Your Bank Account Is Slowly Bleeding to Death

The Casey Report

Dear Fellow Investor,

Making money with common stocks and index funds has been tough in the last decade.

On January 3, 2000, the Dow closed at 11,357.51. On December 31, 2010, the Dow sat at 11,577.51… having hovered around that level for the past ten years. That means a full decade of investing in the index would have returned you a measly 1.9%.

Frankly, you would have been better off letting that money sit in a savings account.

But maybe you were one of the lucky ones making, say, a solid 3% in stock gains per year.

I hate to break it to you – but you still lost money. Capital gains tax and brokerage fees included, you actually paid for the privilege of owning stock.

How is that possible?

The simple answer: Your money is constantly losing value – year after year, month after month. Yet the steady drip-drain on your assets is so gradual that most investors never even realize it.

And in the last decade, the pace of this slow drain has vastly accelerated.

You see, your year-2000 dollar is only worth 77 cents today. From January 2000 to December 2010, it shed 23% of its value.

In other words, if you had stashed $10,000 under a mattress eleven years ago, today that $10,000 would only buy about $7,700 worth of goods. So effectively, you got robbed of $2,300.

The blood-sucking parasite responsible for this loss is… INFLATION. It's so insidious because it diminishes the purchasing power of your money, one dime at a time.

But right now I want you to know, all is not lost.

There's a way for you to protect your assets from dwindling away, and it's a beautifully simple solution. Trying to stop the runaway inflation train is an exercise in futility… but by making the trend your friend, you can easily outpace it.

Before we get to that, though, let me show you the root causes of inflation and what it can do to your net worth…

The U.S. Dollar: Backed by Hot Air

In our society, money has become such an abstract concept that is hard to grasp for the average American.

Gone are the days where money came in the form of solid silver, copper and gold coins, and there was no doubt about their value. Today we are dealing with paper money "created out of thin air."

And usually there isn't even any paper – because what analysts mean when they say the Fed is "printing money" is that it is adding a couple zeros on some electronic ledger. Indeed, today most of our money exists only as digits on a computer screen.

Let's examine some of the facts about money.

You probably know that until 1933, the United States was on a gold standard – that means, every dollar could be redeemed for physical gold at your local bank. That, of course, meant that the number of dollars that could be printed was finite… since there was only so much gold to go around. A virtual guarantee that the dollar would keep its purchasing power in the long run.

Then, in 1933, Franklin D. Roosevelt issued Executive Order 6102, which effectively outlawed private gold ownership. And in 1971, Richard Nixon ended the last brittle connection between the dollar and gold. Now the world's reserve currency isn't backed by anything anymore – except the (rapidly waning) faith of the global community that the U.S. government is as good as its word.

The Bane of Inflation

A nation's money supply needs to be managed carefully, or the paper currency can be destroyed by inflation.

Let's look at a recent worst-case example, aptly described by Thayer Watkins of the Economics Department at San Jose State University:

Under Tito [who reigned as president from 1953 to 1980], Yugoslavia ran a budget deficit that was financed by printing money. This led to a rate of inflation of 15 to 25 percent per year. After Tito, the Communist Party pursued progressively more irrational economic policies. These policies and the breakup of Yugoslavia . . . led to heavier reliance upon printing or otherwise creating money to finance the operation of the government and the socialist economy. This created the hyperinflation.

[…] Between October 1, 1993 and January 24, 1995 prices increased by 5 quadrillion percent. This number is a 5 with 15 zeroes after it. The social structure began to collapse.

At its peak, inflation in Yugoslavia was running at over 37% per day – and prices were doubling every 48 hours.

That means if you bought a pack of chewing gum for a dollar on January 1, at an inflationary rate of 37% per day… by April 1 you'd need one hundred billion dollars to buy the same pack of chewing gum.

Now, let's say you were one of the super-rich and had a hundred billion dollars stashed away somewhere in a Swiss bank account. By April 1, at 37% inflation per day, the purchasing power of that staggering wealth would have shrunk to exactly one dollar, buying you… a pack of chewing gum!

While this is an extreme example, it makes it crystal-clear that inflationary monetary regimes punish savers and encourage spending.

And even though the "official" rate of inflation here in the U.S. is only 1.6% right now, according to some experts, the real inflation rate could be more than five times higher than the U.S. government cares to admit. You've seen it yourself, at the gas pump and in the grocery store.

That's why, as an investor, you need to make sure to find the smartest profit opportunities… just to keep pace with the continuous loss of purchasing power.

But who or what is causing this rampant inflation? The answer may surprise you...

The Fed: Merchants of Debt

I know it's hard to believe, but the institution that causes this parasitic drain on your net worth is the Federal Reserve.

Our very own central bank is perhaps the biggest culprit in destroying the U.S. economy… and your hard-earned wealth.

Running the printing presses day and night – now quaintly called "Quantitative Easing" – Ben Bernanke & Co. are hard at work diluting the value of the dollars already in circulation.

They do it to finance Washington's sky-high deficit spending… and to provide bailout money for bankrupt banks and failed corporations.

In a way, the U.S. government is like a junkie frantically looking for the next fix. And one of its dealers is the Fed, which exchanges its freshly printed (or digital) Federal Reserve Notes for U.S. Treasury bonds, the government's form of an IOU.

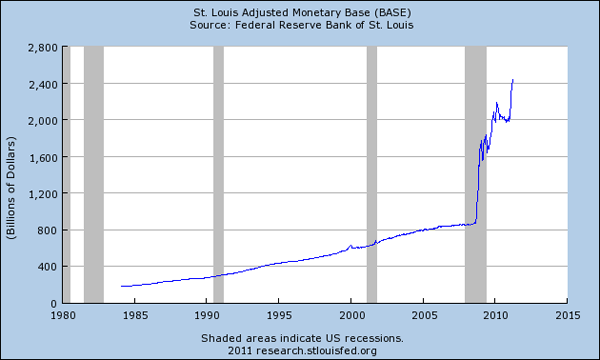

For an idea of how much money the Federal Reserve has created out of thin air, look at the chart below from the St. Louis Fed:

You see that the monetary base - that means the amount of money in the economy – has grown from about $600 billion in 2000 to $2.2 trillion in 2010. In other words, in just ten years the money supply has nearly quadrupled.

And the more money is flooding the economy, the more the money supply is "watered down," and its value keeps diminishing.

But you don't have to sit helplessly and watch how your net worth drops to next to nothing; help is literally just a mouse click away…

Let the Trend Hunters Work for You

A number of years ago, "investment guru" and financial author Doug Casey gathered some of the best financial minds this side of the Atlantic – for one explicit purpose: to bring subscribers in-depth analysis of budding big-picture trends and actionable recommendations to protect and multiply their wealth.

Doug Casey

Chairman Casey Research, Contrarian Investor, Acclaimed Financial Author, Public Speaker

If you have seen or listened to Doug live, you know why there's standing room only when he speaks at investment conferences all over North America. Not only has he become a living legend for his keen observations of the markets and his instinct for emerging trends, he is also famous – or should we say, infamous – for speaking his mind with few if any thoughts wasted on political correctness.

Doug literally wrote the book on profiting from periods of economic turmoil: Crisis Investing spent multiple weeks as #1 on the New York Times bestseller list and became the best-selling financial book of its time.

-

Bud Conrad

Chief Economist

Bud is the data-crunching genius and analytical brain of the Casey Report team. Convinced that a chart says more than a thousand words, he spends late nights exposing the financial schemes of governments and central banks. Educated at Yale and Harvard, Bud has been a futures investor for nearly 30 years and a full-time investor for more than 10. If you're lucky, you may run into him at Golden Gate University, where he teaches graduate courses in investing.

-

Terry Coxon

Sr. Editor, Economist

Terry Coxon is the man with the big-picture plan. Well versed in the ins and outs of economic theory, he knows that Situation A combined with Catalyst B will inevitably result in Consequence C. Terry is the author of two books, one of which – Inflation-Proofing Your Investments – he co-authored with the late Harry Browne, a legendary free-market libertarian writer and twice-presidential candidate. For more than two decades, he served as the president of the Permanent Portfolio Fund he founded, a mutual fund that invests in precious metals as well as stocks and bonds.

-

David Galland

Managing Director, Managing Editor

Aside from being one of Doug Casey's closest confidants, David Galland is the managing director of Casey Research and the managing editor of The Casey Report, providing razor-sharp insight into the economy and markets with a libertarian slant. He has extensive experience in the financial world – from years of running the famous New Orleans Investment Conference, to co-founding EverBank, one of the greatest and most solid successes in online financial services. Being exceptionally gifted in getting startups off the ground, he was also a founding partner and director of the Blanchard Group of Mutual Funds.

-

If you watch FOX or CNBC business news, or listen to radio shows like Jim Puplava's Financial Sense Newshour, you've probably experienced one or more of our Trend Hunters live already – because they're in high demand for commentary on the economy and the markets. [For a taste, here is an interview with Bud Conrad on 2011 as the year of discontent, and why inflation is coming.]

Currency debasement through out-of-control money printing and its fatal consequences for our economy – and your wealth – is only one factor Doug Casey and his colleagues keep a close eye on… but it's one of the most important.

In their monthly advisory, The Casey Report, they make it their mission to present investors with solid inflation hedges… from low-risk, steady gainers like large-cap stocks and funds, to more risky but potentially highly rewarding small-cap companies and option plays.

Their diligent work is a lifeline for inflation-beleaguered investors – and for less than a night on the town, you can enlist their services for a full year.

But before I extend that offer to you, you should know…

How Bad Is Inflation Right Now?

Inflation is not just felt by investors; its slimy tendrils are creeping into every nook and cranny of the economy. Due to the Fed's excessive printing, more money is chasing fewer goods… and the prices of those goods – from food to oil, to clothing – are going up, up, up.

No politician likes to admit he's a failure. Therefore, since the 1970s U.S. administrations have come up with rather "creative" accounting methods to maintain the appearance of low consumer price inflation.

One such method is "consumer substitution" in the basket of goods that make up the Consumer Price Index (CPI).

Simply, if the price of filet mignon skyrockets, the Bureau of Labor Statistics replaces it with ground beef. After all, isn't it reasonable to assume that people will buy cheaper items when their favorites get too expensive?

Voilá, the price of beef stays low… or is even lower than before.

And thanks to the CPI's "quality adjustment," purportedly neither furniture nor clothing nor automobiles have risen in price for many, many years now.

Housing costs look great too – according to the Owners' Equivalent Rent index, which calculates the cost of shelter as "the implicit rent that owner occupants would have to pay if they were renting their homes."

Their math goes like this: Housing prices are falling, hence you're paying less for your home.

It's so stupid, it's hard to believe.

Of course there are good reasons why the government does what it does: It makes politicians look better in the eyes of voters… prevents the general population from rioting in the streets… and allows Washington not to raise Social Security payouts, which are supposed to be annually adjusted for changes in cost of living.

Currently, the U.S. government states a puny 1.6% consumer price inflation. Nothing to worry about, right?

But thanks to a virtual "Robin Hood" of economics, we know the grim truth.

John Williams, an acclaimed economist and advisor to many Fortune 500 companies, uses the old-fashioned accounting methods from the days before official figures were twisted and warped to the U.S. government's liking. You could call him an economic whistleblower who keeps revealing the actions of the "man behind the curtain."

Below, compare John's real inflation numbers (in blue) to the fairytale figures the government calls a CPI report:

According to John's calculations, real CPI is in the 9% range right now. It's pretty obvious that there's a huge discrepancy between the government-tweaked numbers and what's really going on.

Knowledge Is Your Best Weapon

While there isn't much you can do about rampant inflation, investing wisely and making the most out of every dollar you have is just common sense. And if you do, you can indeed stay one step ahead of the slow destruction of the dollar.

To accomplish that, you need to keep yourself informed on:

- Current and future actions of the Federal Reserve, including planned bailouts and rounds of "Quantative Easing"

- New and planned laws and regulations by the U.S. government that could directly or indirectly affect your investments and personal wealth

- Foreign economies: How are China, India, Russia, the EU faring economically, and how will their health – or lack thereof – impact the North American markets?

- Is the U.S. dollar about to lose its status as the world's reserve currency, and what would that mean for you and me?

- Global events: from wars in the Middle East to social unrest in Eastern European countries, to floods in Australia and earthquakes in South America – these are things to watch for because they could hugely impact oil prices, energy supplies, commodity futures, and stock market performance.

If it sounds like a lot of work – well, it is. Fortunately, you don't have to do it on your own. Let the editors of The Casey Report do the heavy lifting for you, and let them be…

Your Eyes and Ears on the Ground

Every month, this star-studded cast takes apart and examines the economic apparatus of the United States (and other countries) to see what makes it tick… to find the grit in the gears that could bring the whole machinery to a screeching halt, and to discover the incredible opportunities hidden within today's complex economies.

For that purpose, they frequently consult experts from their vast network of connections – such as

- Andy Miller of the Miller-Frishman Group, a leading real estate developer, financier, and troubleshooter

- Currency expert Axel Merk

- Financial author and investment advisor Vitaliy Katsenelson

- And even 2008 Republican presidential candidate Ron Paul, to glean early warning signs of major political shifts.

From the knowledge gained, the editors then devise the best investment strategies for Casey Report subscribers. Because, as Doug likes to say, every crisis involves opportunity as well as danger.

I think you'll be thrilled with what The Casey Report has to offer…

Make the Trend Your Friend:

Crisis Investing with the Pros

|

American financial structure will be threatened... As people who bought houses with floating-rate mortgages and little money down slip into default, millions of dwellings will hit a no-bid market. And when hundreds of billions in loans go bad, the institutions holding them and the whole American financial structure will be with a deflationary collapse.

Doug Casey, October 2006 |

Near the peak of the housing market, when financial TV talking heads were falling over each other praising the "never-ending increase in home values," and many Americans used their homes as cash cows, Doug Casey and his team predicted that a major crisis was imminent.

Of course, back then barely anyone was listening – except for those subscribers who followed the editors' advice.

After a long and very eye-opening Casey Report interview with real estate entrepreneur Andy Miller, Doug and his team recommended shorting real estate investment trust Emcor (EME), closing the position with a quick two-month gain of 87% for subscribers.

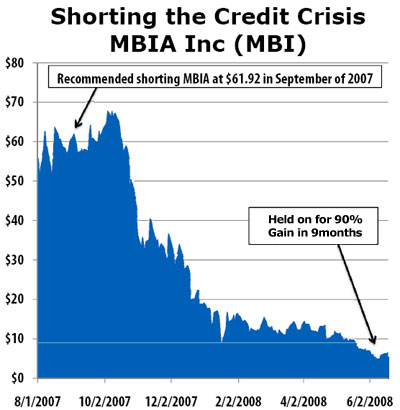

In the summer of 2007, they advised shorting bond insurer MBIA – a company that stood squarely in the way of the approaching avalanche – with exceptional results: a 93.3% gain for Casey Report subscribers within 10 months.

But they didn't stop there. They correctly predicted the devastating credit and currency crisis we are now witnessing, which has led to an overall economic decline in the United States that most of us have never seen in our lifetimes.

And there's much more to come. As a subscriber to The Casey Report, you will be privy to all the analysis… all the early warnings… all the profit opportunities this team of experts provides.

As an example, here are the contents of the January 2011 edition:

Retired at 46... Thanks to Casey Research "I've been with Doug since the beginning. His picks have made me tons of money over the years, enough so that I have been 'retired' since 1992, at age 46, and have done nothing but invest since then."

- Bob O.

200% Gains... Because of Casey Research "Casey Research is the best I know of. I have been a subscriber to Casey for a number of years, with gains that average over 200%."

-John H.

Casey Research "truly has altered my life" "I started with about $50k and it grew to about $350k. I also manage my parents' account; it started with about $250k and grew to over $1.1 million. It truly has altered my life for the better. P.S. I'm only 33 years old."

-Joseph M.

"The first dollar I invested is up over 1,000%!!" "I have been a subscriber of Mr. Casey's International Speculator for over 10 years, but have only actively followed his advice for the last seven years. Over the last seven years, my investments have risen by an average 42.9% per year. . . The first dollar I invested is up over 1,000%!! Keep up the great work."

-Jim G.

"Six-fold growth..." "I have had six-fold growth in a portfolio that I consider mostly positioning for an anticipated run-up...

I am a middle-aged spinster caring for an aged parent, and thanks to Doug's help I will not have to 'inherit the earth.' I've got a secret lifeline"

–Susan H.

- The Fed: Merchants of Debt. In this eye-opening analysis, Chief Economist Bud Conrad exposes how central bankers are manipulating the dollar and the economy… with potentially disastrous consequences for your savings and investments. But as dire as the situation is, it also holds opportunity for clever investors...

- Making the Chicken Run. Investing legend Doug Casey believes the tipping point for the U.S. he's been talking about for years – economic bankruptcy accompanied by financial chaos – is now at hand. This may be your last chance to protect your wealth (and maybe yourself) outside of U.S. borders. Read what to expect, what to do, and why excuses don't work anymore.

- Later Is Now. The Casey Report editors have long predicted that interest rates will have to rise. Terry Coxon makes his case why this event is not just inevitable but imminent… and how you can profit from it.

- Obama Watch – Cleaning up the Mess. Washington watchdog Don Grove describes the harrowing task of curbing out-of-control government spending that the 112th Congress is facing… and how likely it is that it will succeed.

- How to Invest. Actionable advice on today's best precious metal and energy plays, as well as smart ways to profit from rising interest rates.

That's a ton of valuable information – and that is just ONE SINGLE EDITION of The Casey Report, which usually runs more than 40 pages.

Here's what you get when you subscribe:

- Immediate access to the current edition of The Casey Report PLUS the next 12 issues as they are published – with timely and enlightening articles by the Trend Hunters and other well-known experts, as well as actionable recommendations and stock picks that help you protect your wealth.

- Immediate access to years of archived issues, including the January 2011 edition I described above… and you'll see that many of them are just as pertinent today as when they were written. We urge you to read those issues at your own convenience, because they provide a thorough education on what exactly is wrong with our economy and what you have to look out for.

- Immediate access – via your protected password – to a wealth of special reports, investor Q&As, and other useful information only subscribers can see.

The regular price for a one-year subscription to The Casey Report is $349. And as happy subscribers can testify, it's worth every penny.

|

But you don't even have to pay that much. Right now, we're offering The Casey Report for only $279 per year – a $70 savings over the retail price.

And you will lock in this low price for as long as you remain a subscriber – while we may raise subscription fees for The Casey Report in the future, we guarantee that YOUR price will never go up.

One last thing: If you're worried that The Casey Report may not be all we are promising here… don't be. You have 3 full months – that's three 40+-page editions – to decide whether it's right for you.

Cancel within those 3 months and you'll receive a prompt refund of every penny you paid, no questions asked. Even if you cancel after the 3 months are up, we'll still give you a prorated refund for the unused portion of your subscription.

I can't think of a fairer deal. You really don't have anything to lose… but a lot to gain.

http://www.caseyresearch.com/crpmkt/crpSolo.php?id=231&ppref=CSR231ED0812B