The Trap has Now Been Set on the Comex!

Records Keep Shattering

Last week’s price action, as we know, saw gold being dragged in a monstrous shorting undertow that left gold & silver spot prices at weekly closes under $1,100 and $15, respectively. The reason why this is happening is something I’ve covered at great length, but the affect which these new price lows are having on retail and wholesale demand are colossal!

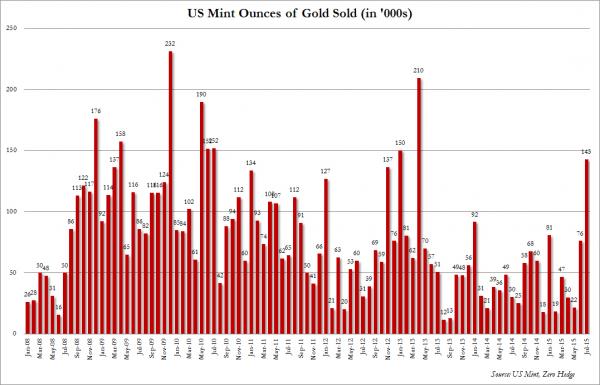

For months, silver has been experiencing record sales while retail gold sales at Western mints have been truly asleep. This price dive has now awakened some very pent up demand, producing some of the largest demand numbers seen in years. This chart of US Mint demand for the month of July speaks for itself…

Remember, this chart is several days old, as demand is now over 143,000 oz, but as you can see, July is set to become the all-time highest July sales month in the near 30 year history of the American gold eagle coin. Here’s what the chart now looks like, compared to all the largest sales months of the past 10 years…

Gold eagle sales are now blazing a trail to a probable finish in the top 5 sales months of all time! Very impressive!

Meanwhile, China(who vastly understated their gold reserves, as detailed by a friend of mine), continues apace to break all its previous records.

In the last 2 weeks alone, the Shanghai exchange has delivered another ridiculous 130 tonnes of gold to Chinese citizens! 130 tonnes in 2 weeks!

Put another way, Chinese citizens are now demanding about 13 tonnes of gold per business day!

If that wasn’t enough though, GLD “inventory” also continues to vanish, with “stockpiles”(of paper journal entries) now sitting as low as 680 tonnes. I promise you this: whatever physical gold is actually left in the GLD system there, is shortly to be stamped with Mandarin characters!

However, what’s really a head-turner though, is what continues to be happening in the Comex positioning of gold and silver contracts there…

The Comex “Honey Trap”

Here’s something to remember, as we head into Comex options expiry this week…because, if history is any guide, the cartel will be keen to make these paper losses in precious metals have some staying power…at least until expiry is over with! This is a process that should take a few more days, and perhaps spill over some into next week as well.

As most of you know, I’ve taken some time to spell out how JP Morgan is not the big short in silver/gold, and they still aren’t(at least, not in raw Comex futures contracts). With each passing day, the situation in those futures gets more and more surreal…as hedge funds lap up whatever shorts the banks place in their doggie bowl!

I’d firmly believed during last week’s price attacks, that the banks were going long every possible ounce they could get….and boy, they did not let me down!

In fact, I had to take a second look at these numbers, because I couldn’t believe my eyes the first go-around, just look at this!

http://thewealthwatchman.com/the-trap-has-now-been-set-on-the-comex/