Friday Fun

I was telling Mr Hyde late last night that I didn't think Santa's next "angel" was going to offer much resistance. Anymore, the levels aren't that far apart on a percentage basis and there seems to be some history that shows every other level to be challenging. With $1849 behind us (Dec gold hit 1881 earlier today), let's wait for the next one, instead. Given that I'm expecting a short-term peak next week, probably somewhere between 1936 and 2000, the 1936 angel seems to be worthy of watching. Here's why:

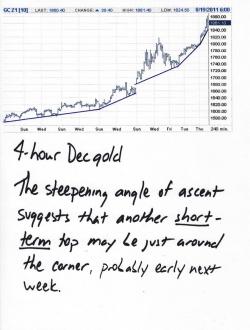

Take a look at this first chart. It's a 4-hour gold. Note that the angles of ascent are steepening. This can only continue for a little while longer as, eventually, the trendline goes straight up and that's as far as it can go. It's not parabolic yet, however, and I don't expect a significant peak today...not ahead of what will be a very interesting weekend. Early next week, though, we could get our peak. It is critical to understand this, though: I'm only talking about a short-term peak, similar to nine days ago. If a dip develops, it will simply offer you an opportunity to buy. Just like last week's pullback stopped right on schedule at 1725, the next dip will do the same. IF I'm right, you'll have a choice to make:

1) Enforce some sell discipline on yourself to lock in some profits and look to buy the pullback.

2) Look the other way and wait for the market to rebound.

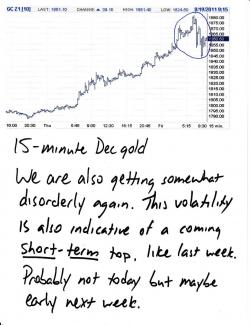

Reinforcing this opinion is the whole "orderly vs disorderly" idea I postulated last evening. The move from the lows of last week had been orderly and calm. This type of advance is sustainable. Last night into this morning has been disorderly, like early last week. Volatility extends markets into short-term overbought or oversold territory and this is where we are headed by early next week. You can see the onset of the disorderly action on this 15-minute chart.

In short, absent a margin hike or The Second Coming, I expect gold to be firm all day. There will be dips but dips will be bought. Ask yourself: Would you like to be long gold or out of gold over the weekend? Exactly. Using charts to predict headlines is challenging to say the least but these charts suggest to me that early next week will see another $50-100 advance in the price of gold. From there, maybe another 3-5% dip? We'll see. The key is to assess these eventualities so that, when they occur, you can act with discipline and not emotion.

Silver looks great, doesn't it? As background, I suggest you pause for a moment and read this from Trader Dan:

http://traderdannorcini.blogspot.com/2011/08/silver-stuff.html [1]

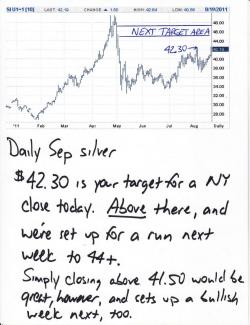

As Dan says, the first key closing level today is about 41.50. A close above there will draw the 10-day moving average through the 20-day. This is a bullish crossover and would portend higher prices next week. The next number to watch is 42.30, which is the intra-day high from earlier this month. A close above there today would be bring a response Monday that is similar to today's reaction to yesterday's close. All in all, my $44 by Labor Day pick is looking pretty solid right about now. It may even be a tad conservative. Watch today's close very closely. It will be your clue for next week.

Lastly, both silver and gold have moved into significant backwardation this morning. This is an extremely significant development and, if it continues, is indicative of very tight, short-term supplies. A few loyal Turdites questioned the significance of the "Venezuelan Decision" when I posted the news Wednesday evening. Let me set this straight. It is extremely significant. Why?

1) The Venezuelan gold is on deposit at the Bank of England.

2) The Bank of England supplies the gold for the GLD.

3) I believe the GLD to be an empty, fraudulent shell game of fractional bullion banking.

4) It has been speculated that there might be only 1 ounce of gold for every 100 ounces of paper gold.

5) The withdrawal of 8% of GLD's gold from the BoE would cause a massive supply squeeze.

6) This massive supply squeeze would reveal itself by backwardation in the gold market.

7) See the paragraph above.

8) IF I'm right and GLD is exposed as the scam I believe it to be....well, let's just say that gold is going a little bit higher from here.

9) Money flows out of GLD and back into the rightful place...the miners.

That's it for now. Equities are rallying and the PMs are falling as I type. This is not a surprise nor is it unexpected. The prices as of 10:20 a.m. are of no consequence. Let's see where we are at 1:30 and 4:00.

http://www.tfmetalsreport.com/print/2114

Aug. 19, 2011