EVIL CORPORATE TAX HOLIDAY DEAL STILL ALIVE !

Matt Taibbi

Just a quick update on the corporate tax holiday situation …

There was some talk that a corporate tax holiday might be rolled up somehow into the debt-ceiling deal. I heard that from a few quarters in DC in the weeks leading up to Obama’s Bighornesque debt/supercommittee massacre.

However, the tax holiday turned out to not be part of that deal. That does not mean, however, that the proposal is dead. In fact, calling around in the last few days, I’m hearing that it is very much alive.

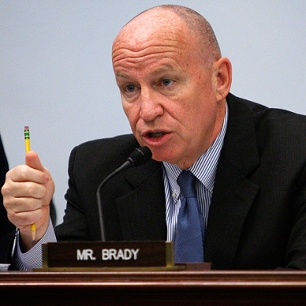

The action revolves around a bill sponsored in May by Texas Republican Kevin Brady (and co-sponsored by Utah Democrat Jim Matheson) called the Freedom To Invest Act, which would “temporarily” lower the effective corporate tax rate to 5.25 percent for all profits being repatriated.

Essentially, this is a one-time tax holiday rewarding companies for systematically offshoring their profits since 2004 – the last time they did this “one-time” deal.

The Brady bill is still alive and in speaking to three different Hill staffers (on the House side) over the last few days, I’m hearing that it was “unaffected” by the debt deal and that it continues to gain momentum, thanks in large part to a lobbying effort that two different staffers described as intense and ongoing.

For people interested in this story, I definitely recommend reading this Bloomberg article focusing on Cisco, one of the biggest lobbyers in favor of the tax holiday. This is a company whose CEO, John Chambers, wrote an editorial last October in the Wall Street Journal predicting that the tax holiday would generate a trillion dollars in repatriated earnings, money that Chambers insisted would outdo even Barack Obama’s stimulus as a job-creation engine:

The amount of corporate cash that would come flooding into the country could be larger than the entire federal stimulus package, and it could be used for creating jobs, investing in research, building plants, purchasing equipment, and other uses.

And yet: Chambers’s company, Cisco, would not commit to creating so much as a single job if the tax holiday is passed. As it is, the company has already committed to a wave of layoffs. When asked a question about Cisco's plans w/regard to a potential tax holiday, the company’s spokesman, John Earhardt, declined to answer. From the Bloomberg piece:

It’s unclear whether any jobs would come from Cisco, which announced plans in May to shed an unspecified number of workers. Earnhardt, the spokesman, declined to comment on hiring plans for the company, whose customers include Verizon Communications Inc. (VZ) and AT&T Inc. (T)

For more on this, check out my appearance on Keith Olbermann’s Countdown last night. Also urge folks to check out Paul Krugman's spot on the same show, talking about the potential for a future recession. Met him for the first time last night, totally nice guy. The whole green room was kind of equally bummed out about the Obama debt deal ...

Aug. 4, 2011

http://www.readersupportednews.org/opinion2/279-82/6895-evil-corporate-tax-holiday-deal-still-alive