit.

One thing is certain: there is much more depreciation to go. As we reminded readers yesterday, one month ago we predicted at least another 15% in CNY devaluation, something Bloomberg agreed with over the weekend. And as China devalues more, it will face even more outflows: at least $670 billion which will drastically cut the country’s pile of FX reserves at the worst possible time – just as China’s banks are forced to begin recognizing the huge pile of non-performing loans as a result of a tsunami of pent up corporate defaults mostly in the commodity sector.

All that assume a continuation of the smooth devaluation seen since the August 11 shocker.

As SocGen points in a note today, “press reports at the end of last week suggested that senior policy advisors would like to see a sharp one-off depreciation of the CNY. The theory is that once such a move had been accomplished, the domestic capital outflows, that are putting additional pressure on China’s financial system and draining the FX reserve, would stop. The same policy advisors, however, recognise the dangers of such a strategy. First, domestic savers may not believe a “one-and-done” strategy, risking further capital outflows. Second, China’s political standing in the G20 group could well suffer as a result, which is important point to the current administration. Finally, the potential disruption to financial stability outside China, and with the risk of an Asian currency war, would ultimately feedback negatively to China.

The first point is one we broadly mocked back in August when one after another PBOC speaker swore that the devaluation is over. We were correct in pointing out that it had only just begun.As such it is logical why the local population no longer believes a single word uttered by officials.

Which brings us to another key point by SocGen:

While China is willing to spend some of its FX reserves to manage the pace of currency depreciation, we believe that the authorities would step in with further capital controls should this be deemed necessary rather than risk an accelerated run down of reserves. Already last week saw some further tightening of the existing rules; Chinese citizens are still allowed to convert $50,000 annually (resetting on January 1), but a maximum daily limit of $5,000 has now been set unless an in-person appointment is made, in which case the cap is $10,000 and with a maximum of three meetings permitted per week. The irony is that expectations of further tightening of capital controls could add to outflow pressure.

Bingo.

Because as Ming Pao, the most influential Chinese newspaper in Hong Kong, reports that Shanghai residents are lining up at local banks to sell Yuan for Dollars over fears of even more Yuan devaluation.

Ming Pao: Shanghai residents are queuing at local banks to sell #RMB for #USD amid fears about more RMB depreciation pic.twitter.com/WbjMUU6WEE

— George Chen (@george_chen) January 10, 2016

The good news: there may be lines, but they aren’t long. Which is good: the last time we say long lines was in December 2014 when the ruble imploded and the local population was rushing to exchange their rapidly devaluing pieces of paper into dollars or hard assets.

More on the current sentiment on the ground in China, google translated from Ming Pao, according to which to avoid long lines forming, China Merchants Bank is urging people to seek personal appointments or be limited in how much they can convert:

China Merchants Bank yesterday to purchase foreign exchange business can be seen in public not long lines, but bank employees significantly increased the number refers to the earlier exchange, cash dollar now the best appointments, but she said that did not change in swap lines. Mainland exchange regulations limit $ 50,000 per day for a year, to be exchanged for cash the same day, the maximum limit of $ 10,000.

Not helping matters was a comment by Chen Xuebin, Professor in the Institute for financial studies at Fudan University, in which he said that based on past experience, the currency devaluation may cause a short-term panic effect. The silver lining: during last year’s 6% depreciation, there were no bank runs, so he is not too worried this time either.

This time may be different, as SocGen points out:

To our minds, the most significant change on China since the equity market first crashed last summer is the perception that the Chinese administration holds much less control over the economy and financial system than what was previously perceived. Part of this is the natural consequence of reform, and not least in the financial sector. Less than apt communication and somewhat confusing policy initiatives have unhelpful, to say the least. This does not mean, however, that the administration is without control.

That is certainly the case, and over the next several weeks and months we will find out just how much, or little, control China’s administration still has left.

theunhivedmind

When will people stop empowering the nightmare which causes all these sub-nightmares? If the Chinese people want to get out of Yuan then they should move into physical gold or Bitcoin. Bitcoin might become a problem if the Chinese authorities clamp down but owning gold at home will be fine and harder to confiscate. Never empower the United States by using US Dollars my god at least look at Pounds Sterling if you’re that desperate to continue playing in the Rothschild monopoly debt instrument game.

☆´¨)

.·´ ¸.·★¨) ¸.·☆¨)

★(¸.·´ (¸.*´ ¸.·´

`·-☆ The Unhived Mind

http://theunhivedmind.com/wordpress3/this-is-what-gold-does-in-a-currency-crisis-china-edition/

keenly

Speaking of money do you know who controls the The Depository Trust Company (DTC)?

theunhivedmind

I don’t know why you speak of money and the DTC in the same breath? Like all the others the DTC controls debt ponzi schemes as real money no longer exists. To understand who owns the DTC then just look at who privately owns the Federal Reserve and for that look up the work of Eustace Mullins. When it comes to any banking power in the United States then you have to look towards Wall Street which itself is mastered by the City of London. The ultimate answer is simply the New Venice Empire Templar network. In the West and much of the world there is hardly anything that isn’t controlled by the same Templars. When the BRICS is fully put in place then there will be some different Olympian players but until then the followers of both Zeus and Kronos will continue to run the roulette wheel. I believe the DTC is where all the bonds are held for the admiralty system. Under this admiralty law system you become a corporation when a birth certificate is created, at the same time bonds are issued against the corporation and I believe the DTC masters this for U.S. Citizen chattel but ultimately the admiralty system since 1815 has been mastered from the Templar Bar (City of London) and tied to its wickednesses starting from 1666 and the Great Fire of London bring about the Cestui Que Vie Act 1666 not forgetting its Venetian roots going back to the Cestui Que Vie Act 1540 tied in with the farce of the Venetian-led Reformation. Therefore if you’ve got a birth certificate then you’re someone elses property (serf) and non-living in the owners eye. If you have been Christened or similar then you’ve further been enslaved and now you can understand why everyone was forced into a birth certificate and a Christening in order to do things like legal marriage etc. In order to be a real human with standing you need to never have a birth certificate or any other contract with the state such as baptism etc. The Venetians destroyed everything that was based on God and people being in control of their own destiny and these Venetians used a system masquerading as God’s system.

☆´¨)

.·´ ¸.·★¨) ¸.·☆¨)

★(¸.·´ (¸.*´ ¸.·´

`·-☆ The Unhived Mind