‘The End Is Not Near, It Is Here and Now’ – Gold Legend Jim Sinclair

Gold Core

Gold fell $28 or 1.73% yesterday in New York and closed at $1,591.60/oz. Gold traded sideways prior to another 1% fall in Asia but has recovered somewhat in early European trading and has made gains in euros and Swiss francs particularly.

(SCROLL DOWN)

*

*

*

*

*

*

*

*

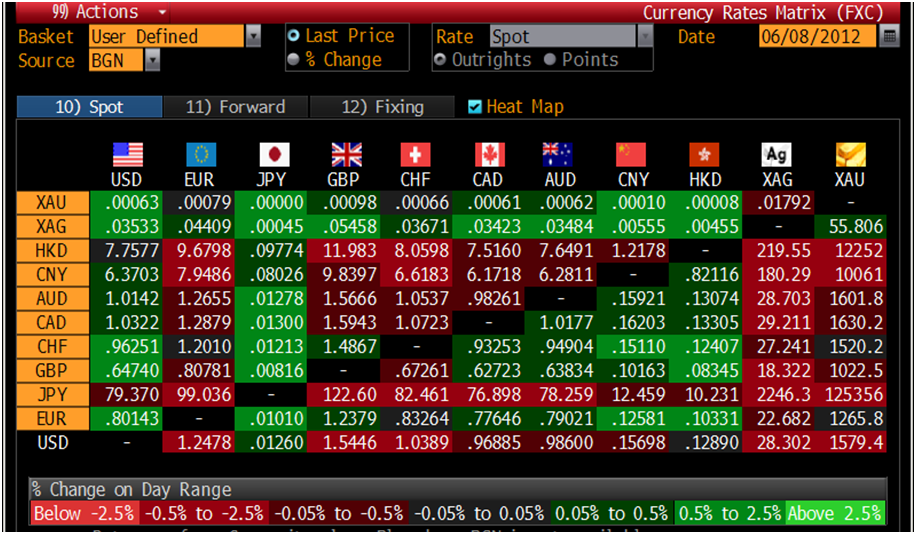

Cross Currency Table – (Bloomberg)

Gold’s sell off was attributed to Fed Chairman Ben Bernanke not hinting at further quantitative easing. Leveraged speculators sold gold & silver aggressively after Bernanke failed to communicate aggressive use of helicopters to dump money on the citizenry of the US and further debase the dollar.

When prices hit around $1,600/oz, Comex gold stop losses kicked in and exacerbated the selloff.

Bernanke’s testimony also led to US equities falling at the close and weakness has continued in Asian and European indices.

Although Bernanke didn’t offer hints in the near term, he said that “the central bank was ready to shield the economy if financial troubles mounted,” which suggests that the kneejerk speculative sellers will be buying back sooner rather than later.

QE3 is assured as are further versions of QE - although they will no doubt be given a new dissembling name and acronym and remarketed as something other than mass currency debasement.

The People’s Bank of China cut their interest rate due to concerns of a property crash and because of their slowing economy. Gold rose on the news prior to prices being capped.

German exports and imports have dropped sharply in April - the latest sign that Europe's largest economy is beginning to feel the chill from the euro zone debt crisis.

Europe’s debt crisis is creating economic contagion and may be spreading to the already fragile Chinese and American shores.

‘The End Is Not Near, It Is Here and Now’ – Gold Legend Sinclair

Veteran and respected gold and silver trader and a former adviser to the Hunt Brothers in the silver market in 1980, Jim Sinclair is now warning on his website,http://www.jsmineset.com/ that ‘The end is not near, it is here and now’ in reference to the global financial system.

He is also reiterating his long held view that there will be “QE to infinity” despite the denials of Bernanke and other central bankers.

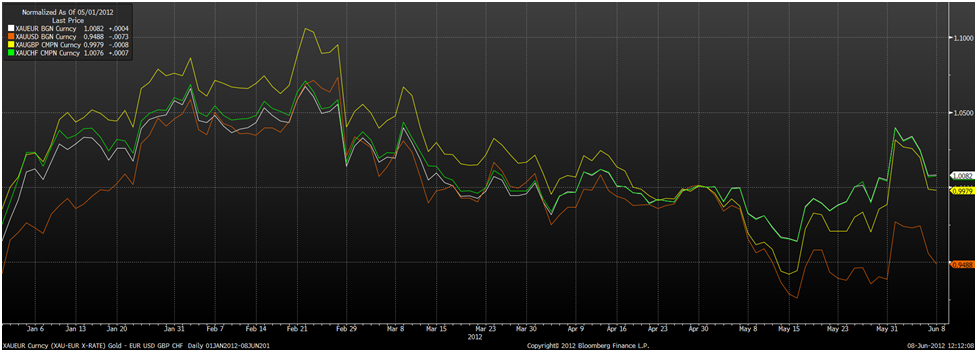

Currency Ranked Returns – (Bloomberg)

Sinclair believes that gold and silver will surge in value very soon and much sooner than most are currently forecasting.

Mr Sinclair disagrees with George Soros , who accumulated gold aggressively in Q1 2012, who recently said that the euro has three months to sort itself out. He thinks the euro, in its current form, will be lucky to survive three weeks.

He believes that after a couple of years of crises in the euro zone, market commentators and investors may have become desensitised to bad news and are in danger of missing the real denouement when it is actually about to happen.

The Greek election on June 17 is only 11 days away and is an obvious flash point ahead. Meeting after meeting of European leaders does not seem to be getting anywhere.

Nobody really seems to have a handle on the situation and a realisation that this is a global debt crisis and not a regional “euro debt crisis”.

Only massive debt write downs and debt forgiveness and a form of global debt jubilee can prevent a collapse of the financial system and a deep global depression.

XAU/EUR, XAU/USD, XAU/GBP & XAU/CHF Daily – (Bloomberg)

Mr. Sinclair has a good track record. He predicted back in the early 2000’s with gold below $300 an ounce that gold would reach $1,650 within a decade. Now he is talking about “quantitative easing to the moon” and a similar trajectory for gold and silver prices.

OTHER NEWS

(Bloomberg) -- iShares Silver Trust Holdings Dropped 30.17 Tons Yesterday

Silver holdings in the iShares Silver Trust, the biggest exchange-traded fund backed by silver, dropped 30.17 metric tons yesterday to 9,669.08 tons, according to the company’s website. Assets increased by the same amount the day before.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

NEWS

Gold extends sell-off after Fed disappoints - Reuters

Gold futures extend slide in Asian trading - MarketWatch

FTSE falls as euro mood darkens again - Citywire

Asia stocks fall sharply after recent gains - MarketWatch

COMMENTARY

The 'Big Reset' Is Coming: Here Is What To Do – Zero Hedge

Euro Breakup Precedent Seen When 15 State-Ruble Zone Fell Apart - Bloomberg

End Is Here for Financial Markets, Warns Jim Sinclair – Resource Investor

Keiser Report: Planet Ponzi – Max Keiser

Gold Standard, Gold Futures, and Perception Management – Midas Letter

Rickards: The US Is the Biggest Currency Manipulator – Casey Research

.png)