Bank failures coming: Raft of federally insured banks compromised by unwise over-investment in failing cryptocurrencies and exchanges

JD Heyes

t’s bad enough that millions of cryptocurrency investors have lost nearly all of their initial money after the industry began crashing earlier this year, but now it looks as though federal taxpayers are also going to be on the hook.

According to a report by Wall Street On Parade, Sen. Elizabeth Warren (D-Mass.) tipped everyone off to the coming disaster — probably inadvertently — with remarks she made last week during a Senate Banking, Housing and Urban Affairs hearing.

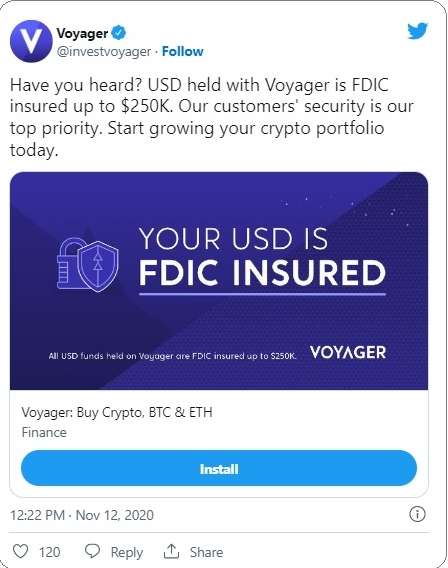

Warren garnered the attention, too, of federal regulators when she said that Voyager, a crypto platform that filed for bankruptcy protection early last month, had promoted itself as an FDIC-insured financial instrument. “FDIC stands for Federal Deposit Insurance Corporation and is the federal agency that oversees federal deposit insurance for the nation’s regulated banks and savings associations,” the WSOP report stated.

It should be noted, however, that crypto trading platforms are currently not regulated by the federal government. Also, they have been regularly linked to criminal activities, and they are quickly going broke or filing for bankruptcy while blocking customers from making withdrawals of their liquid assets and/or their cryptocurrencies.

If these rank, corrupt platforms were allowed to be within a stone’s throw of a federally insured bank there is no question that the public’s trust in the country’s federal regulatory processes for banking and investment would collapse. That said, federal bank regulators have known for years that federally insured banks were taking in crypto companies but have instead chosen to look away and ignore what was taking place, WSOP reported.

But just a few hours after Warren’s statement at the Senate hearing, both the FDIC and the Federal Reserve released a joint letter that was sent to Voyager the same day, which read, in part:

Voyager has made various representations online, including its website, mobile app, and social media accounts, stating or suggesting that: (1) Voyager itself is FDIC-insured; (2) customers who invested with the Voyager cryptocurrency platform would receive FDIC insurance coverage for all funds provided to, held by, on, or with Voyager; and (3) the FDIC would insure customers against the failure of Voyager itself. These representations are false and misleading and, based on the information we have to date, it appears that the representations likely misled and were relied upon by customers who placed their funds with Voyager and do not have immediate access to their funds.

What the crypto platform actually did, however, was to open an “omnibus” account at Metropolitan Commercial Bank, which is FDIC insured, as the bank “apparently decided to roll the dice and accept deposits from multiple crypto firms,” Wall Street On Parade reported.

Months ago — as of March 31 — the bank still held more than $1.1 billion in crypto-related deposits. The institution is part of the Metropolitan Bank Holding Corp., which is publicly traded and whose stock price has fallen by 35 percent year-over-year as of last week.

But because the bank gave Voyager the “omnibus” account insured by the federal government, the platform used the reputation and status of the FDIC to promote itself as safe for investors.

But here’s where it gets bad: Metropolitan Commercial is not the only FDIC-insured bank that has decided to go all-in with corrupt crypto: Another federally insured financial institution, Silvergate Bank, which is part of the publicly-traded Silvergate Capital Corp., is also involved in the dubious ‘currency.’

“We began pursuing digital currency customers in 2013 and have been deliberate in our approach to serving this community since then. Today, we have 1,300+ digital currency and fintech customers that are using our platform daily to grow and scale their businesses,” the bank has bragged in the recent past.

But the bank’s annual report filed with the Securities and Exchange Commission admitted the dangers of cryptocurrencies: “The characteristics of digital currency have been, and may in the future continue to be, exploited to facilitate illegal activity such as fraud, money laundering, tax evasion and ransomware scams; if any of our customers do so or are alleged to have done so, it could adversely affect us…”

And yet, now the bank’s cryptocurrency holdings exceed half its assets: “Deposits from digital currency exchanges represent approximately 58.0% of the Bank’s overall deposits and are held by approximately 94 exchanges,” the December 2021 annual filing says.

It is becoming clear that the country’s financial collapse may be intricately linked to the collapse of crypto.

Sources include:

https://www.naturalnews.com/2022-08-08-federally-insured-bank-failures-coming-over-investment-cryptocurrencies.html