Russia Touches U.S. Achilles Heel: Petrogold instead of Petrodollar

Gold Silver Worlds

The US government feels the need to intervene in the Russian issue with Ukraine. If it wasn’t for an economic reason, nobody could come up with a valid argument explaining what the US has to do with a former USSR geopolitical issue. Is it really true that US policy makers leverage these “opportunities” as they desperately seek for GDP growth which they can’t find elsewhere?

Today’s Russia is not governed by an alcohol addict named Jeltsin. Putin, with his roots in the KGB, clearly does not feel any intimidation by the US cabal. By contrast, his answer to the US warnings goes straight to the Achilles heel of the US: the US Dollar based global oil system, also known as “Petrodollar.”

From Examiner.com (source):

However, like with the Syrian crisis of last September, Russia is quickly retaliating with their own economic threats, and one major action that they could undertake as a response is to discard the Petro-Dollar and demand physical gold as payment for energy purchases in both oil and natural gas.

Along the same lines on Goldcore.com (source):

Russian government officials and businessmen are bracing for sanctions resembling those applied to Iran according to Bloomberg. Should Russian foreign exchange reserves and bank assets be frozen as is being suggested, then Russia would likely respond by wholesale dumping of their dollar reserves and bonds.

In retaliation, Russia could opt to only accept gold bullion for payment for their gas, oil and other commodity exports. This would likely lead to a sharp fall in the dollar and a surge in gold prices.

Indeed, no country is immune to the global currency war. It is a farce to say there is no currency war, like Goldman Sachs want us to believe (see here) or our political leaders as represented in the G20 (see here).

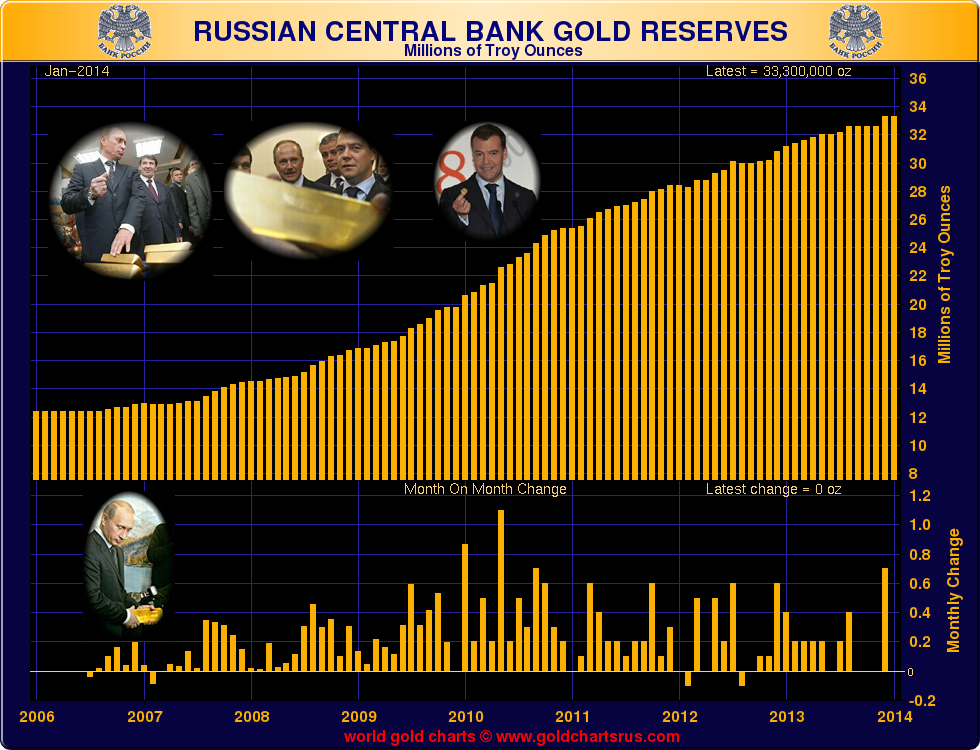

Russia, just like China, has been piling up their gold reserves for several years now. They really did so for a reason. As the following chart shows, Russia has been positioning itself for the nasty effects of the currency war which has been in the making for several years now. That’s in sharp contrast with countries like the US who have shown a preference for unlimited easy money.

How this will end, nodoby knows. What seems to be proven once again, is that gold equals strength. The petrodollar system is based on one, and only one, thing: trust. As soon as trust fades, the whole system collapses. That is the unspoken Achilles heel of the US. Unexpectedly, Russia is now in the position to touch this Achilles heel. Is this the trigger that will lead to a collapse of trust in the US dollar, as predicted for a long time by people like Jim Rickards and Peter Schiff?