RUSSIAN BANKS PURCHASING GOLD AS WELL AS THE CENTRAL BANK OF RUSSIA

The Unhived Mind

What is “Supreme Excellence”?, Pt. 1

Posted on August 26, 2014 by The Doc

http://www.silverdoctors.com/what-is-supreme-excellence-pt-1/

There was quite an interesting headline in the news, which, to my great surprise, went almost completely under the radar, at the close of 2013. It was only picked up by a few small media outlets, and then was quickly dropped.

Nothing further was said, and no additional commentary was even given. I hope to remedy that today.

The headline was this: Russian banks buy up 181.4 tons of gold, in 2013.

Read that again, carefully.

Does it say, “Central Bank of Russia buys 181.4 tons of gold”?

No, it says that commercial Russian banks bought almost 90% of Russia’s gold production in 2013.

Submitted by The Wealth Watchman:

Why Did they Buy it?

The alternative media sure has its hands full these days, as it seems there are so many important items to cover.

So it’s understandable when an occasional headline passes through with nary a peep from the places where I’d normally expect a great deal of attention. Yet, now and then, something which I’d consider highly important will slip through the cracks, unnoticed.

Speaking of exactly that, there was quite an interesting headline in the news, which, to my great surprise, went almost completely under the radar, at the close of 2013. It was only picked up by a few small media outlets, and then was quickly dropped. Nothing further was said, and no additional commentary was even given. I hope to remedy that today.

The headline was this: Russian banks buy up 181.4 tons of gold, in 2013.

Read that again, carefully.

Does it say, “Central Bank of Russia buys 181.4 tons of gold”? No, it says that commercial Russian banks bought almost 90% of Russia’s gold production in 2013.

This is most curious. Right? Many of us here might be aware of the Central Bank of Russia’s(CBR) policy of gold accumulation, but what would commercial banks, more specifically Sberbank, Gazprombank, and Namos Bank possibly want or need with hundreds of tons of gold between them? Why would they purchase a sum of gold that is more than double the amount that the CBR bought in the same period?

One possible explanation is that the CBR is using other Russian banks as their intermediaries to accomplish gold accumulation benchmarks which they and the Kremlin both share. We shouldn’t be surprised at this, as it’s done in a similar manner in other countries as well. This would be very like the relationship that the Federal Reserve has with its “primary dealer” banks. For instance, how JP Morgan is the Fed’s pet bank, which is used to do alot of the dirty work of price-rigging in the broader markets. What I’m simply saying here, is that it’s possible the CBR is buying a great deal more gold than it’s admitting to.

While that institution’s gold dealings are far more transparent than the Federal Reserve’s, or the U.S. Treasury’s is(not that that’s saying much), if you think that any central bank is keen to make its gold dealings public, in a line item fashion, then I submit to you, that you don’t quite understand gold’s importance.

If this is truly what is happening, then purchasing the country’s own gold production for official Russian reserves(through commercial banks) would make a great deal of sense. It takes care of several important considerations:

1)It allows Russia to easily pick off the lowest-hanging fruit on the “golden tree”: their own. With demand at all-time highs(while price languishes at multi-year lows) it makes little sense to bring such a precious domestic resource to market at give-away rates.

When one considers that Russia is currently the 3rd largest gold producer in the world, with the possibility of overtaking Australia for 2nd place by the end of 2014, it makes even less sense not to store up that gold production for a rainy(and more lucrative) day. Put a different way:Russia is acting more like how you’d expect major mining companies to act, if those companies were actually run for the benefit of their shareholders(alas, they are not).

2)It allows major Russian financial institutions to share a stake in the official Kremlin gold policy, and by extension, the greater Russian gold market. This is key, because when it comes to strategic reserves, the right hand must know what the left hand is doing. It does not behoove Moscow and the CBR, to seek a greater role in the world market’s gold mining, trading, and pricing, while keeping every detail to themselves. For logistics, for possible gold-financing programs, and other strategic reasons, it builds loyalty and cooperation to work hand in hand with their major banks in this endeavor.

3)Lastly, and most importantly, it keeps it all “hush hush”. Keeping gold transactions strictly between Russian banks, makes the anonymity and privacy issues much less of a concern.

This is the easiest reason to understand. They prefer discretion in such matters, for all the same reasons you prefer everyone not to see your checking account balance each day. Your net worth is your own business, right? Privacy becomes even more precious the richer you are. If you were worth $10 million dollars, would you really want to plaster that figure on a T-shirt, and wear it around town? The more well-off you are, the bigger target you become in the eyes of the unsavory.

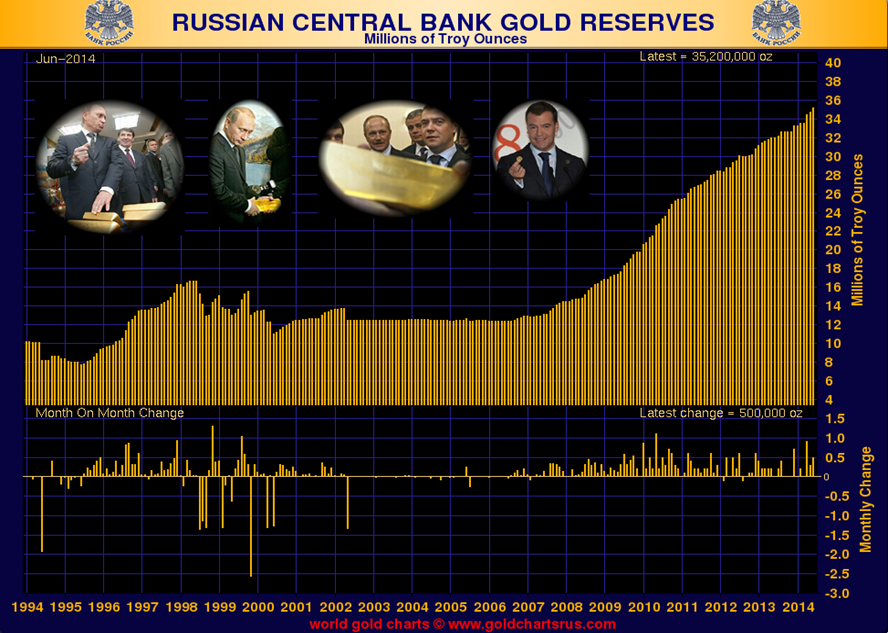

Make no mistake, this involvement in the gold market is not happenstance, but is a core Kremlin policy, orchestrated from the very top. The CBR, who is heavily involved in buying each year, is reported to have bought roughly 60 to 70 tonnes of gold in 2013. If you doubt me, then simply click on this excellent chart, and ponder it for a few minutes.

This chart details every monthly purchase(or sale) of gold by the Russian Central Bank, for the past 20 years. Do you notice anything striking in this image, beginning in the year, say, 2006? Is there a powerful trend here?

Yes, there is: the CBR has been stockpiling gold for nearly a decade. They’ve been doing so rather “slowly” as well, almost as if there is a formula for how much gold they think they can buy, without “upsetting” the gold market. The average, annual purchase for them, seems to be within the range of 60 to 90 tons. So far this year, they’ve purchased roughly 2.2 million ounces, or close to 70 tons.

Since 2006, this slow and steady approach has helped Moscow to reach nearly 36 million ounces of gold, when just 8 years ago, they “only” held roughly 12 million ounces. Put another way, they’ve been able to triple their gold reserves in less than a decade. Not half bad, wouldn’t ya say?

But, what if these figures are bogus? What if these commercial banks, and other intermediaries, have been able to stockpile an additional 2,000 tons for the CBR since the end of the Cold War? Why wouldn’t Moscow simply give the true figures, and quote Russian gold reserves at 3,100 tons, instead of 1,100?

Again, this is self evident. There’s a saying in Poker, “don’t play the cards, play the man.” You simply never ‘tip off your hand’, whether it is a winning hand or not. The reason is that secrecy gives you a degree of leverage. If your opponent can even moderately guess your hand, you’re already whipped. You must keep your opponent guessing, for doing so can give you enough leverage to turn the tables in any situation, no matter what your hand is.

What if They Simply Did it for Themselves?

There’s a final consideration I want to touch upon, that I haven’t seen mentioned: what if these commercial banks simply bought that gold for themselves?

Why would they do this?

Years ago, Vladimir Putin wrote a thesis, in which he spoke of something which he’s now made a core part of his governing strategy: National Champions. What are “National Champions”?

In a nutshell, Putin’s thesis stated that he believed Russia’s regional and global status would be more secure, if Russian-friendly corporations and businesses could be established, which would act in the interests of the Russian people, and the Russian State. This is especially highlighted in the areas of minerals, finance, and energy. These companies, he argued, are to be part-owned by the Russian Federation, and are to give special considerations and deals to the Russian people, before that of others.

This is basically a form of corporatism with a unique nationalist flare, rather than the globalist flare that we see every day in the Western world. Say what you will about Mr. Putin, but he has never had any fond feelings toward “globalism”, and seems to do things based upon whether or not they will hurt or help the “Greater Russian” ideal.

Can you think of any examples of his philosophy playing out in the real world? Has that strategy of “National Champions” paid any dividends?

You’d better believe it has.

Just these two companies alone fill the halls of Brussels and London with trepidation: Rosneft and Gazprom.

Russia’s natural gas and oil operations are world class, andwhen it comes to warming the homes of Europe in the cold winter months, Russia is the only game in town. This has caused great consternation, jealousy, and even needless acts of hostility from Western governments. These hostilities have grown ever more open and dangerous, but the strong Russian response has largely made these hostilities self-defeating. What is the cause of this position of Russian strength?

Yellow-Tinted Battlements

This year, particularly, there was a surprising act of hostility, enacted against Russia, by none other than JP Morgan, acting on behalf of the U.S. government(those “intermediary” policies at work again). JP Morgan, out of the blue, decided to block a payment from a Russian embassy within central Asia. The amount of the transaction was less than a mere $5,000, but it wasn’t the amount that so angered Moscow and Putin:this was a shot across the bow, as blocking monetary transfers from Russia, in any amount, is a symbolic act of economic war. It became even more direct as it was announced that Bank Rossiya, in St. Petersburg, was to be frozen out of the U.S. Dollar.

This was a serious action that demanded an immediate, decisive response: and Putin did not disappoint.

First he announced that Russia’s largest commercial bank would immediately cease giving loans in foreign currencies(read U.S. Dollars). Next he announced thathe would soon open up a personal bank account at Bank Rossiya, and he upped the ante by stating that he would also take a personal salary from Bank Rossiya.

Then came the knock-out punch: they changed the symbol of the Ruble at the Central Bank of Russia’s office to a gold Ruble. Lest the meaning escape anyone, they impressed upon Itar-Tass:

“The Golden Symbol of Russian Rouble installation in front of the bank’s office in Perevedensky pereulok in Moscow will symbolize the rouble’s stability and its backing by the country’s gold reserves.”

The effect was immediate: JP Morgan bowed out and reversed their transfer block within a mere 24 hours. One of the world’s largest and most powerful banks was forced to duck and run, with their tail between their legs. Their normal bully tactics of coercing or strong-arming either Putin or Russian banks, was not an option.

Conclusion

Does it make sense now, as to why individual Russian companies also might choose to own so much gold, when they’re now routinely targeted, individually, for sanctions?

I can hear the heads of Bank Rossiya now: “I’m sorry, but I can’t see who’s threatening me, with all of this gold blocking my view!”

“Wow!”, you may be thinking, “What incredibly good luck that Putin had these companies built hand in hand with a Russian State who owns so much gold!”

If you think, however, that “luck”, rather than years of meticulous planning, had anything to do with that key sanction reversal, you’re gravely mistaken…

To be continued, in Pt. 2

-The Wealth Watchman